- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:LPTH

Can You Imagine How Jubilant LightPath Technologies' (NASDAQ:LPTH) Shareholders Feel About Its 226% Share Price Gain?

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right stock, you can make a lot more than 100%. For example, the LightPath Technologies, Inc. (NASDAQ:LPTH) share price had more than doubled in just one year - up 226%. On top of that, the share price is up 43% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. It is also impressive that the stock is up 77% over three years, adding to the sense that it is a real winner.

See our latest analysis for LightPath Technologies

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

LightPath Technologies went from making a loss to reporting a profit, in the last year.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

However the year on year revenue growth of 10% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

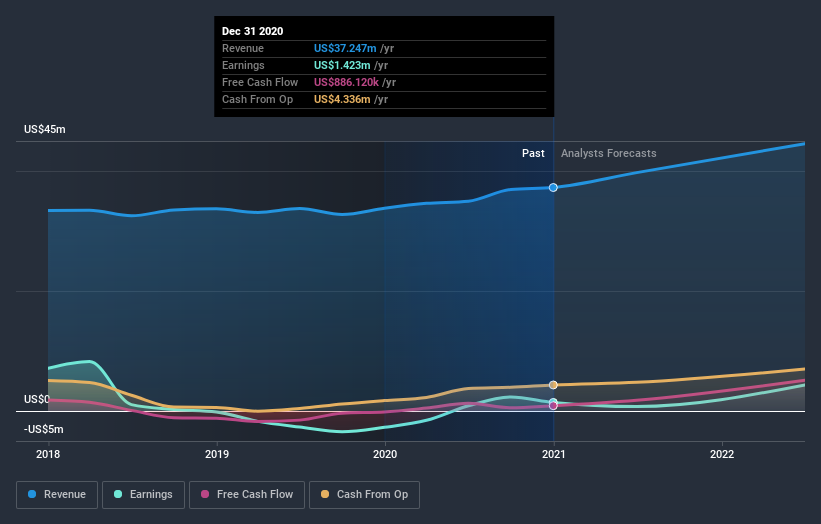

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that LightPath Technologies has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on LightPath Technologies

A Different Perspective

It's good to see that LightPath Technologies has rewarded shareholders with a total shareholder return of 226% in the last twelve months. That's better than the annualised return of 10% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with LightPath Technologies , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading LightPath Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:LPTH

LightPath Technologies

Designs, develops, manufactures, and distributes optical components and assemblies.

Flawless balance sheet low.