- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

Super Micro Computer (SMCI) Valuation After Recent Analyst Caution On Margins And Profitability

Reviewed by Simply Wall St

Why recent analyst caution matters for Super Micro Computer (SMCI)

Recent caution from Citi, Goldman Sachs, and other analysts has put Super Micro Computer (SMCI) under the microscope, with concerns centering on margin pressure, earnings volatility, and earlier accounting and compliance issues.

For you as an investor, that mix of strong AI demand on one side and questions about profitability and execution on the other creates a situation in which the stock is heavily influenced by how the next few quarters play out.

See our latest analysis for Super Micro Computer.

That caution has played out in the share price, with a 9.59% 7 day share price return and a 4.81% 30 day share price return, offset by a 33.24% 90 day share price decline. The 1 year total shareholder return is slightly negative and the 5 year total shareholder return is very large, suggesting long term holders have still seen substantial gains even as recent momentum has cooled and then tentatively picked up again.

If AI hardware swings and analyst debates have your attention, this could be a good moment to widen your search and look at high growth tech and AI stocks.

With SMCI now around $32.24, trading at what looks like a large discount to the average analyst price target and screening as cheap on value metrics, you have to ask: is this a reset buying opportunity, or is future growth already baked in?

Price-to-Earnings of 24.3x: Is it justified?

At a last close of US$32.24, Super Micro Computer trades on a P/E of 24.3x, which screens as cheaper than its peer average but higher than the broader Global Tech industry.

The P/E ratio tells you how much investors are paying today for each dollar of current earnings, and it is especially watched for profitable, growth oriented tech names. For SMCI, that 24.3x multiple sits in an interesting middle ground, with one set of numbers suggesting it is expensive and another pointing to value.

On one hand, SMCI is described as expensive relative to the Global Tech industry average P/E of 22.7x, which implies the market is already paying a higher price tag for its current earnings than it does for many other tech companies. On the other hand, the stock is flagged as good value versus its own peer group, where the average P/E is 62.2x, and also versus an estimated fair P/E of 70.3x, a level the market could move towards if those relationships hold.

Explore the SWS fair ratio for Super Micro Computer

Result: Price-to-Earnings of 24.3x (UNDERVALUED)

However, you still need to weigh risks such as further margin pressure or renewed scrutiny of past accounting issues, which could quickly challenge any perceived valuation upside.

Find out about the key risks to this Super Micro Computer narrative.

