The board of PCTEL, Inc. (NASDAQ:PCTI) has announced that it will pay a dividend of $0.055 per share on the 15th of February. This means the annual payment is 4.7% of the current stock price, which is above the average for the industry.

View our latest analysis for PCTEL

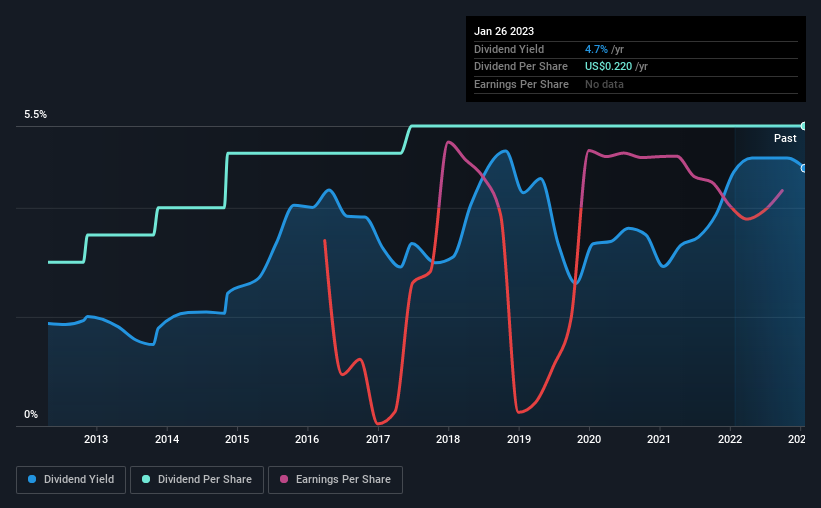

PCTEL Is Paying Out More Than It Is Earning

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, the dividend made up 348% of earnings, and the company was generating negative free cash flows. Paying out such a large dividend compared to earnings while also not generating any free cash flow would definitely be difficult to keep up.

The next 12 months is set to see EPS grow by 54.3%. If the dividend continues on its recent course, the company could be paying out several times what it earns in the next 12 months, which could start applying pressure to the balance sheet.

PCTEL Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2013, the dividend has gone from $0.12 total annually to $0.22. This implies that the company grew its distributions at a yearly rate of about 6.2% over that duration. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

Dividend Growth Could Be Constrained

Investors could be attracted to the stock based on the quality of its payment history. PCTEL has impressed us by growing EPS at 24% per year over the past five years. EPS has been growing well, but PCTEL has been paying out a massive proportion of its earnings, which can make the dividend tough to maintain.

The Dividend Could Prove To Be Unreliable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about PCTEL's payments, as there could be some issues with sustaining them into the future. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 5 warning signs for PCTEL (of which 1 can't be ignored!) you should know about. Is PCTEL not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PCTI

PCTEL

PCTEL, Inc., together with its subsidiaries, provides industrial Internet of Thing devices (IoT), antenna systems, and test and measurement solutions worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.