- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:PLUS

A Look at ePlus (PLUS) Valuation Following Share Pullback on Fresh U.S.-China Trade Concerns

Reviewed by Kshitija Bhandaru

ePlus (PLUS) shares slipped 3% in afternoon trading as worries about U.S.-China trade tensions resurfaced following blunt remarks from the U.S. President. Investors responded swiftly, especially regarding tech companies reliant on Chinese supply chains.

See our latest analysis for ePlus.

Despite today’s 3.7% dip in share price, which reflects fresh sector-wide anxiety around U.S.-China trade, ePlus has seen some notable events recently, including upgraded managed services with Juniper Networks and a prominent conference appearance. Short-term momentum has faded, with a year-to-date share price return of -5.9%. However, the bigger picture is more upbeat; long-term shareholders have still enjoyed a 77% total return over five years, showing ePlus’s ability to deliver value over time.

If the shifting landscape for tech companies has you looking beyond the headlines, this could be your moment to explore fast growing stocks with high insider ownership.

With ePlus trading at a noticeable discount to analyst price targets after a tough year, the central question emerges: is this a value play with upside, or has the market fully recognized the company’s prospects for future growth?

Most Popular Narrative: 24.3% Undervalued

ePlus’s current share price of $69.62 is well below the $92.00 fair value implied by the most widely followed narrative, creating a sizable gap that challenges recent market pessimism. The narrative closely examines this valuation gap, linking it to prominent business shifts and strategic investments in new technology segments.

The transition to a pure-play technology product and services company, following the sale of the financing business, simplifies operations and reduces earnings volatility. This allows management to focus capital on higher-growth, higher-margin areas, potentially unlocking higher net margins and more consistent earnings over time.

What is the real reason behind this bold upside call? The full story includes analyst projections for shrinking profit margins, less predictable large deals, and a future profit multiple that could surprise even seasoned investors. Find out which forecasts underpin the narrative’s confident target—click to see what could drive ePlus’s next big move.

Result: Fair Value of $92.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in key customer verticals or continued margin pressure could quickly challenge expectations and shift sentiment on ePlus's long-term trajectory.

Find out about the key risks to this ePlus narrative.

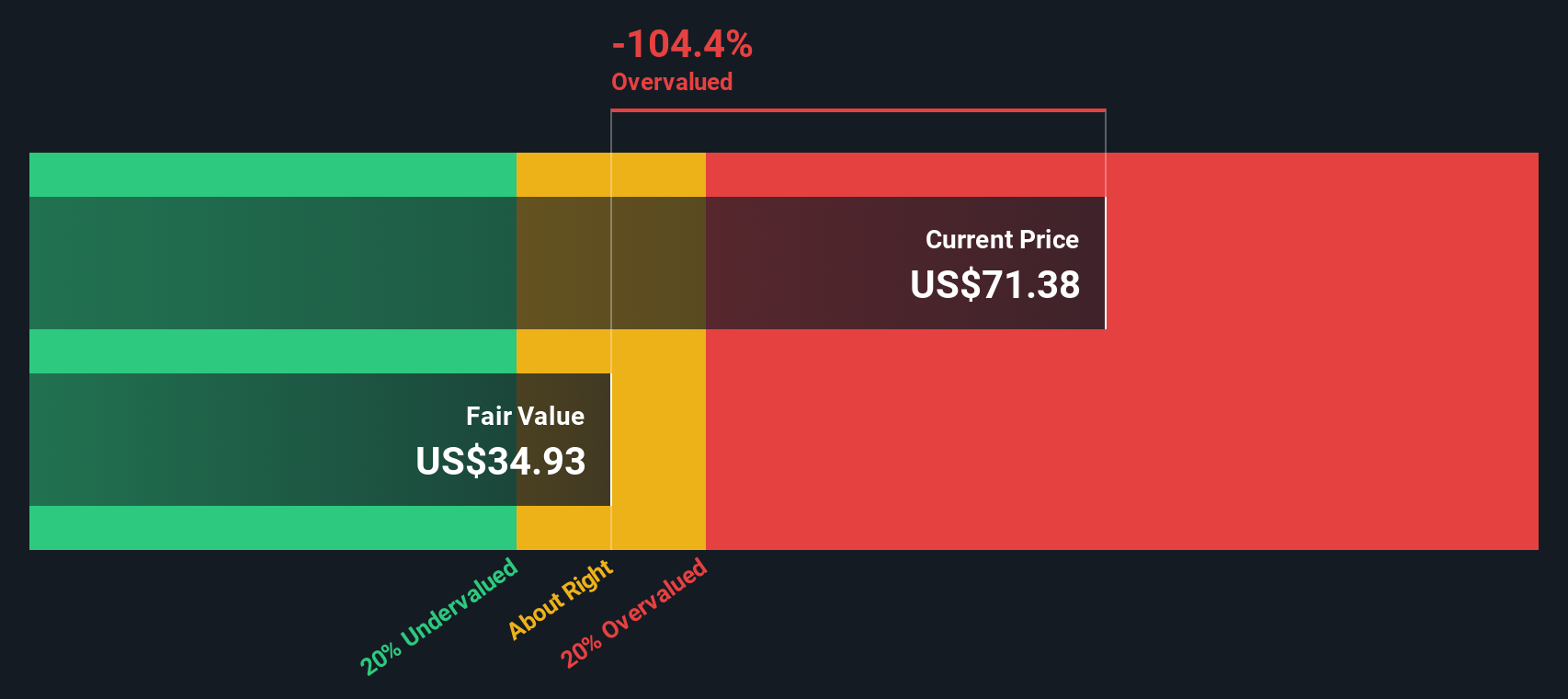

Another View: Contrasting the DCF Model

While analysts see ePlus as undervalued based on growth and market multiples, our DCF model tells a different story. According to this approach, ePlus's fair value sits much lower than current trading levels. This implies that the share price may actually be running ahead of its long-term cash flow fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ePlus for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ePlus Narrative

If you have a different perspective or want to dig deeper, you can shape your own ePlus investment story using our data tools in just minutes. Do it your way.

A great starting point for your ePlus research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Expand your portfolio by tapping into unique stock ideas beyond ePlus. Don’t let fresh opportunities pass you by. See how these handpicked screens could power your next smart move:

- Maximize your cash flow potential and uncover companies trading well below intrinsic value by checking out these 898 undervalued stocks based on cash flows.

- Boost your passive income stream and spot reliable firms with generous payouts through these 19 dividend stocks with yields > 3%.

- Ride the next wave in healthcare innovation by targeting top performers in artificial intelligence using these 33 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLUS

ePlus

Provides information technology (IT) solutions that enable organizations to optimize IT environment and supply chain processes in the United States and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives