- United States

- /

- Tech Hardware

- /

- NasdaqGS:NTAP

Should NetApp’s (NTAP) Executive Hires and Insider Buying Influence Views on Its Hybrid Cloud Strategy?

Reviewed by Sasha Jovanovic

- Earlier this week, NetApp reported steady gains in all-flash storage, cloud services, and AI at the Goldman Sachs Communicopia + Technology Conference, while noting lingering weakness in U.S. public sector and EMEA demand.

- Notably, multiple senior leadership hires and strong insider buying activity have highlighted management’s confidence in NetApp’s evolving hybrid cloud and data portfolio.

- We'll explore how NetApp’s focus on hybrid cloud growth and executive hiring could reshape its overall investment narrative going forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

NetApp Investment Narrative Recap

To own NetApp stock, you need to believe in its ability to capitalize on the accelerating adoption of hybrid cloud and AI-driven data infrastructure, even as competitive threats persist from hyperscalers and pure cloud providers. This week's updates of steady growth in all-flash storage and AI, despite lingering softness in U.S. public sector and EMEA demand, do little to change the main near-term catalyst, expansion of hybrid cloud solutions, while leaving geographic concentration as a material ongoing risk for the business.

Among recent announcements, NetApp's September launch of StorageGRID 12.0 is most relevant, enhancing AI workload support and security right as enterprises increasingly demand high-performance, scalable, and resilient cloud data infrastructure. This ties directly to the ongoing shift toward AI and hybrid cloud, reinforcing the company's outlook around its most important growth drivers and potentially supporting higher revenue visibility.

Yet, in contrast, investors should be aware that persistent regional weakness, especially in EMEA, could still...

Read the full narrative on NetApp (it's free!)

NetApp's narrative projects $7.5 billion revenue and $1.4 billion earnings by 2028. This requires 4.3% yearly revenue growth and a $0.2 billion earnings increase from $1.2 billion currently.

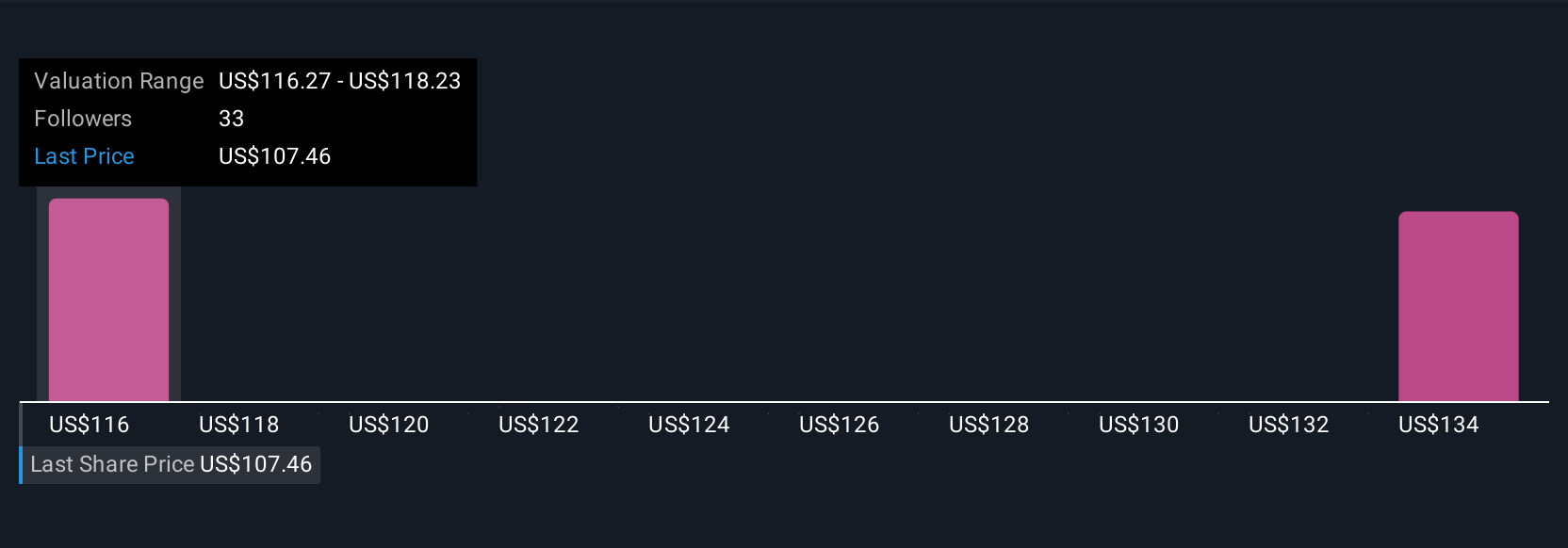

Uncover how NetApp's forecasts yield a $119.71 fair value, in line with its current price.

Exploring Other Perspectives

Five individual estimates from the Simply Wall St Community peg NetApp's fair value from US$119.71 up to US$179.02 per share. As growth in hybrid cloud adoption continues to drive company initiatives, now is a good time to compare these varied views and consider the impact of regional demand risks.

Explore 5 other fair value estimates on NetApp - why the stock might be worth just $119.71!

Build Your Own NetApp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NetApp research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NetApp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NetApp's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NetApp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTAP

NetApp

Provides a range of enterprise software, systems, and services that customers use to transform their data infrastructures in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives