- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:NOVT

Is Novanta (NASDAQ:NOVT) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Novanta Inc. (NASDAQ:NOVT) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Our analysis indicates that NOVT is potentially overvalued!

What Is Novanta's Net Debt?

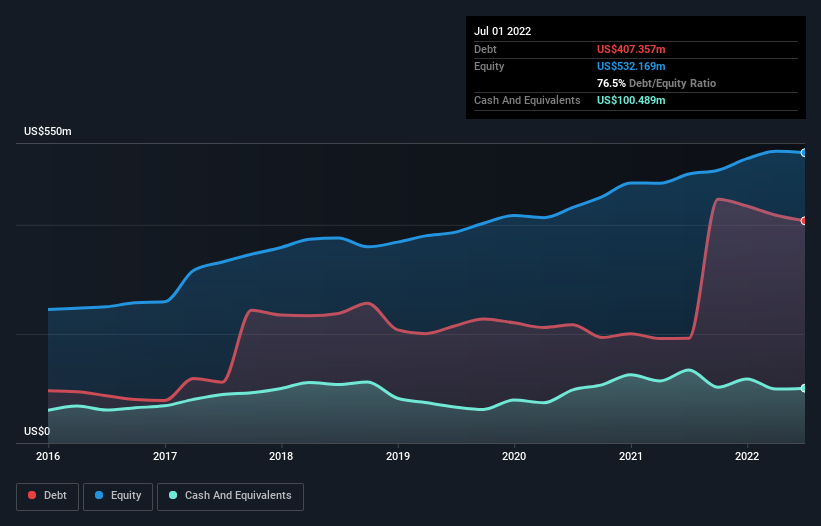

As you can see below, at the end of July 2022, Novanta had US$407.4m of debt, up from US$192.2m a year ago. Click the image for more detail. However, it also had US$100.5m in cash, and so its net debt is US$306.9m.

A Look At Novanta's Liabilities

The latest balance sheet data shows that Novanta had liabilities of US$198.4m due within a year, and liabilities of US$475.3m falling due after that. Offsetting this, it had US$100.5m in cash and US$129.8m in receivables that were due within 12 months. So it has liabilities totalling US$443.4m more than its cash and near-term receivables, combined.

Given Novanta has a market capitalization of US$5.00b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Novanta's net debt of 2.0 times EBITDA suggests graceful use of debt. And the fact that its trailing twelve months of EBIT was 9.8 times its interest expenses harmonizes with that theme. It is well worth noting that Novanta's EBIT shot up like bamboo after rain, gaining 59% in the last twelve months. That'll make it easier to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Novanta's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Novanta actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

Novanta's conversion of EBIT to free cash flow suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And the good news does not stop there, as its EBIT growth rate also supports that impression! Overall, we don't think Novanta is taking any bad risks, as its debt load seems modest. So we're not worried about the use of a little leverage on the balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 1 warning sign with Novanta , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Novanta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NOVT

Novanta

Provides precision medicine, precision manufacturing, medical solutions, robotics and automation solutions, and advanced surgery solutions in the United States and internationally.

Moderate growth potential with mediocre balance sheet.