- United States

- /

- Tech Hardware

- /

- NasdaqCM:QUBT

Quantum Computing (QUBT) Is Up 9.0% After Securing First NIST Deal and Major Chip Order—What’s Changed

Reviewed by Simply Wall St

- Quantum Computing Inc. recently announced it secured its first direct government contract from the National Institute of Standards and Technology (NIST) for the design and fabrication of thin-film lithium niobate photonic integrated circuits, alongside a new chip order from a Fortune 500 science and technology company.

- This marks a notable step for Quantum Computing Inc. in establishing itself as a key domestic supplier of advanced photonic technologies at a time of increasing demand for U.S.-based chip innovation.

- We'll explore how winning the NIST contract and a major commercial order is reshaping Quantum Computing Inc.'s investment narrative around TFLN photonics leadership.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Quantum Computing's Investment Narrative?

To believe in Quantum Computing Inc., you need conviction that emerging quantum and photonic chip technologies will see accelerating demand, and that QCi is well-positioned to lead a new era of domestic TFLN photonics. The latest NIST contract, coupled with a Fortune 500 chip order, suggests fresh traction in government and commercial markets. This may shift the company's most important short-term catalysts: actual delivery and performance on these contracts could fuel revenue visibility and enhance the business narrative, especially as QCi has just begun meaningful government partnerships. However, risks remain: QCi is still unprofitable, has diluted shareholders heavily in the past year, and is caught in a securities fraud lawsuit that could weigh on both reputation and operations. While recent revenue growth has been rapid and the share price reaction has been strong, this new momentum does not resolve longstanding challenges like board inexperience and persistent financial losses. Yet, the unresolved lawsuit could become a much bigger concern for shareholders than recent wins suggest.

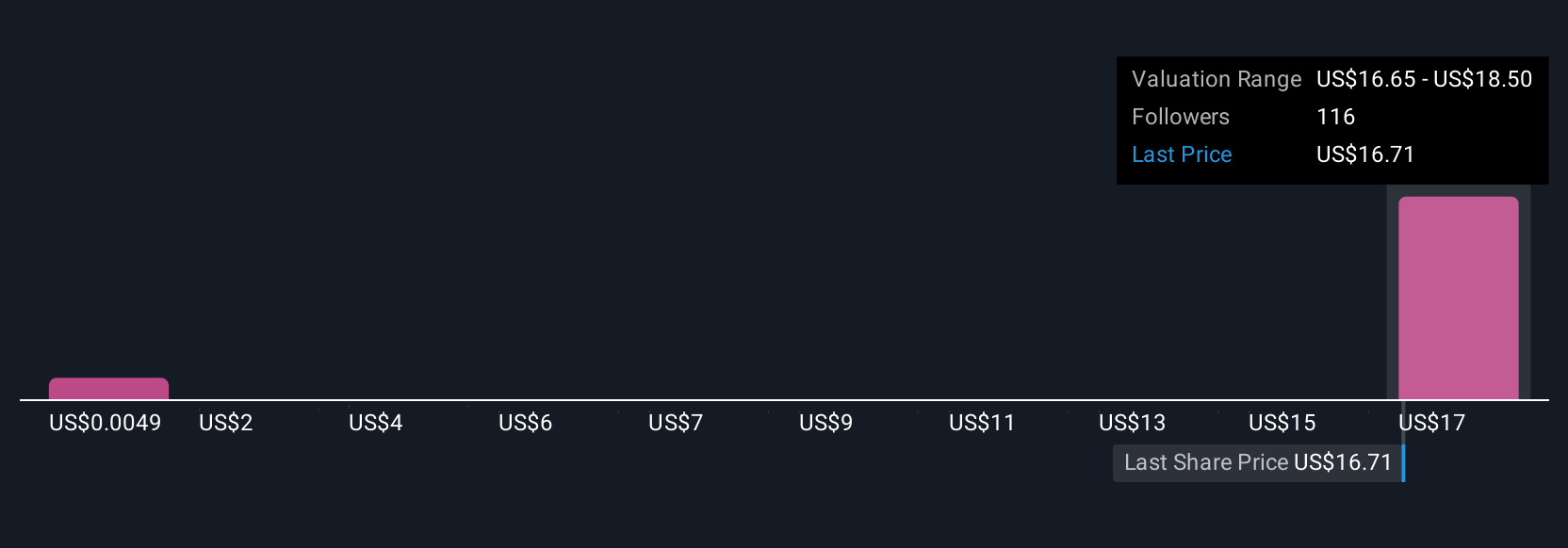

Our valuation report here indicates Quantum Computing may be overvalued.Exploring Other Perspectives

Explore 25 other fair value estimates on Quantum Computing - why the stock might be worth as much as 15% more than the current price!

Build Your Own Quantum Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quantum Computing research is our analysis highlighting 1 key reward and 6 important warning signs that could impact your investment decision.

- Our free Quantum Computing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quantum Computing's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Quantum Computing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:QUBT

Quantum Computing

An integrated photonics company, provides quantum machines to commercial and government markets in the United States.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)