- United States

- /

- Communications

- /

- NasdaqCM:ONDS

Does the Huge 54% Surge in Ondas Signal Lasting Value for 2025?

Reviewed by Bailey Pemberton

If you have been watching Ondas Holdings lately, you are not alone. The stock has been catching quite a few eyes, especially after its recent surge. In just the past week, Ondas shot up an impressive 54.0%, adding to a 30-day rally of 85.8%. Stretch that out and the gains look even more dramatic: up 328.1% year-to-date and a staggering 1149.2% over the past twelve months. Even for seasoned investors, those numbers are hard to ignore.

So, what is driving all this excitement? Partly, it is optimism swirling around developments in wireless communications and automation, areas where Ondas is building a reputation for innovative solutions. Many see newfound potential, and the market seems to be collectively reassessing both the risks and rewards of holding shares in Ondas Holdings.

Of course, explosive growth also means recalibrating what the company is actually worth. That is where a clear-eyed look at valuation comes in. Using six classic valuation checks, Ondas scores a 2, indicating that it appears undervalued in just two categories so far. That might leave you wondering: is the big run-up already baked into the price, or is there further room to climb?

Next, we will break down each valuation approach to see where Ondas truly stands, and stick around. We will share a smarter way to assess a stock's real potential, beyond the numbers.

Ondas Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ondas Holdings Discounted Cash Flow (DCF) Analysis

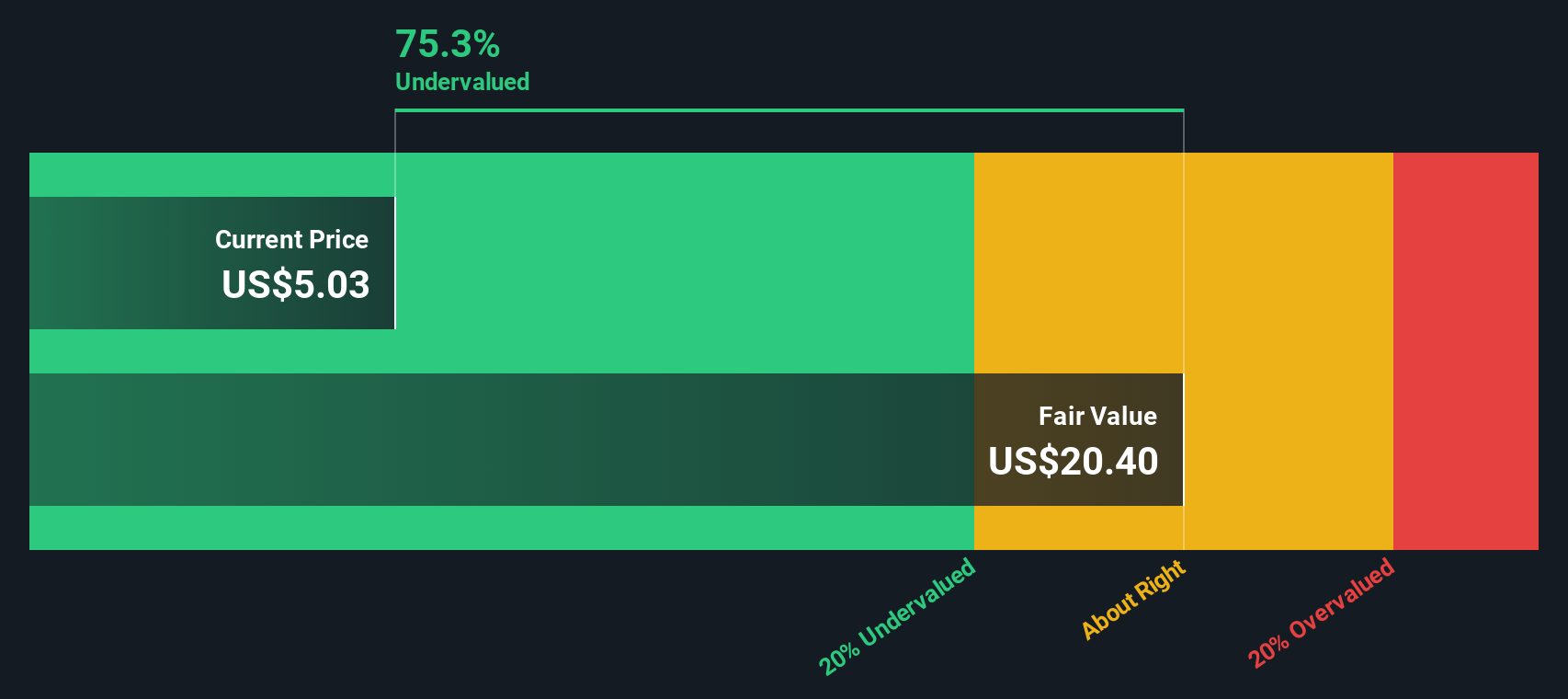

The Discounted Cash Flow (DCF) model estimates a company’s true worth by forecasting its future cash flows and discounting them back to today’s value. In Ondas Holdings’ case, this approach uses the 2 Stage Free Cash Flow to Equity method, focusing on how much cash the business might generate for shareholders in the years ahead.

Currently, Ondas Holdings posts a Free Cash Flow (FCF) of -$33.48 million, which means the company is still burning cash rather than generating it. Looking ahead, analysts expect improvements. By 2029, forecasts show FCF rising to $107.67 million, with further growth projected into the next decade. While only the first five years are based on direct analyst forecasts, Simply Wall St uses industry assumptions to estimate further gains out to 2035. This model estimates FCF could reach over $386 million by that time.

Applying DCF analysis, the model arrives at an intrinsic fair value of $14.21 per share. With Ondas Holdings trading at a 20.8% discount to this value, the numbers suggest that the stock is undervalued at current levels based on realistic cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ondas Holdings is undervalued by 20.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

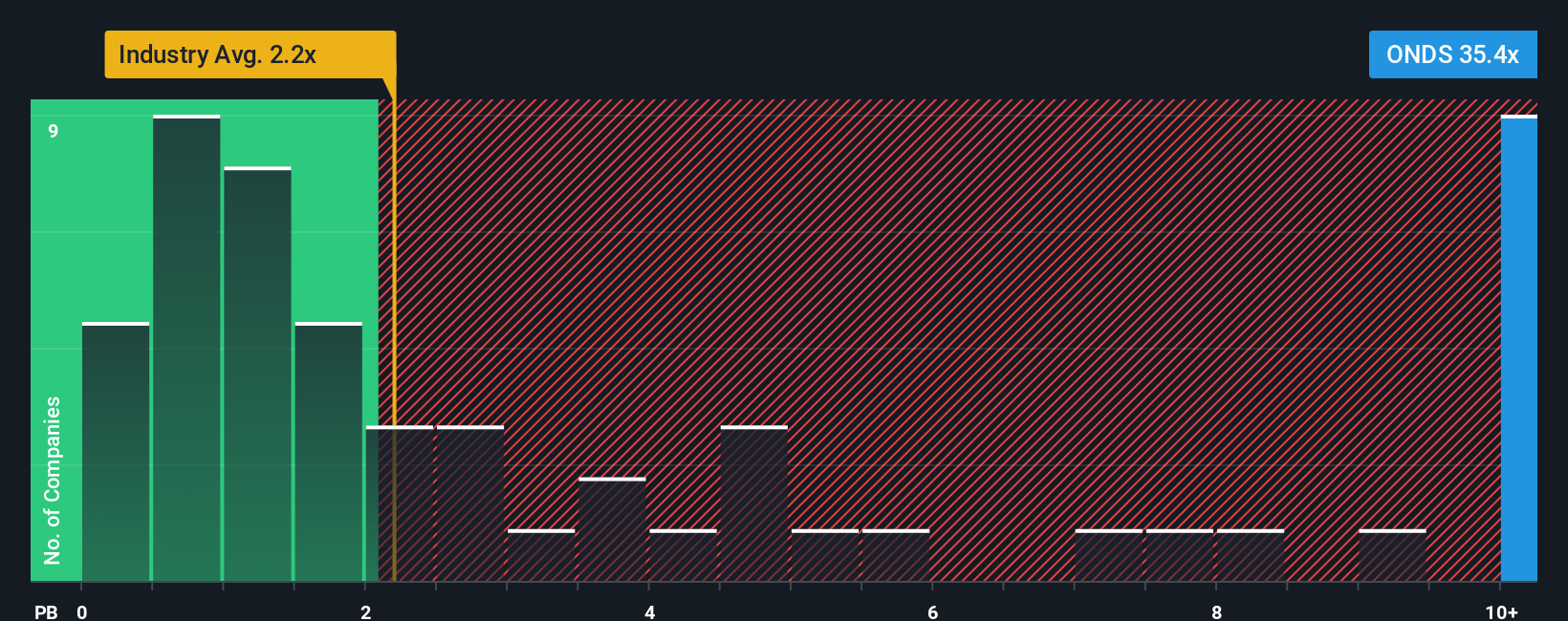

Approach 2: Ondas Holdings Price vs Book

The Price-to-Book (P/B) ratio is often used to value companies, especially when earnings are negative or unpredictable. While profitable firms might use Price-to-Earnings, P/B is helpful for businesses like Ondas Holdings, where book value provides a tangible baseline investors can analyze. This metric compares a company’s market value to its net assets, making it particularly relevant for evaluating asset-heavy or turnaround companies.

Growth prospects and perceived risks in a business often influence what investors view as a "normal" or fair P/B ratio. If a company’s future looks bright, the market may accept a higher multiple. Uncertainties or weak profitability generally suppress it relative to the industry.

Currently, Ondas Holdings trades at a sky-high P/B ratio of 40.53x. To put this in perspective, the average among its industry peers is just 13.19x, and the communications sector itself averages an even lower 2.18x. Ondas is priced well above these benchmarks, signaling strong market optimism or perhaps a premium for its growth narrative.

This is where Simply Wall St's proprietary “Fair Ratio” steps in. Instead of simply comparing to industry or peer averages, the Fair Ratio provides a tailored view, weighting factors such as future earnings growth, profit margins, company size, risk, and sector trends. This approach captures nuances that other comparisons can miss.

When comparing Ondas' actual P/B ratio to its Fair Ratio, the difference is significant. Ondas trades far above what would be considered fair given its current fundamentals. That suggests the stock, by this measure, is in overvalued territory.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ondas Holdings Narrative

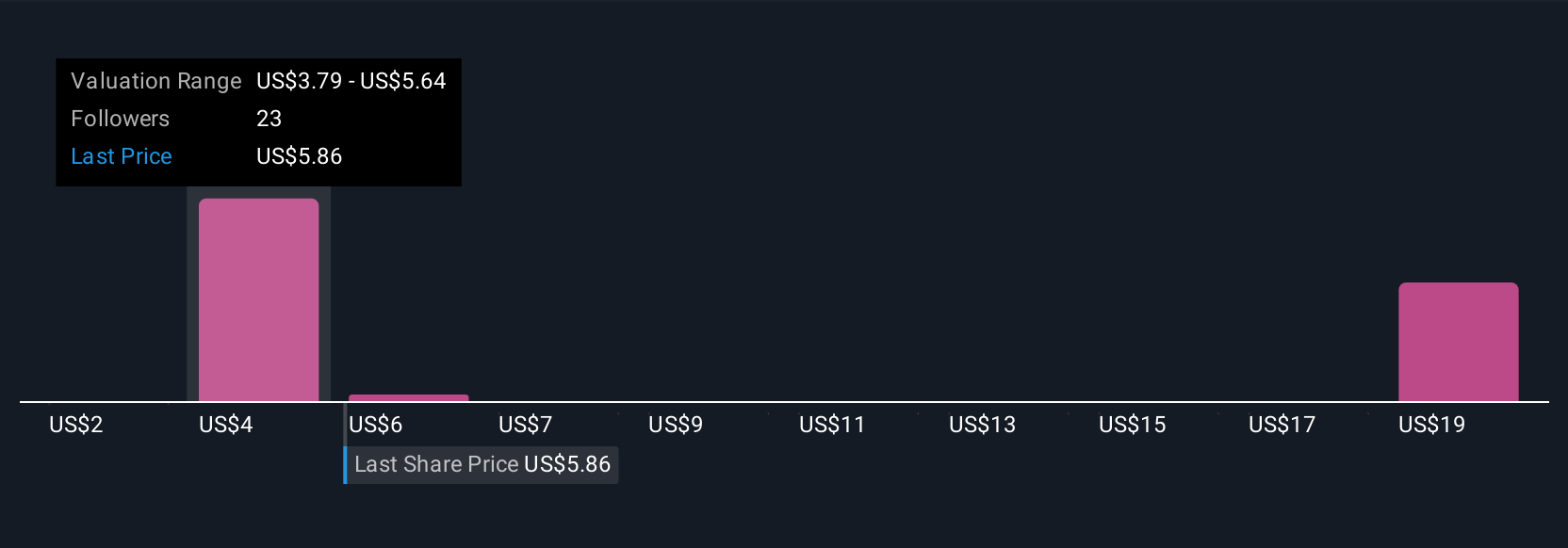

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce Narratives. A Narrative is simply the story you tell about a company, based on both its big-picture potential and financial realities. Rather than just looking at numbers in isolation, Narratives connect what is happening in the business, your outlook on future revenue, earnings and margins, and your idea of fair value, all into one clear forecast.

On Simply Wall St’s Community page, used by millions of investors, Narratives make it easy for you to combine your research and perspectives to create a personal take on where Ondas Holdings is heading. By mapping these insights to a financial forecast and comparing your fair value to the current share price, Narratives empower you to decide when to buy, hold, or sell, with confidence.

What sets Narratives apart is that they update dynamically whenever new information such as news or earnings comes out, helping your investment thesis stay relevant. For example, one Ondas investor might build a bullish Narrative, predicting strong defense sector growth and setting a fair value as high as $8.17 per share, while another might be more cautious, accounting for recurring losses and valuing the company closer to $2.00. Which story fits your view? With Narratives, smarter investing is right at your fingertips.

Do you think there's more to the story for Ondas Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ONDS

Ondas Holdings

Provides private wireless, drone, and automated data solutions in the United States and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives