- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:MASS

908 Devices Inc.'s (NASDAQ:MASS) Shares Climb 26% But Its Business Is Yet to Catch Up

Despite an already strong run, 908 Devices Inc. (NASDAQ:MASS) shares have been powering on, with a gain of 26% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 18% is also fairly reasonable.

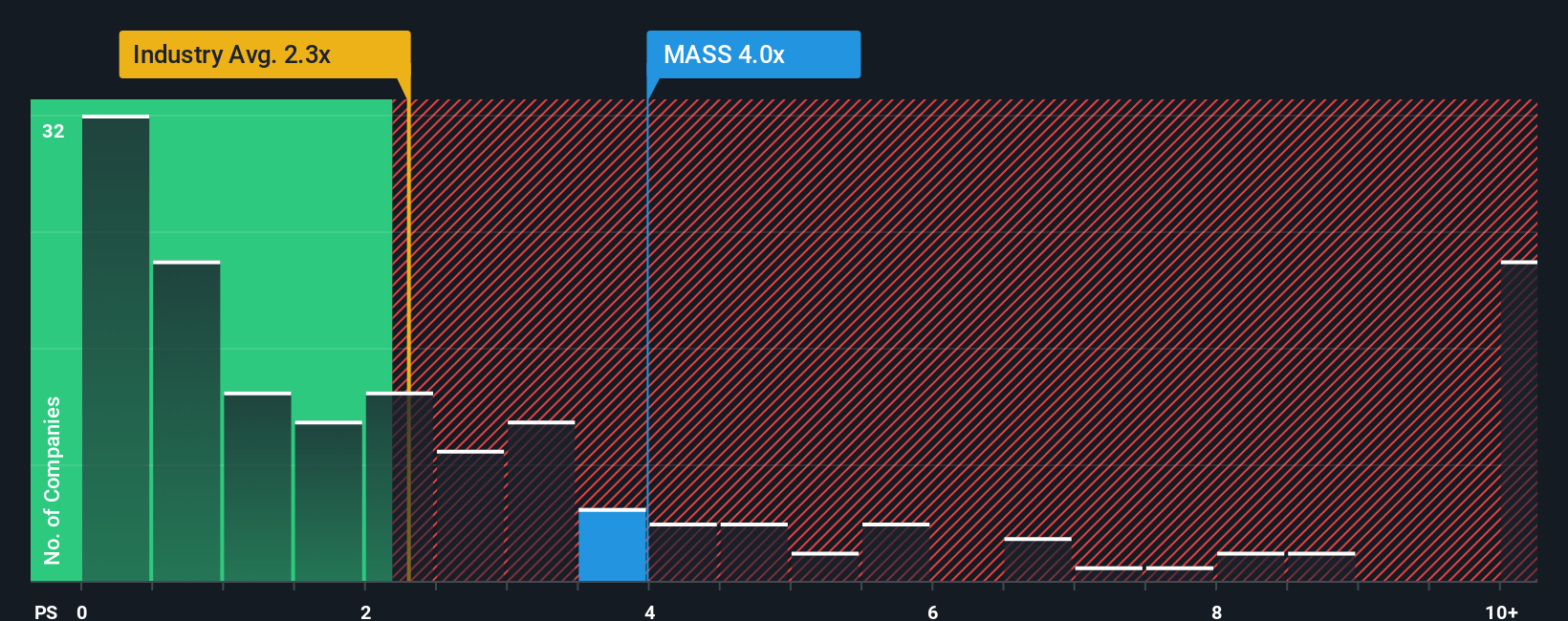

Following the firm bounce in price, given close to half the companies operating in the United States' Electronic industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider 908 Devices as a stock to potentially avoid with its 4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for 908 Devices

What Does 908 Devices' Recent Performance Look Like?

Recent times have been advantageous for 908 Devices as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think 908 Devices' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For 908 Devices?

908 Devices' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 33%. Pleasingly, revenue has also lifted 42% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 10% as estimated by the four analysts watching the company. Meanwhile, the broader industry is forecast to expand by 18%, which paints a poor picture.

With this information, we find it concerning that 908 Devices is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On 908 Devices' P/S

908 Devices' P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of 908 Devices' analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with 908 Devices, and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if 908 Devices might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:MASS

908 Devices

A commercial-stage technology company, provides various purpose-built handheld and desktop mass spectrometry devices for use in life sciences research, bioprocessing, pharma/biopharma, forensics, and adjacent markets.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026