Another view on SMCI's value

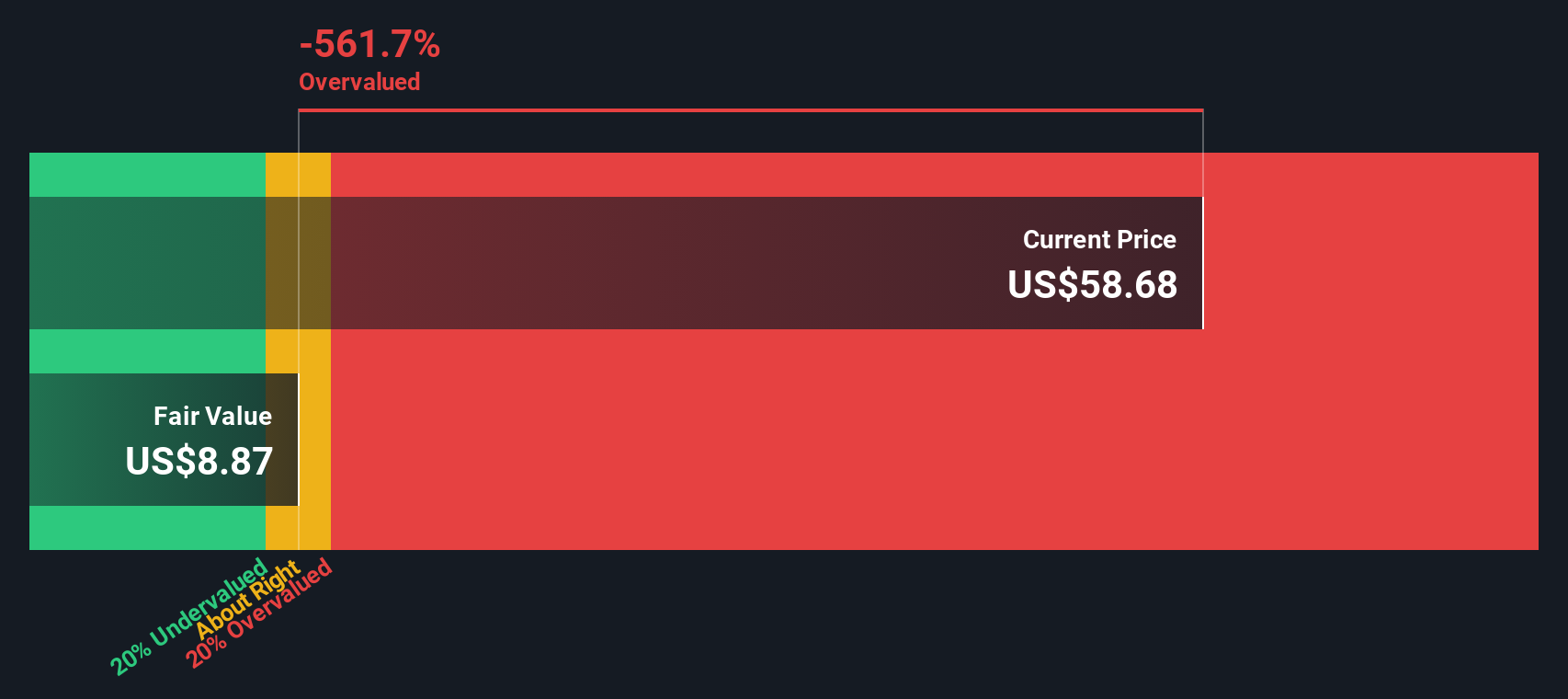

Looking beyond the headline P/E, our DCF model points to a different picture, with SMCI at US$32.24 trading below an estimated future cash flow value of US$51.03. That implies a sizeable gap. Is the market being too cautious, or are the cash flow assumptions too generous?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Super Micro Computer for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Super Micro Computer Narrative

If you look at the numbers and come to a different conclusion, or simply prefer to test your own assumptions, you can build a full narrative in just a few minutes with Do it your way.

A great starting point for your Super Micro Computer research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If SMCI has you thinking harder about where to put your money next, do not stop here; broaden your watchlist with ideas filtered by clear fundamentals.

- Spot potential turnaround candidates early by scanning these 3534 penny stocks with strong financials that already line up with stronger balance sheets and financial quality checks.

- Focus your AI interest on companies tied to real projects and revenues by running through these 23 AI penny stocks curated around this theme.

- Hunt for opportunities that may be priced below their cash flow potential by checking out these 881 undervalued stocks based on cash flows before the crowd pays closer attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells server and storage solutions based on modular and open-standard architecture in the United States, Asia, Europe, and internationally.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Nova Ljubljanska Banka d.d. future looks bright with a profit margin change of 38%

Viohalco S.A. (VIO.AT): Greece's Leading Integrated Metals Processor

M&A machine with a relentless focus on operational excellence

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!

with the recent increase in Yttrium over the course of 2025 and it's now apparent value perceived by the market, Rainbow Rare Earths states this would add approx. 30M USD (@Ex rate 0.75USD - 1GBP of 0.75)/22.5M GBP to EBITDA per annum. Therefore I adjust my fair value price to MORE than previous - how much more? Who cares... I'm simply allowing for 40% of this figure to fall to the bottom line in my estimation of fair value. I now now estimate the fair value of >£1.20 - that's all I need to know.