- United States

- /

- Tech Hardware

- /

- NasdaqGS:NTAP

NetApp (NTAP) Valuation in Focus Following Q1 Earnings, Guidance, Dividend, and Buyback Update

Reviewed by Simply Wall St

Most Popular Narrative: 2.4% Overvalued

The prevailing narrative suggests that NetApp is currently trading a touch above its fair value. Analyst consensus points to a slightly overvalued position when balancing future earnings potential against today’s share price.

Expanding portfolio of AI-ready innovations, operating efficiencies, and consistent improvements in Public Cloud gross margins (now guided to 80 to 85%, up from 75 to 80%), are expected to further enhance profitability and drive long-term earnings growth.

Eager to uncover what’s fueling this valuation call? The numbers behind this narrative lean on ambitious forecasts for profit margins and steady revenue growth, but that’s not the whole story. What secret financial assumptions are making all the difference for NetApp’s perceived value?

Result: Fair Value of $118.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as declining product revenue and heavy reliance on cloud partners could challenge NetApp’s growth narrative in the quarters ahead.

Find out about the key risks to this NetApp narrative.Another View: What Does Our DCF Model Say?

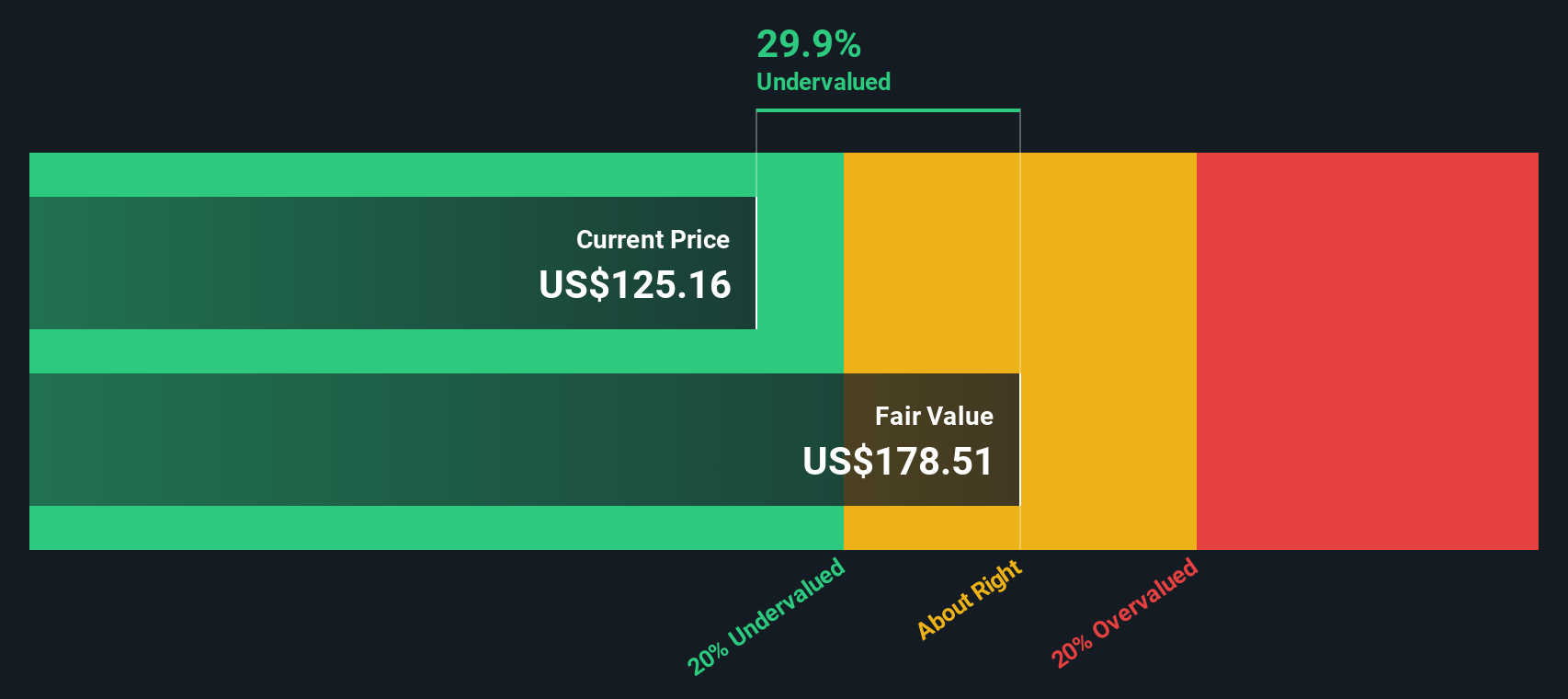

While analyst price targets suggest NetApp may be overvalued, our SWS DCF model offers a different perspective. It points to potential undervaluation, raising the question of whether the real opportunity lies in the detail of future cash flows.

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding NetApp to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own NetApp Narrative

If you have a different outlook or are curious to run the numbers yourself, you can quickly build your perspective and shape your own thesis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding NetApp.

Looking for More Smart Investment Opportunities?

You don’t need to settle for just one stock idea. Open the door to a world of opportunities. The Simply Wall Street Screener serves up unique angles and curated picks, making sure you stay a step ahead of the crowd. These expert-driven shortlists are designed to help you spot trends, find the next breakout, or build a well-balanced portfolio without wasting time.

- Uncover hidden gems that could shake up the market by checking out the best penny stocks with strong financials available right now.

- Power up your portfolio with the latest breakthroughs by exploring companies revolutionizing healthcare using artificial intelligence with our healthcare AI stocks.

- Maximize your income potential by scanning for companies that consistently deliver attractive yields over 3%, all in one place with our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NetApp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:NTAP

NetApp

Provides a range of enterprise software, systems, and services that customers use to transform their data infrastructures in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)