- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:ITRI

Getting In Cheap On Itron, Inc. (NASDAQ:ITRI) Might Be Difficult

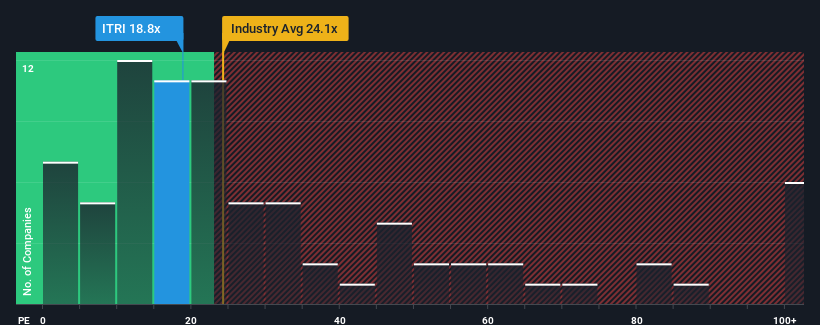

There wouldn't be many who think Itron, Inc.'s (NASDAQ:ITRI) price-to-earnings (or "P/E") ratio of 18.8x is worth a mention when the median P/E in the United States is similar at about 18x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's superior to most other companies of late, Itron has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Itron

How Is Itron's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Itron's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 201% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings should grow by 9.3% per annum over the next three years. With the market predicted to deliver 11% growth per annum, the company is positioned for a comparable earnings result.

In light of this, it's understandable that Itron's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Itron maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Itron you should be aware of.

If you're unsure about the strength of Itron's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ITRI

Itron

A technology, solutions, and service company, provides end-to-end solutions that help manage energy, water, and smart city operations worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

GameStop will ace the financial crisis wave with its strategic Bitcoin investment and cash reserves

BABA Analysis: Buying the Fear, Holding the Cloud

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026