- United States

- /

- Communications

- /

- NasdaqGS:RBBN

Investors in Ribbon Communications (NASDAQ:RBBN) from three years ago are still down 51%, even after 11% gain this past week

It's nice to see the Ribbon Communications Inc. (NASDAQ:RBBN) share price up 11% in a week. But that doesn't change the fact that the returns over the last three years have been disappointing. Tragically, the share price declined 51% in that time. So it's good to see it climbing back up. Perhaps the company has turned over a new leaf.

While the last three years has been tough for Ribbon Communications shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

See our latest analysis for Ribbon Communications

Given that Ribbon Communications didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Ribbon Communications' revenue dropped 1.7% per year. That is not a good result. The share price decline of 15% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Having said that, if growth is coming in the future, now may be the low ebb for the company. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

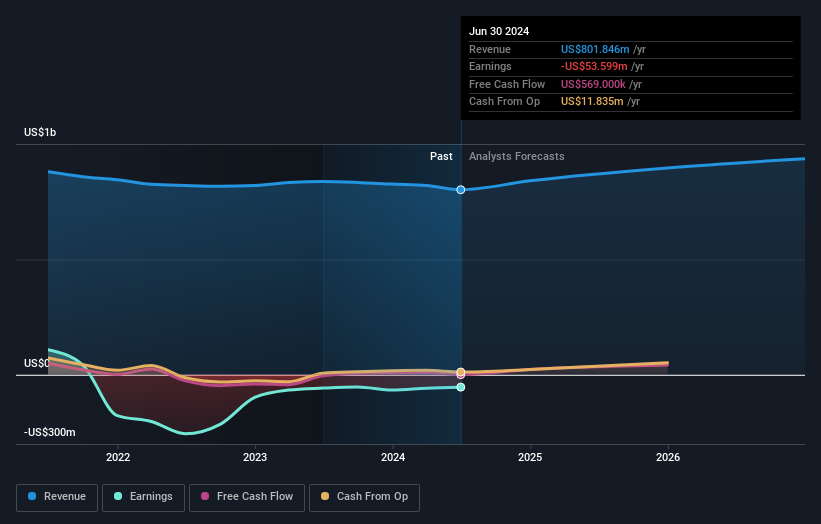

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling Ribbon Communications stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Ribbon Communications provided a TSR of 14% over the last twelve months. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 6% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Ribbon Communications better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Ribbon Communications you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RBBN

Ribbon Communications

Provides communications technology in the United States, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026