- United States

- /

- Communications

- /

- NasdaqGS:RBBN

The Market Lifts Ribbon Communications Inc. (NASDAQ:RBBN) Shares 31% But It Can Do More

Those holding Ribbon Communications Inc. (NASDAQ:RBBN) shares would be relieved that the share price has rebounded 31% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

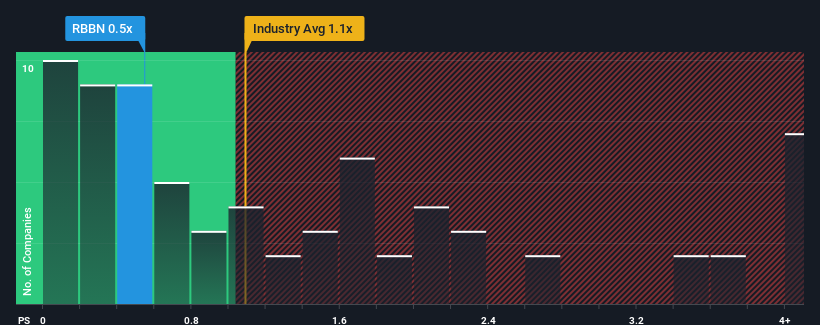

In spite of the firm bounce in price, considering around half the companies operating in the United States' Communications industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider Ribbon Communications as an solid investment opportunity with its 0.5x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Ribbon Communications

What Does Ribbon Communications' P/S Mean For Shareholders?

Ribbon Communications could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Ribbon Communications' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Ribbon Communications?

The only time you'd be truly comfortable seeing a P/S as low as Ribbon Communications' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 9.6% in total over the last three years. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 4.7% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 0.4%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Ribbon Communications' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Despite Ribbon Communications' share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at Ribbon Communications' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It is also worth noting that we have found 2 warning signs for Ribbon Communications that you need to take into consideration.

If you're unsure about the strength of Ribbon Communications' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Ribbon Communications, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RBBN

Ribbon Communications

Provides communications technology in the United States, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Very undervalued with adequate balance sheet.