- United States

- /

- Tech Hardware

- /

- NasdaqCM:OSS

Does One Stop Systems (NASDAQ:OSS) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that One Stop Systems, Inc. (NASDAQ:OSS) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for One Stop Systems

What Is One Stop Systems's Net Debt?

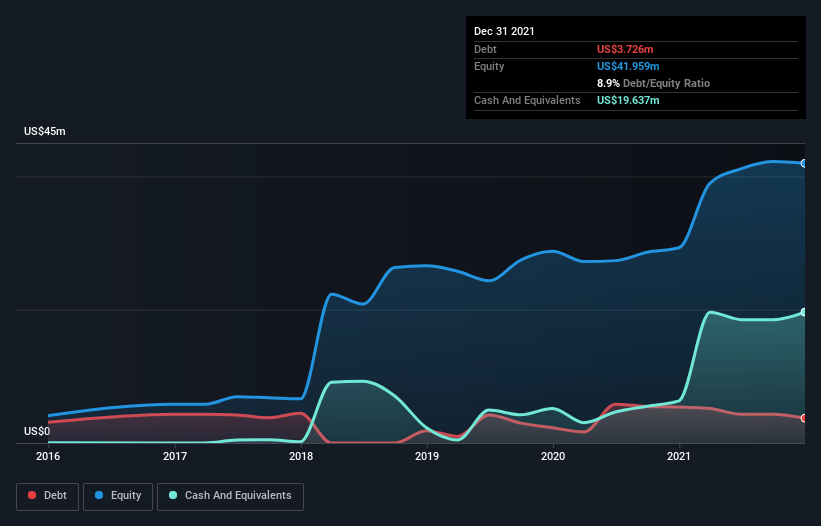

The image below, which you can click on for greater detail, shows that One Stop Systems had debt of US$3.73m at the end of December 2021, a reduction from US$5.39m over a year. But it also has US$19.6m in cash to offset that, meaning it has US$15.9m net cash.

A Look At One Stop Systems' Liabilities

Zooming in on the latest balance sheet data, we can see that One Stop Systems had liabilities of US$9.63m due within 12 months and no liabilities due beyond that. Offsetting these obligations, it had cash of US$19.6m as well as receivables valued at US$5.09m due within 12 months. So it actually has US$15.1m more liquid assets than total liabilities.

This excess liquidity suggests that One Stop Systems is taking a careful approach to debt. Due to its strong net asset position, it is not likely to face issues with its lenders. Succinctly put, One Stop Systems boasts net cash, so it's fair to say it does not have a heavy debt load!

It was also good to see that despite losing money on the EBIT line last year, One Stop Systems turned things around in the last 12 months, delivering and EBIT of US$1.7m. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if One Stop Systems can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While One Stop Systems has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, One Stop Systems actually produced more free cash flow than EBIT over the last year. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that One Stop Systems has net cash of US$15.9m, as well as more liquid assets than liabilities. And it impressed us with free cash flow of US$5.1m, being 290% of its EBIT. So we don't think One Stop Systems's use of debt is risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for One Stop Systems that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:OSS

One Stop Systems

Designs, manufactures, and markets rugged high-performance compute, high speed switch fabrics, and storage systems for edge applications of artificial intelligence and machine learning, sensor processing, sensor fusion, and autonomy in the United States and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives