- United States

- /

- Communications

- /

- NasdaqGS:INFN

The 6.4% return this week takes Infinera's (NASDAQ:INFN) shareholders three-year gains to 61%

You can receive the average market return by buying a low-cost index fund. But you can make better returns by buying undervalued shares. To wit, Infinera Corporation (NASDAQ:INFN) shares are up 61% in three years, besting the market return. In contrast, the stock is actually down 11% in the last year, suggesting a lack of positive momentum.

Since the stock has added US$102m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Infinera

Infinera isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years Infinera has grown its revenue at 4.8% annually. Considering the company is losing money, we think that rate of revenue growth is uninspiring. The modest growth is probably broadly reflected in the share price, which is up 17%, per year over 3 years. The real question is when the business will generate profits, and how quickly they will grow. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

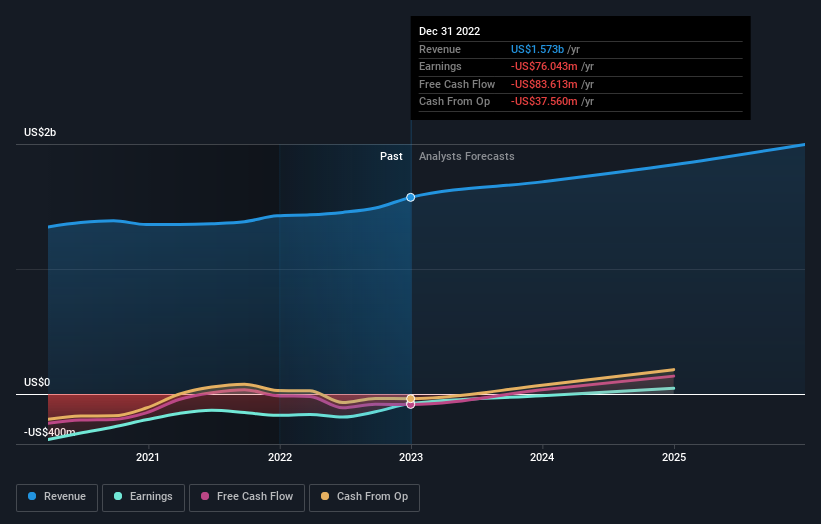

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Infinera

A Different Perspective

While it's never nice to take a loss, Infinera shareholders can take comfort that their trailing twelve month loss of 11% wasn't as bad as the market loss of around 15%. Given the total loss of 5% per year over five years, it seems returns have deteriorated in the last twelve months. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. It's always interesting to track share price performance over the longer term. But to understand Infinera better, we need to consider many other factors. For instance, we've identified 1 warning sign for Infinera that you should be aware of.

Infinera is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:INFN

Infinera

Manufactures semiconductors, and supplies networking equipment, optical semiconductors, software, and services worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives