- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:INVZ

Will Innoviz Technologies (NASDAQ:INVZ) Spend Its Cash Wisely?

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Innoviz Technologies (NASDAQ:INVZ) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for Innoviz Technologies

When Might Innoviz Technologies Run Out Of Money?

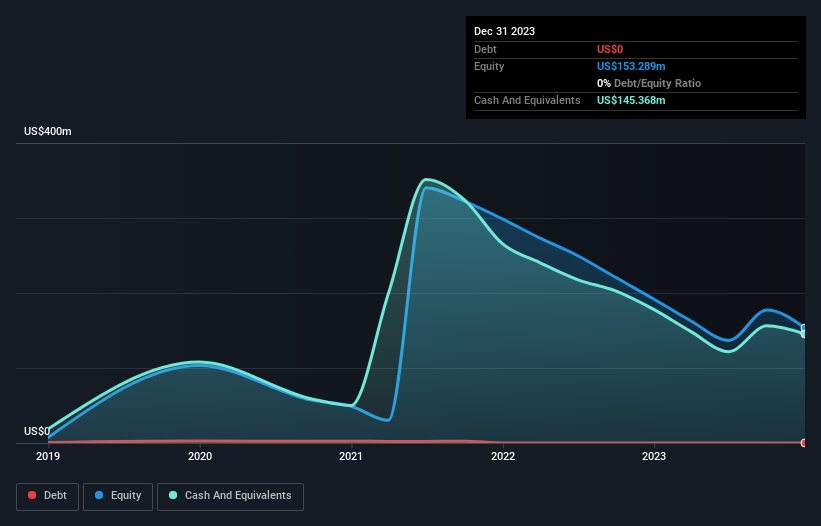

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Innoviz Technologies last reported its December 2023 balance sheet in March 2024, it had zero debt and cash worth US$145m. Importantly, its cash burn was US$100m over the trailing twelve months. That means it had a cash runway of around 18 months as of December 2023. Notably, analysts forecast that Innoviz Technologies will break even (at a free cash flow level) in about 4 years. That means unless the company reduces its cash burn quickly, it may well look to raise more cash. You can see how its cash balance has changed over time in the image below.

How Well Is Innoviz Technologies Growing?

On balance, we think it's mildly positive that Innoviz Technologies trimmed its cash burn by 14% over the last twelve months. But the operating revenue growth of 246% was even better. We think it is growing rather well, upon reflection. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Innoviz Technologies Raise More Cash Easily?

While Innoviz Technologies seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of US$191m, Innoviz Technologies' US$100m in cash burn equates to about 52% of its market value. From this perspective, it seems that the company spent a huge amount relative to its market value, and we'd be very wary of a painful capital raising.

Is Innoviz Technologies' Cash Burn A Worry?

Even though its cash burn relative to its market cap makes us a little nervous, we are compelled to mention that we thought Innoviz Technologies' revenue growth was relatively promising. Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. Even though we don't think it has a problem with its cash burn, the analysis we've done in this article does suggest that shareholders should give some careful thought to the potential cost of raising more money in the future. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 3 warning signs for Innoviz Technologies that investors should know when investing in the stock.

Of course Innoviz Technologies may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:INVZ

Innoviz Technologies

Manufactures and sells automotive grade LiDAR sensors and perception software to enable safe autonomous driving at a mass scale.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026