- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

Super Micro Computer (NasdaqGS:SMCI) Unveils AI Systems With NVIDIA RTX PRO 6000 GPUs

Reviewed by Simply Wall St

Super Micro Computer (NasdaqGS:SMCI) experienced significant developments recently, notably beginning orders for its new enterprise AI systems featuring NVIDIA GPUs. This ambitious product expansion likely contributed to the company’s share price rising by 42% last month. This uptick aligns with broad market trends where the tech sector performed well, despite major indexes like the Nasdaq recording a slight decline. Supermicro's strategic partnership with DataVolt for AI campuses and revised earnings guidance seemed to balance these broader market movements, resulting in a formidable stock performance for the company.

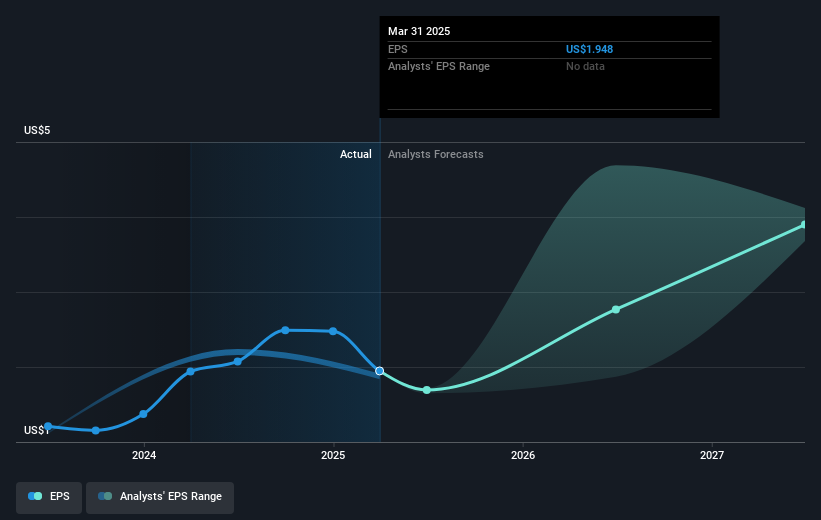

Super Micro Computer's recent developments, particularly its partnership with NVIDIA and orders for new AI systems, are key drivers in shaping its future revenue and earnings growth. The introduction of enhanced AI platforms and global manufacturing capacity are anticipated to improve revenue streams and operational efficiency, which aligns with analyst forecasts indicating significant anticipated earnings growth over the next three years. While these initiatives have led to a short-term share price increase of 42% last month, long-term performance has been even more remarkable. Over the past five years, the company's total return, including share price appreciation and dividends, surged over 1670.36%, showcasing an impressive growth trajectory.

Despite this remarkable long-term growth, the company's one-year performance has not outpaced the broader US Tech industry or the market. Specifically, SMCI's earnings growth of 9.7% over the past year did not surpass the tech industry's 21.7% increase, highlighting potential short-term challenges. However, the long-term investment in AI technologies and international expansion might bridge this gap, positioning the company for enhanced future performance.

In terms of price targets, the current share price of US$32.94 presents a significant discount to the analysts' consensus target of US$48.76. This implies a potential for upward adjustment if the company meets its revenue and earnings projections, which are expected to rise significantly, with earnings predicted to reach US$3.7 billion by 2028. Investors should note the variance in analyst price targets, with a range from US$15 to US$93, reflecting differing views on the company's future growth potential and associated risks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Super Micro Computer, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives