- United States

- /

- Communications

- /

- NasdaqGS:LITE

A Look at Lumentum (LITE) Valuation Following R64 Optical Circuit Switch Launch for AI Data Centers

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 11.8% Overvalued

According to the most widely followed narrative, Lumentum is trading above its calculated fair value, suggesting investors have priced in significant optimism about the company’s future.

Early and accelerating customer adoption of next-generation modules (cloud modules, 200G+ EMLs), optical circuit switches, and co-packaged optics, backed by record orders and a growing hyperscaler customer base, provide clear, additive revenue streams. These are projected to materially increase total revenue and expand earnings over the next 12-18 months.

What is fueling this punchy price tag? The narrative hinges on a handful of bold analyst assumptions. Rapid expansion, escalating margins, and a projected profit surge are all factored into the valuation. Want to see the precise growth targets and the ambitious future profit-multiple underpinning this outlook? The full narrative breaks down the financial math driving this fair value estimate.

Result: Fair Value of $143.79 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including reliance on a small number of cloud customers and persistent supply constraints. These factors could limit Lumentum’s momentum if conditions shift.

Find out about the key risks to this Lumentum Holdings narrative.Another View: Our DCF Model

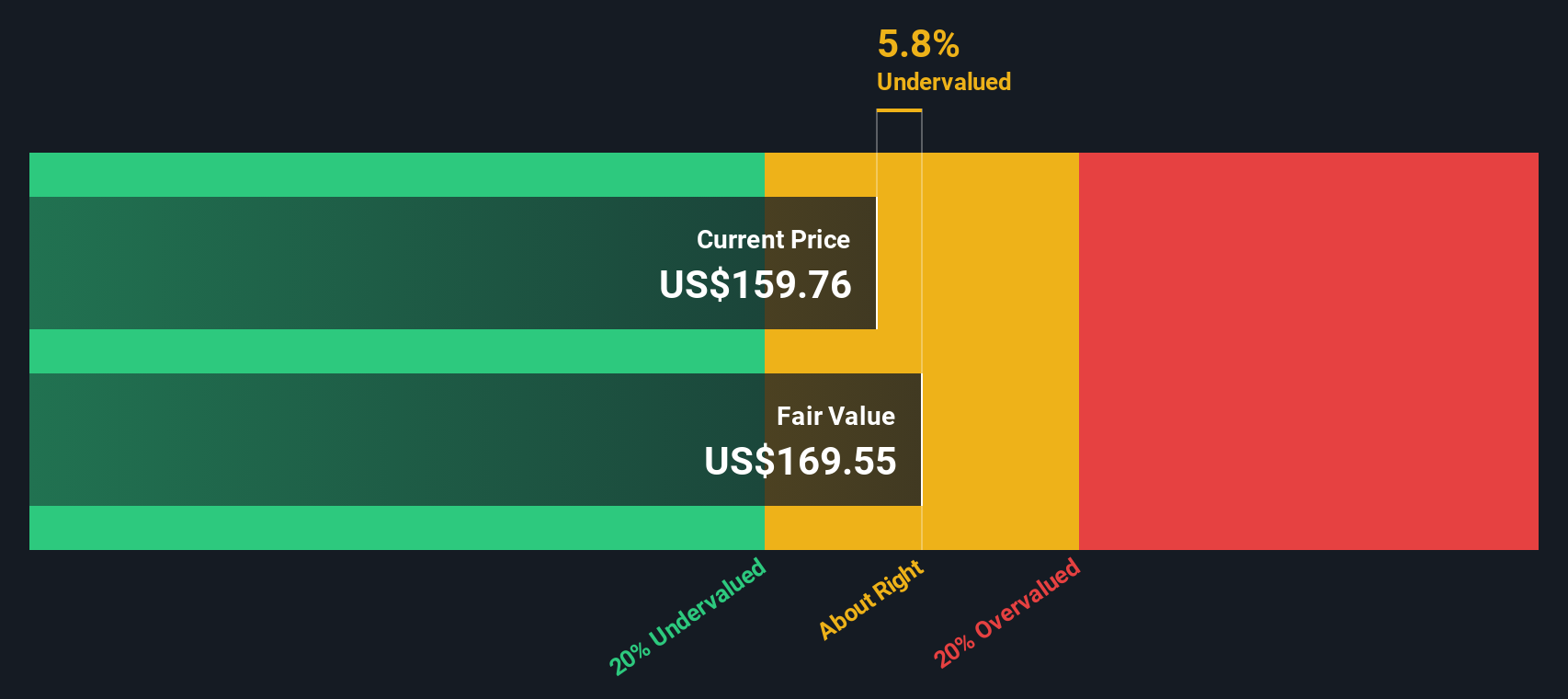

While analysts see Lumentum as priced for optimism, our SWS DCF model offers a different perspective. It currently suggests the stock trades below its calculated fair value. Could market expectations and intrinsic worth soon come together?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lumentum Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lumentum Holdings Narrative

If you have your own perspective or want to dig deeper into the numbers, crafting your own take is quick and straightforward. Do it your way

A great starting point for your Lumentum Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that the market never sleeps. Uncover unique opportunities, stay ahead of trends, and make bolder portfolio moves with Simply Wall Street’s hand-picked stock ideas. The right decision today can influence your wealth tomorrow.

- Jump straight into tomorrow’s breakthroughs with AI penny stocks and support the innovators reshaping industries through artificial intelligence.

- Tap into untapped value by searching for hidden gems using undervalued stocks based on cash flows, focusing on companies attractively priced based on future cash flows.

- Boost your income strategy by targeting consistent yield and financial strength with dividend stocks with yields > 3% to filter stocks with proven dividend potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LITE

Lumentum Holdings

Manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Exceptional growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives