- United States

- /

- Tech Hardware

- /

- NasdaqCM:QUBT

Quantum Computing (QUBT) Is Up After $750 Million Private Placement to Accelerate Expansion Plans

Reviewed by Sasha Jovanovic

- In early October 2025, Quantum Computing Inc. entered into agreements for a major private placement with institutional investors, securing approximately US$750 million in gross proceeds and filing related shelf registrations for up to US$774 million in common stock offerings.

- This substantial capital raise is intended to accelerate the company's commercialization, fund potential acquisitions, and scale production capacity, signaling an ambitious expansion plan in quantum computing technologies.

- We'll look at how Quantum Computing's significant infusion of capital may reshape its investment narrative by enabling broader commercialization efforts.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Quantum Computing's Investment Narrative?

To be a shareholder in Quantum Computing Inc., you have to buy into the idea that quantum technologies remain a long-term play. What stands out right now is the company raising around US$750 million through a private placement with backing from large, existing shareholders, signaling enough confidence to fund ambitious growth, acquisitions, and production scaling. This is a big shift that could speed up commercialization and address a key short-term catalyst, building out revenue-generating products, which has so far lagged forecasts. On the risk side, the dilution from repeated capital raising is hardly trivial, especially given the company’s low revenue base and persistent losses. The recent capital injection could ease near-term financial pressures but also leaves new investors exposed to volatility, execution hurdles, and ongoing legal and compliance uncertainties. With price swings and losses continuing, the balance of optimism and risk is as stark as ever. But here’s what you might not expect: share dilution may remain a pressing concern.

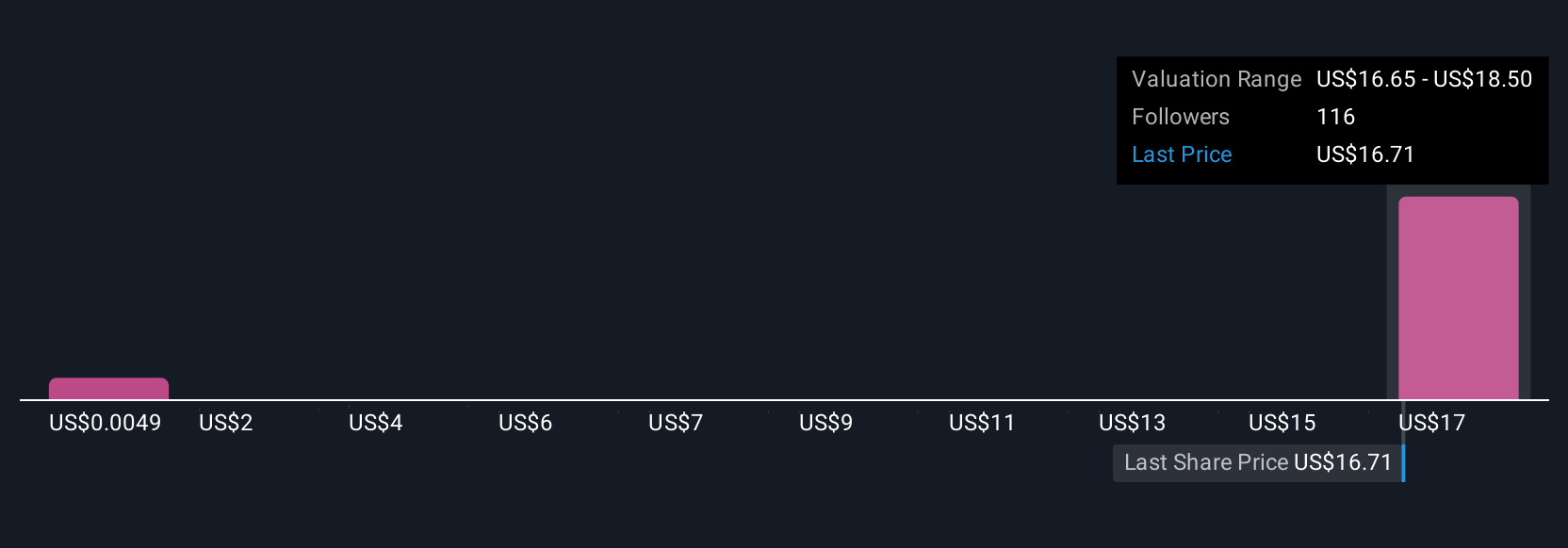

Upon reviewing our latest valuation report, Quantum Computing's share price might be too optimistic.Exploring Other Perspectives

Explore 31 other fair value estimates on Quantum Computing - why the stock might be worth as much as 38% more than the current price!

Build Your Own Quantum Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quantum Computing research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Quantum Computing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quantum Computing's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quantum Computing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:QUBT

Quantum Computing

An integrated photonics company, provides quantum machines to commercial and government markets in the United States.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

West Africa's 20 Baggers Gold Play (Nigeria/Senegal)

Tesla’s Nvidia Moment – The AI & Robotics Inflection Point

Micron's New Supercycle: Riding the High-Bandwidth Memory Wave

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Early mover in a fast growing industry. Likely to experience share price volatility as they scale