- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:IPGP

Will Analyst Caution on Weak Profitability Shift IPG Photonics' (IPGP) Growth Narrative?

Reviewed by Sasha Jovanovic

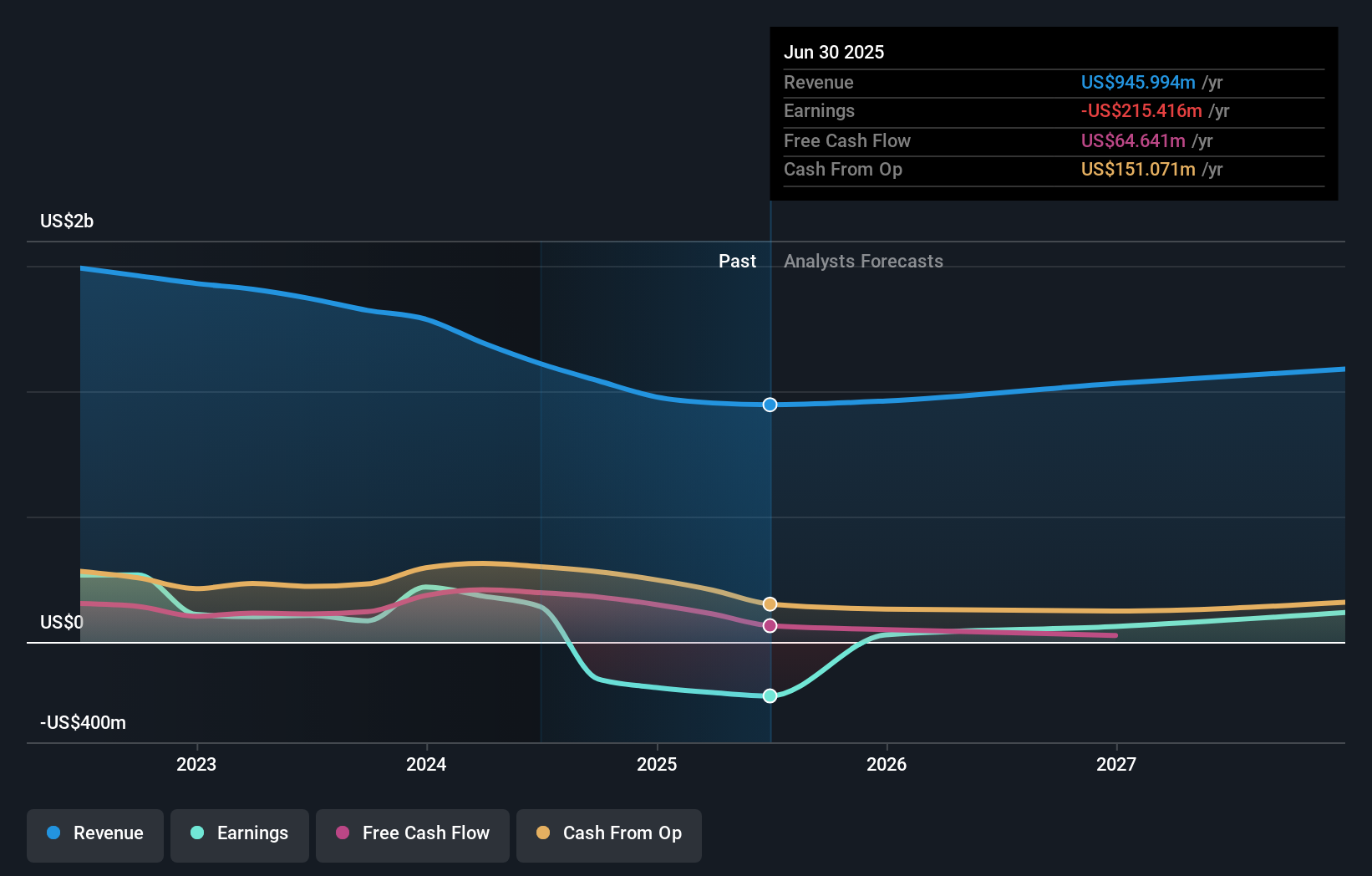

- In recent days, Wall Street analysts have grown more cautious on IPG Photonics, citing ongoing declines in sales, shrinking operating margins, and reduced earnings per share as key concerns for the company's future prospects.

- This shift in sentiment highlights the magnitude of IPG Photonics' recent operational struggles, which analysts believe are rooted in structural business challenges rather than temporary market factors.

- Given analysts' concerns over weakening profitability, we'll explore how these pressures may shift IPG Photonics' growth narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

IPG Photonics Investment Narrative Recap

The investment case for IPG Photonics relies on confidence in the company’s ability to pivot from shrinking legacy markets to emergent, higher-margin applications like defense, medical, and micromachining. However, the recent negative analyst sentiment points directly at the company’s declining sales and margins, with the immediate risk that sustained operational underperformance could overshadow growth initiatives, leaving future catalysts less impactful in the near term if the core business remains weak.

Among IPG’s recent announcements, the unveiling of the CROSSBOW MINI high-energy laser system stands out as particularly relevant. This product embodies IPG’s push into new defense applications, an area many consider a critical growth catalyst as the company counters slowdowns in industrial laser sales. Adapting successfully to these new markets will be essential for stabilizing performance and justifying a renewed long-term outlook for shareholders.

But for investors, it’s important to recognize that unlike past cycles, this time the challenge may go beyond short-term volatility and involves...

Read the full narrative on IPG Photonics (it's free!)

IPG Photonics is projected to deliver $1.2 billion in revenue and $133.9 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 8.1% and represents a $349.3 million increase in earnings from the current level of -$215.4 million.

Uncover how IPG Photonics' forecasts yield a $80.20 fair value, in line with its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community have each set a fair value for IPG Photonics ranging from US$3.83 to US$80.20. With these varied views, consider how ongoing margin pressures raised by analysts could influence confidence in the company’s turnaround potential, and explore several alternative insights before making a decision.

Explore 3 other fair value estimates on IPG Photonics - why the stock might be worth as much as $80.20!

Build Your Own IPG Photonics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IPG Photonics research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free IPG Photonics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IPG Photonics' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IPGP

IPG Photonics

Develops, manufactures, and sells various high-performance fiber lasers, fiber amplifiers, and diode lasers used in materials processing, medical, and advanced applications worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives