- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

Is the Hitachi Vantara Partnership Shaping a New AI Data Center Edge for SMCI?

Reviewed by Sasha Jovanovic

- In October 2025, Hitachi Vantara announced it is working towards a partnership with Super Micro Computer (NASDAQ: SMCI) to integrate Supermicro’s advanced GPU and AI compute systems with Hitachi's unified Virtual Storage Platform One for enterprise AI infrastructure and analytics.

- This collaboration aims to jointly market each company’s flagship solutions, helping customers unify storage and compute for more efficient AI and data workloads across enterprise environments.

- In the sections ahead, we'll explore how the new alliance with Hitachi Vantara could further strengthen Super Micro Computer’s AI data center positioning.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Super Micro Computer Investment Narrative Recap

To be a Super Micro Computer shareholder, you need confidence in the rapid growth of AI-driven infrastructure, a market where integrated compute and storage are key differentiators. The recent announcement of a partnership with Hitachi Vantara supports Super Micro’s exposure to large enterprise AI deployments, but it does not materially address the near-term risk of revenue concentration, with much business still hinging on a handful of large customers. Of the latest developments, the launch of Supermicro’s NVIDIA Blackwell Ultra solutions (September 2025) stands out, as it underlines the company’s ability to quickly bring advanced GPU offerings to market. This aligns closely with the main catalyst for Super Micro: capturing demand from enterprises scaling up AI workloads, especially as next-generation chips become available, supporting higher-margin product growth. However, while these new products and partnerships promise growth, investors should also be mindful that if any of Super Micro’s top customers scale back orders...

Read the full narrative on Super Micro Computer (it's free!)

Super Micro Computer's narrative projects $48.2 billion revenue and $2.4 billion earnings by 2028. This requires 29.9% yearly revenue growth and a $1.4 billion earnings increase from the current $1.0 billion.

Uncover how Super Micro Computer's forecasts yield a $50.06 fair value, a 5% downside to its current price.

Exploring Other Perspectives

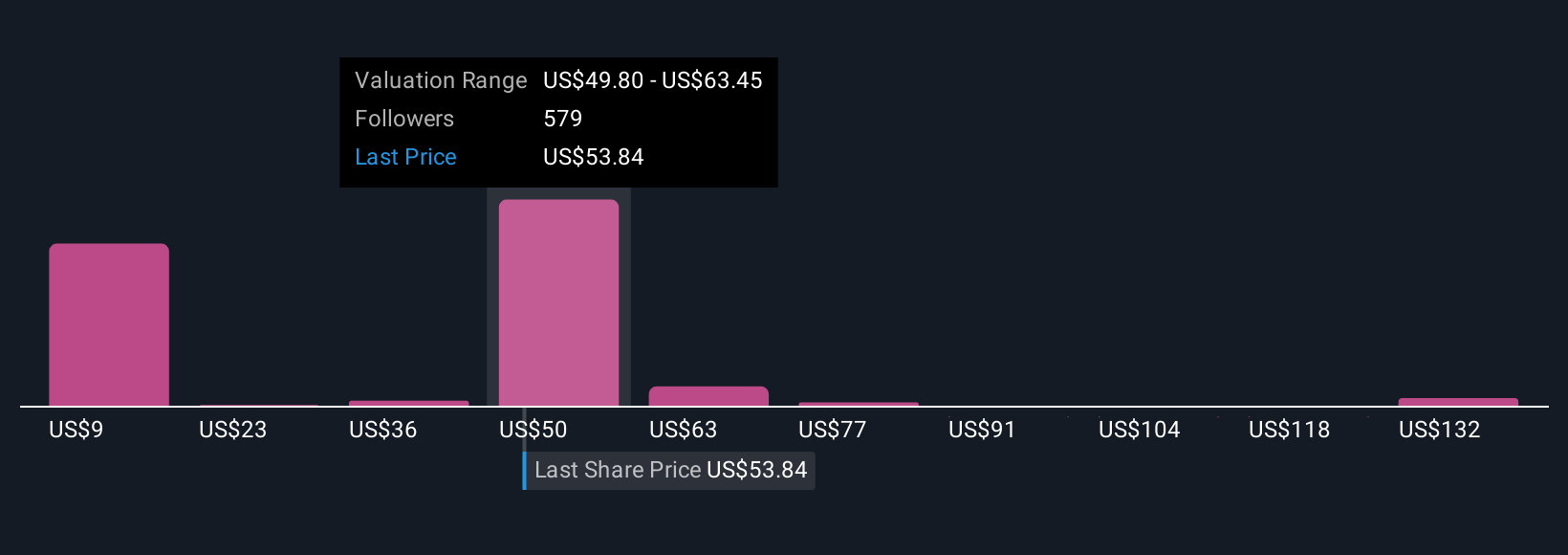

Community fair value estimates for Super Micro Computer range from US$8.85 to US$145.34 across 72 individual opinions within the Simply Wall St Community. Revenue dependency on only a few large customers remains a key discussion point shaping expectations for the stock's long-term stability and growth potential.

Explore 72 other fair value estimates on Super Micro Computer - why the stock might be worth over 2x more than the current price!

Build Your Own Super Micro Computer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Super Micro Computer research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Super Micro Computer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Super Micro Computer's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells server and storage solutions based on modular and open-standard architecture in the United States, Asia, Europe, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives