- United States

- /

- Tech Hardware

- /

- NasdaqGM:PMTS

If EPS Growth Is Important To You, CPI Card Group (NASDAQ:PMTS) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like CPI Card Group (NASDAQ:PMTS). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide CPI Card Group with the means to add long-term value to shareholders.

Check out our latest analysis for CPI Card Group

CPI Card Group's Improving Profits

CPI Card Group has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. CPI Card Group's EPS shot up from US$2.20 to US$2.94; a result that's bound to keep shareholders happy. That's a fantastic gain of 34%.

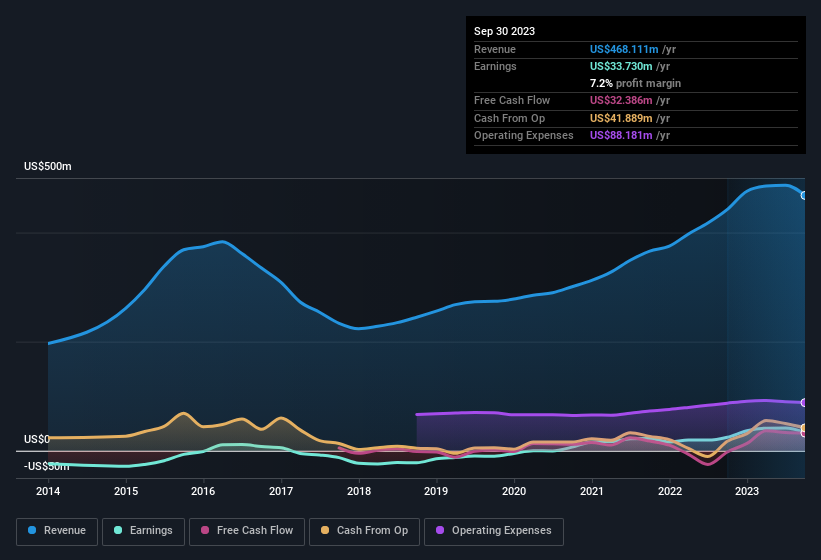

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. CPI Card Group maintained stable EBIT margins over the last year, all while growing revenue 5.8% to US$468m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for CPI Card Group's future profits.

Are CPI Card Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the bigger deal is that the Independent Chair, H. Riley, paid US$179k to buy shares at an average price of US$23.92. Purchases like this clue us in to the to the faith management has in the business' future.

It's reassuring that CPI Card Group insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. To be specific, the CEO is paid modestly when compared to company peers of the same size. The median total compensation for CEOs of companies similar in size to CPI Card Group, with market caps between US$100m and US$400m, is around US$1.5m.

CPI Card Group offered total compensation worth US$1.1m to its CEO in the year to December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is CPI Card Group Worth Keeping An Eye On?

For growth investors, CPI Card Group's raw rate of earnings growth is a beacon in the night. And that's not the only positive either. We have both insider buying and reasonable and remuneration to consider. The overriding message from this quick rundown is yes, this stock is worth investigating further. Still, you should learn about the 2 warning signs we've spotted with CPI Card Group (including 1 which can't be ignored).

There are plenty of other companies that have insiders buying up shares. So if you like the sound of CPI Card Group, you'll probably love this curated collection of companies in the US that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PMTS

CPI Card Group

Engages in the design, production, data personalization, packaging, and fulfillment of payment cards in the United States.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion