- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

Will ePlus (PLUS) and Juniper's Deeper Partnership Test Its Competitive Edge in Enterprise IT Services?

Reviewed by Sasha Jovanovic

- In the past week, ePlus announced an expansion of its Managed Services and Enhanced Maintenance Support offerings to cover the full Juniper Networks infrastructure, aiming to streamline support for clients with multi-vendor environments through certified expertise and direct escalation to Juniper engineers.

- This move deepens ePlus's technical partnership with Juniper Networks and reflects a growing demand for more integrated, lifecycle-driven IT support solutions across complex enterprise networks.

- We'll explore how the expanded Juniper partnership shapes ePlus's investment narrative at a time of growing industry demand for integrated IT services.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

ePlus Investment Narrative Recap

Owning ePlus means believing in the long-term growth of advanced IT services, cloud, and security demand, especially as enterprises move toward more integrated and recurring service contracts. The newly expanded Juniper Networks support aligns with this view, reinforcing ePlus’s managed services push, but does not significantly change the near-term risk of revenue unpredictability tied to large, one-time customer deals, nor the importance of growing recurring revenue streams for stability.

The recent announcement of extended managed services to the entire Juniper Networks infrastructure stands out as most relevant. Strengthening this partnership supports ePlus’s efforts to capture higher-margin, recurring service opportunities, a key driver in reducing reliance on unpredictable, project-based revenues and addressing margin compression pressures.

However, with ongoing customer concentration risk and enterprise spending cycles still in play, investors should also be aware that...

Read the full narrative on ePlus (it's free!)

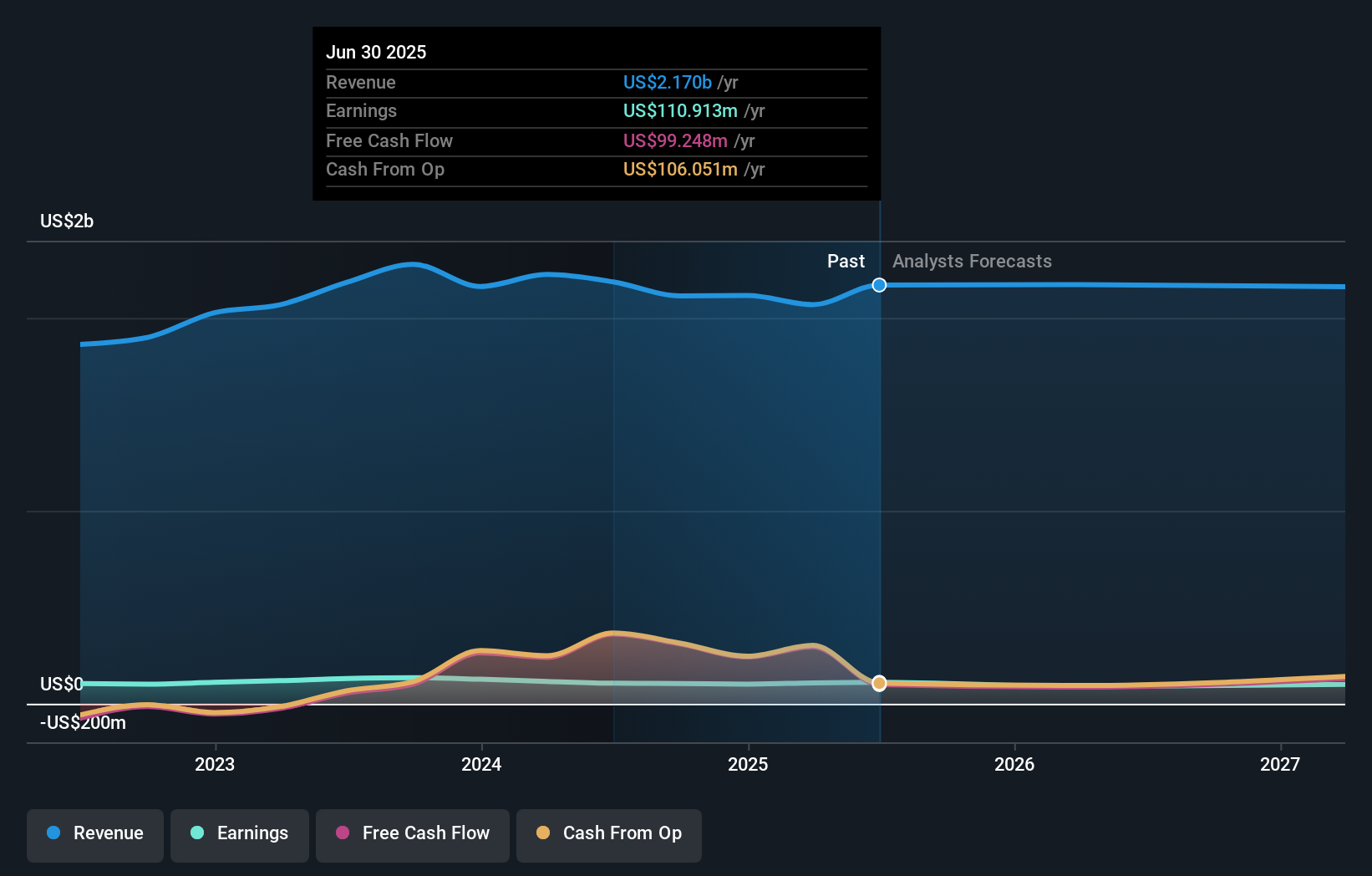

ePlus is projected to reach $2.2 billion in revenue and $78.4 million in earnings by 2028. This forecast assumes a -0.2% annual revenue decline and a $32.5 million decrease in earnings from the current $110.9 million level.

Uncover how ePlus' forecasts yield a $92.00 fair value, a 32% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members place ePlus’s fair value between US$35.03 and US$92 based on two independent models. These diverse outlooks arrive as recurring services gain momentum, but customer demand concentration continues to shape expectations for future stability.

Explore 2 other fair value estimates on ePlus - why the stock might be worth as much as 32% more than the current price!

Build Your Own ePlus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ePlus research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ePlus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ePlus' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives