- United States

- /

- Tech Hardware

- /

- NasdaqGS:SMCI

Is Super Micro at a Tipping Point After 82% Climb in 2025?

Reviewed by Bailey Pemberton

If you have Super Micro Computer on your radar, you are not alone. This stock has captured attention with some head-turning gains in 2024, leaving many investors asking whether there is still room to run or if the ship has sailed. Just in the last week, shares jumped 17.8%, and the 30-day return stands at an eye-popping 35.2%. Year-to-date, Super Micro has soared 81.8%, while delivering a staggering 1856.3% over the past five years. When numbers like these start making the rounds, it is no wonder there is a buzz of excitement, and also a healthy dose of skepticism, about what comes next.

So, what is driving all this? Investors seem to be recognizing the company's role as a key hardware supplier in the race to develop next-generation AI and cloud infrastructure. That optimism has powered both near-term sprints and long-term upward trends in the stock price. However, not all signals point to unqualified value. According to our valuation score, which checks for undervaluation across six key measures, Super Micro Computer only gets a 1 out of 6. In other words, the stock appears undervalued in just one area, while flashing red in the others.

This leaves us with an important question: Are those eye-catching gains justified by fundamentals, or has Super Micro Computer run too far ahead of its value? Next, let’s break down how this valuation score was determined using different approaches, and stay tuned for an even better perspective on what the market might be missing.

Super Micro Computer scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Super Micro Computer Discounted Cash Flow (DCF) Analysis

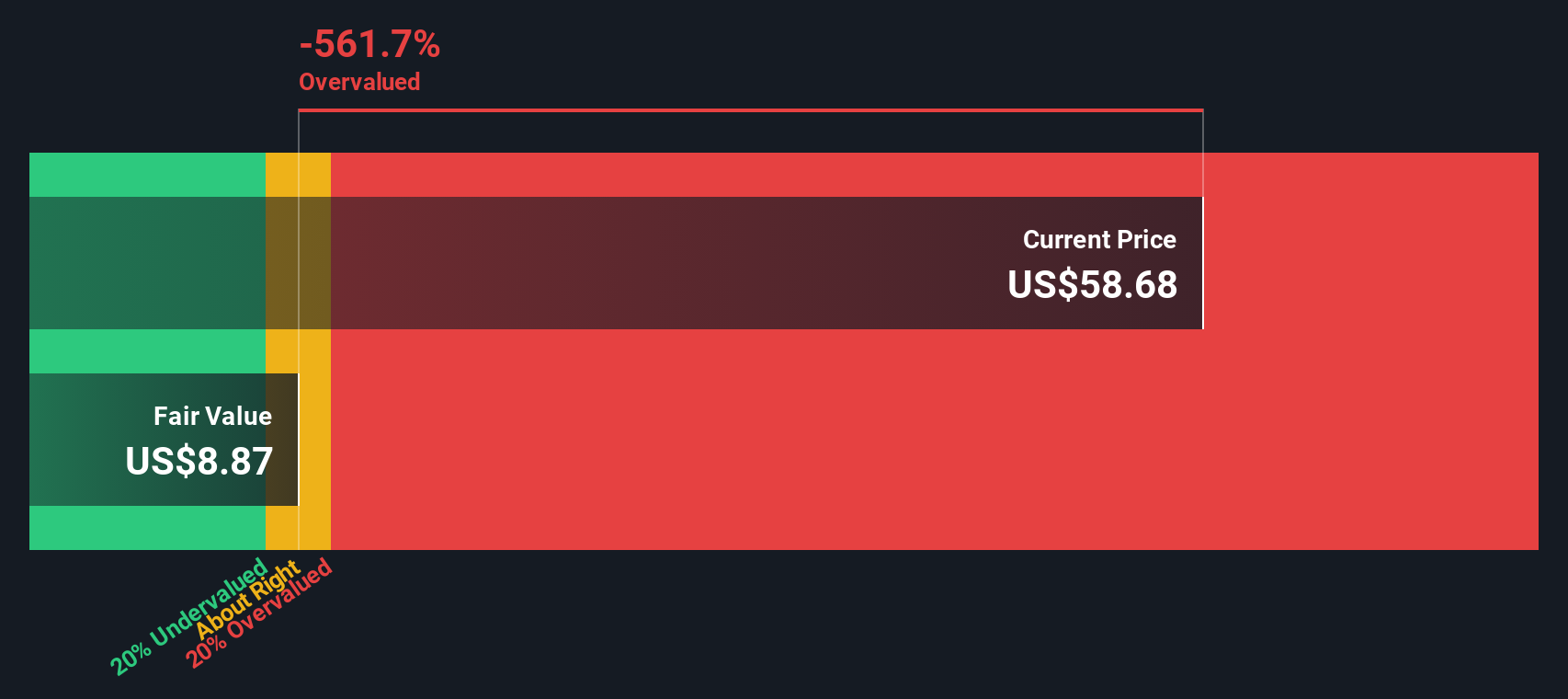

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. For Super Micro Computer, this approach looks at how much cash the business can generate going forward, adjusted for the risk and time value of money.

Currently, Super Micro Computer posted $1.52 billion in free cash flow over the last twelve months. Analyst projections stretch out five years, with models further extrapolated beyond that by Simply Wall St. For 2028, free cash flow is estimated at $820.5 million, with longer-term projections suggesting a gradual decline in annual cash flows in the following years.

Based on these projections in the DCF model, Simply Wall St estimates Super Micro Computer’s intrinsic value at $8.82 per share. In sharp contrast, the current market price is much higher. This calculation suggests the stock is trading at a 519.1% premium to its intrinsic, cash flow-based value. In other words, the DCF indicates the shares are significantly overvalued at current levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Super Micro Computer may be overvalued by 519.1%. Find undervalued stocks or create your own screener to find better value opportunities.

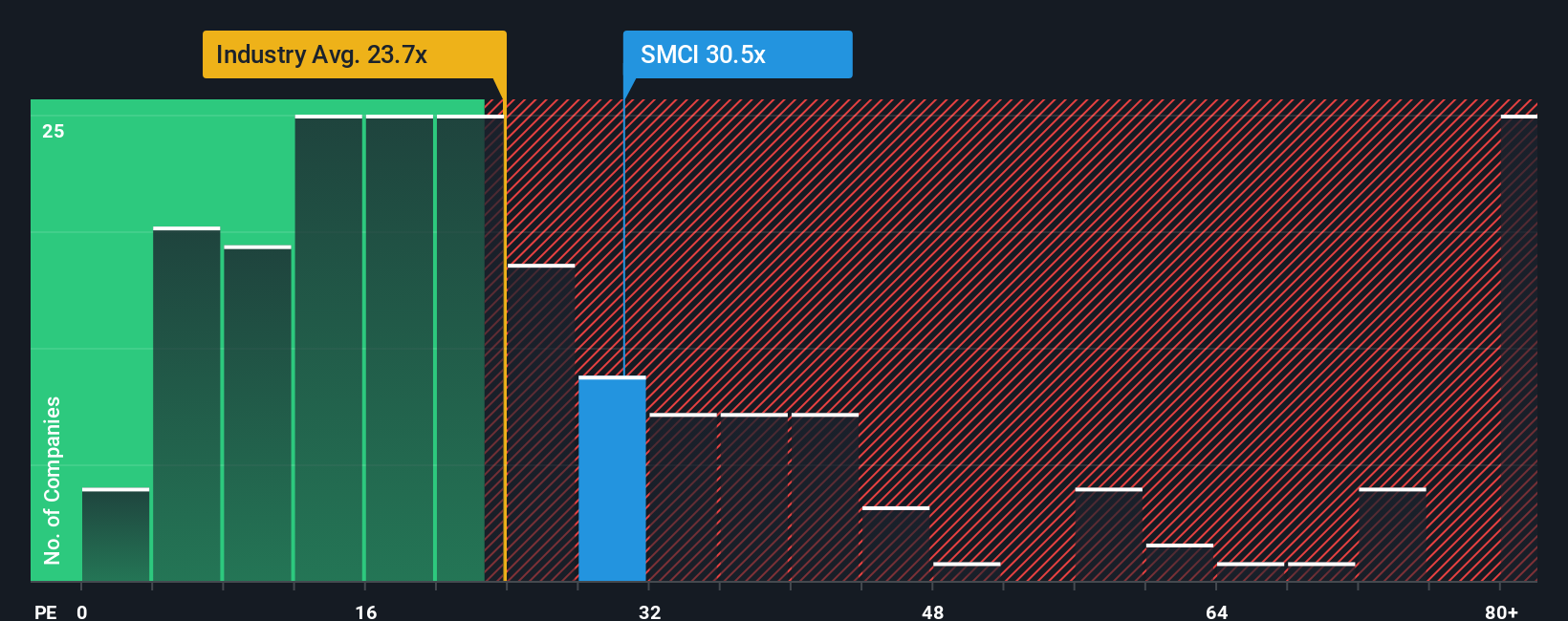

Approach 2: Super Micro Computer Price vs Earnings (PE)

For companies like Super Micro Computer that are consistently profitable, the price-to-earnings (PE) ratio is a reliable valuation tool. The PE ratio tells us how much investors are willing to pay for each dollar of earnings, making it especially relevant for fast-growing tech businesses where profits matter more than just revenue scale.

Of course, what makes for a reasonable PE ratio depends on context. Companies with higher growth prospects and lower risk typically warrant higher multiples, while slower growth or more volatile firms get less generous valuations from the market.

Currently, Super Micro Computer trades at a PE of 30.95x. To put that in perspective, it is notably higher than the broader tech sector’s average of 24.00x and also above its peer group, which sits at 21.49x. At first glance, this premium price tag might raise some eyebrows.

This is where Simply Wall St’s proprietary Fair Ratio comes in. The Fair Ratio for Super Micro Computer is 61.73x, significantly higher than both the company’s current multiple and key benchmarks. The Fair Ratio is a step above traditional comparisons because it takes into account Super Micro Computer’s unique growth trajectory, profit margins, risk profile, as well as its size within the industry. This provides a much more nuanced picture of what the stock should be worth in today’s market.

Comparing these figures, Super Micro Computer’s actual PE is well below its Fair Ratio, suggesting the stock may be undervalued when all the right fundamentals are considered.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Super Micro Computer Narrative

