- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:LASR

Assessing nLIGHT (LASR) Valuation After Sharp Three-Month Rally and Recent 9% Pullback

Reviewed by Kshitija Bhandaru

Shares of nLIGHT (LASR) lost a little ground this week, dipping almost 9% over the past seven days. Despite the pullback, the stock is still up nearly 50% over the past three months, which reflects ongoing investor interest.

See our latest analysis for nLIGHT.

While this week’s 9% dip has made waves, nLIGHT’s share price is still up a striking 49% over the last three months. Momentum has been building since the start of the year. The 12-month total shareholder return stands at an impressive 145%, reflecting renewed optimism about the company’s growth potential.

If you’re interested in finding other stocks with this kind of potential, consider broadening your search and discover fast growing stocks with high insider ownership

But after such rapid gains, is nLIGHT still attractively valued, or are investors already factoring in all the company’s potential future growth? The key question remains: is this a genuine buying opportunity, or is the market getting ahead of itself?

Most Popular Narrative: Fairly Valued

With nLIGHT’s closing share price almost matching the analyst consensus fair value of $28.08, there is little disconnect between what buyers are paying and the broader narrative's outlook. Expectations baked into today’s price make the underlying financial projections key to understanding how long this alignment can last.

The rapid growth and expanding pipeline in aerospace and defense, particularly around high-power laser solutions (for example, HELSI-2 program, DE M-SHORAD, Golden Dome initiative, and increased directed energy orders internationally), positions nLIGHT to benefit from rising global defense spending and modernization, supporting strong multi-year revenue growth. Increasing adoption of advanced laser technologies for automation, smart manufacturing, and additive manufacturing (especially in high-growth EV, clean energy, and microfabrication segments) underpins long-term demand for nLIGHT's differentiated products, providing a runway for sustained top-line expansion.

Want to know which predictions underpin that razor-thin valuation gap? The consensus narrative hinges on an ambitious growth trajectory and future profitability that could surprise many. Find out which assumptions fuel the analyst price target and what could tip the scales next.

Result: Fair Value of $28.08 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy dependence on defense revenue and ongoing commercial segment weakness could quickly undermine the current optimism if market dynamics shift.

Find out about the key risks to this nLIGHT narrative.

Another View: A Closer Look at Price Ratios

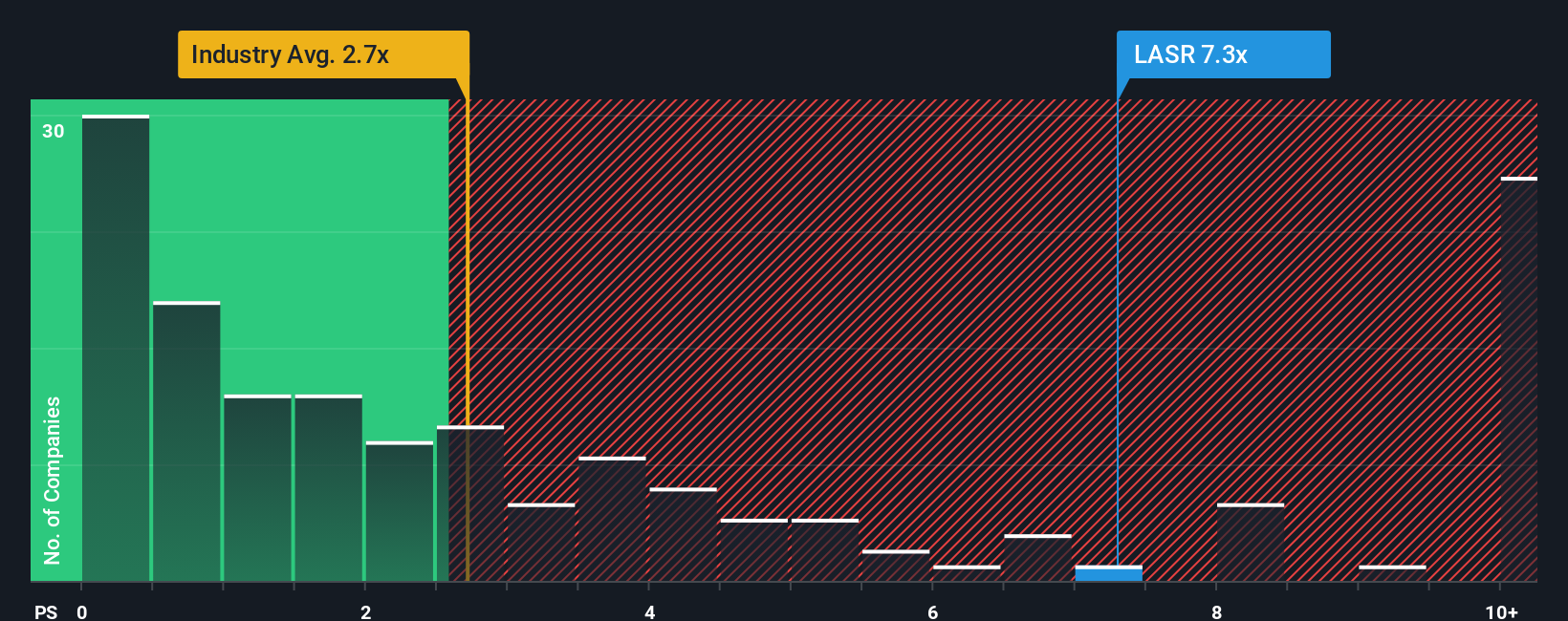

While analyst estimates point to fair value, nLIGHT is currently trading at a Price-To-Sales ratio of 6.5x. This is well above the U.S. Electronic industry average of 2.7x, its peer group at 6.1x, and its own fair ratio of 1.2x. This premium suggests expectations are sky high, leaving little room for disappointment. Is this optimism justified or a valuation risk in disguise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own nLIGHT Narrative

If you want to dive deeper and reach your own conclusions, it only takes a few minutes to explore the numbers for yourself. Do it your way

A great starting point for your nLIGHT research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stop at one opportunity? Give yourself the advantage by checking out investment ideas you might not have considered, each tailored to different strategies and growth stories.

- Tap into the world of high-yielding assets by checking out these 19 dividend stocks with yields > 3% that deliver income potential above 3% for steady returns in today's market.

- Uncover potential game-changers powering tomorrow’s healthcare by seeing these 33 healthcare AI stocks at the forefront of innovation in medical technology and AI-driven solutions.

- Position yourself early in the digital revolution by reviewing these 79 cryptocurrency and blockchain stocks transforming payments, security, and the way we transact around the world.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LASR

nLIGHT

Designs, develops, manufactures, and sells semiconductor and fiber lasers for industrial, microfabrication, and aerospace and defense applications.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives