- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:MVIS

A Look At MicroVision (MVIS) Valuation After Nasdaq Minimum Bid Price Deficiency Notice

Nasdaq deficiency notice puts focus on MicroVision’s listing status

MicroVision (MVIS) recently received a deficiency notice from Nasdaq after its shares traded below the US$1 minimum bid price requirement for roughly a month. This has prompted fresh questions around its listing status.

See our latest analysis for MicroVision.

The deficiency notice comes after a weak run for MicroVision, with a 90 day share price return of 29.07% and a 1 year total shareholder return of 50.51%, pointing to fading momentum despite its US$0.8512 share price.

If this kind of volatility has you looking around the market, it could be a good moment to broaden your watchlist with high growth tech and AI stocks.

With the share price around US$0.85 and a 1 year total shareholder return of 50.51% decline, plus revenue of US$2.64m against a net loss of US$88.38m, is MicroVision a beaten down opportunity, or is the market already pricing in its future growth?

Most Popular Narrative: 98.6% Undervalued

MicroVision’s most followed narrative pegs fair value at $60 per share, a huge gap to the recent $0.85 close that instantly grabs attention.

The most misunderstood catalyst is the strategic and deliberate entry into the defense market. The establishment of a D.C.-area office is not a trivial move, it is a clear signal of intent to capture a piece of a newly defined market. The DoD's reclassification of small drones as "consumable commodities" has created a non-cyclical, government-funded Total Addressable Market (TAM) for tactical sensors overnight. This is not a potential market, it is a funded mandate.

Curious how a company with modest current revenue and a large net loss ends up with that kind of price tag in the narrative? According to TheWallstreetKing, the story leans heavily on future revenue mix, margin expansion, and a very optimistic earnings profile. Want to see exactly how those assumptions stack up to reach a $60 fair value?

Result: Fair Value of $60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on MicroVision winning competitive defense and automotive contracts, and any setback there could quickly challenge the $60 narrative that investors are watching.

Find out about the key risks to this MicroVision narrative.

Another View: What The Market Is Paying Today

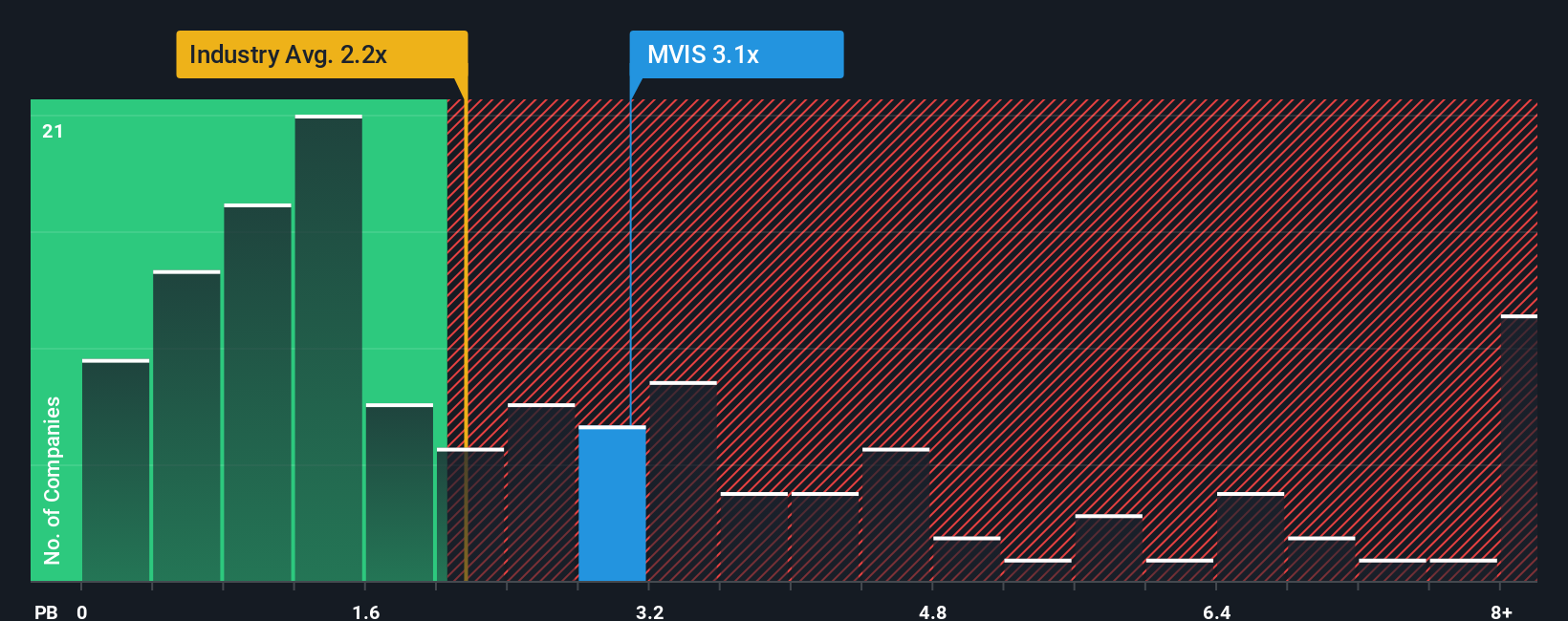

The $60 fair value narrative sits against a very different message from today’s trading multiples. MicroVision’s P/B of 2.9x is slightly higher than the US Electronic industry at 2.6x, yet below its peer average of 3.7x. That mix hints at more valuation risk than the headline $60 story suggests. Which signal do you take more seriously?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MicroVision Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom thesis in just a few minutes with Do it your way.

A great starting point for your MicroVision research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If MicroVision has sharpened your thinking, do not stop here. Use the Simply Wall St Screener to spot other opportunities that could suit your approach.

- Target potential value opportunities by checking out these 874 undervalued stocks based on cash flows that align with your preferred price and quality filters.

- Explore the growth story in artificial intelligence through these 24 AI penny stocks and see which names fit your convictions.

- Review these 18 cryptocurrency and blockchain stocks to identify crypto-related ideas that match your risk tolerance and objectives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MVIS

MicroVision

Develops and commercializes perception solutions for autonomy and mobility applications.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Investing in the future with RGYAS as fair value hits 228.23

The global leader in cash handling

Wolters Kluwer - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!

Thanks for your post but some of your calculations are wrong. It is only the actual silver that should be priced at 100/oz, not the zink and lead. The actual silver is about 5 million ounces and the rest is biproducts which cannot be calculated as 100/oz per silver equivalent. Since it would now require alot more zink and lead to create 1 AgEq with the current silver price which means their AgEq would become lower even if the production remains the same. I am still very bullish on the stock and I own it.