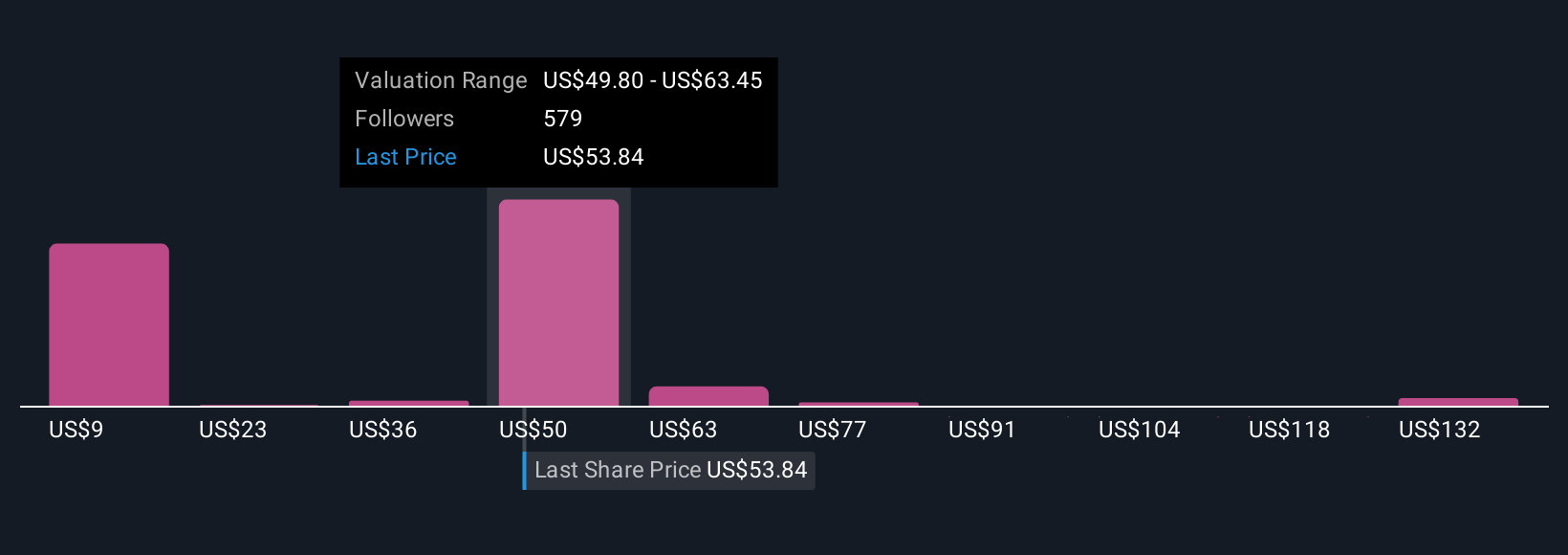

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, user-driven way to connect your outlook for a company, like Super Micro Computer, to the actual numbers: your chosen estimates for future revenue, margins, earnings, and fair value. It offers a story behind the stats.

In essence, Narratives bridge the gap between a company’s big-picture story and a financial forecast, making it easy for anyone to clarify their investment logic with tangible, customizable projections. The best part is that Narratives are easily accessible on Simply Wall St’s Community page, where millions of investors create and share their views.

With Narratives, you can scan the gap between your own Fair Value and the current Price, helping you decide when to buy or sell based on your perspective. They also update automatically as new news, financials, or events emerge, ensuring your view stays relevant.

For Super Micro Computer, for example, some investors forecast a bullish narrative, projecting fair values as high as $74.7 (or even $126.52 with optimistic growth and profit margins), while others take a more cautious stance with estimates as low as $15. This shows there is no single “right” answer, just your own investment story, backed by real numbers.

For Super Micro Computer, we will make it easy for you with previews of two leading Super Micro Computer Narratives:

🐂 Super Micro Computer Bull Case

Fair Value: $74.53

Current price is 26.74% below this fair value estimate

Expected Revenue Growth: 50%

- Management forecasts aggressive revenue growth with targets of $23 to $25 billion for 2025 and $40 billion for 2026, driven by adoption of Direct Liquid Cooling technology in data centers.

- The company is rebounding strongly following short seller scrutiny and a new auditor appointment, expecting clarity with updated financial filings and positioning itself as a premier provider for AI infrastructure.

- Partnerships with NVDA, AMD, xAI, and Intel, combined with growth in Cloud, 5G, and Storage, are seen as key drivers that justify optimistic long-term fair value estimates ranging from $74.7 to $126.52 per share.

🐻 Super Micro Computer Bear Case

Fair Value: $50.06

Current price is 9.11% above this fair value estimate

Expected Revenue Growth: 29.92%

- Global demand for AI and analytics supports ongoing revenue growth, but profit margins remain pressured due to competitive intensity and hardware commoditization in the AI server market.

- Risks arise from dependence on a handful of large customers, extended purchasing cycles, and execution challenges with new product platforms that could delay or diminish margin improvements.

- Analyst consensus estimates a fair value around $50 based on assumptions of revenues reaching $48.2 billion and a future PE of 16.1 times by 2028, with the current share price trading at a premium to this estimate.

Do you think there's more to the story for Super Micro Computer? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMCI

Super Micro Computer

Develops and sells server and storage solutions based on modular and open-standard architecture in the United States, Asia, Europe, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives