- United States

- /

- Communications

- /

- NasdaqGS:HLIT

Could GCI Partnership Reveal a New Competitive Edge for Harmonic (HLIT) in Broadband Innovation?

Reviewed by Simply Wall St

- GCI recently announced a partnership with Harmonic to modernize its Alaska broadband infrastructure using Harmonic's cOS™ virtualized platform and DOCSIS 4.0 technology, promising faster speeds and higher reliability for customers statewide.

- This collaboration highlights the growing momentum for next-generation broadband deployments in underserved geographies, reinforcing Harmonic's position as a leader in cable broadband transformation.

- We'll review how the GCI partnership and broadband platform expansion could strengthen Harmonic's long-term growth outlook and industry standing.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Harmonic Investment Narrative Recap

For shareholders, the core belief to focus on is Harmonic’s ability to capitalize on the accelerating shift toward high-speed, next-generation broadband infrastructure, particularly through its industry leadership in virtualized platforms and DOCSIS 4.0 technology. The recent partnership with GCI may add incremental visibility for continued deployment momentum, especially in underserved markets. However, it does not materially reduce Harmonic's largest near-term risk: an ongoing reliance on a few large customers, which still weighs on revenue concentration and short-term earnings stability.

Among recent announcements, Harmonic’s new cOS broadband platform highlighted at SCTE TechExpo25 is especially relevant. This technology suite, offering unified DOCSIS 4.0, advanced fiber solutions, and AI-powered network management, directly supports Harmonic’s position in multi-gigabit, future-ready broadband, reinforcing potential catalysts like global upgrade cycles and expanding operator demand.

But on the other hand, investors should be aware that Harmonic’s heavy dependence on a small number of key customers remains a...

Read the full narrative on Harmonic (it's free!)

Harmonic's outlook indicates forecast revenues of $695.5 million and earnings of $70.6 million by 2028. This projection assumes a 0.3% annual revenue decline and a $2.0 million earnings increase from current earnings of $68.6 million.

Uncover how Harmonic's forecasts yield a $10.07 fair value, a 5% upside to its current price.

Exploring Other Perspectives

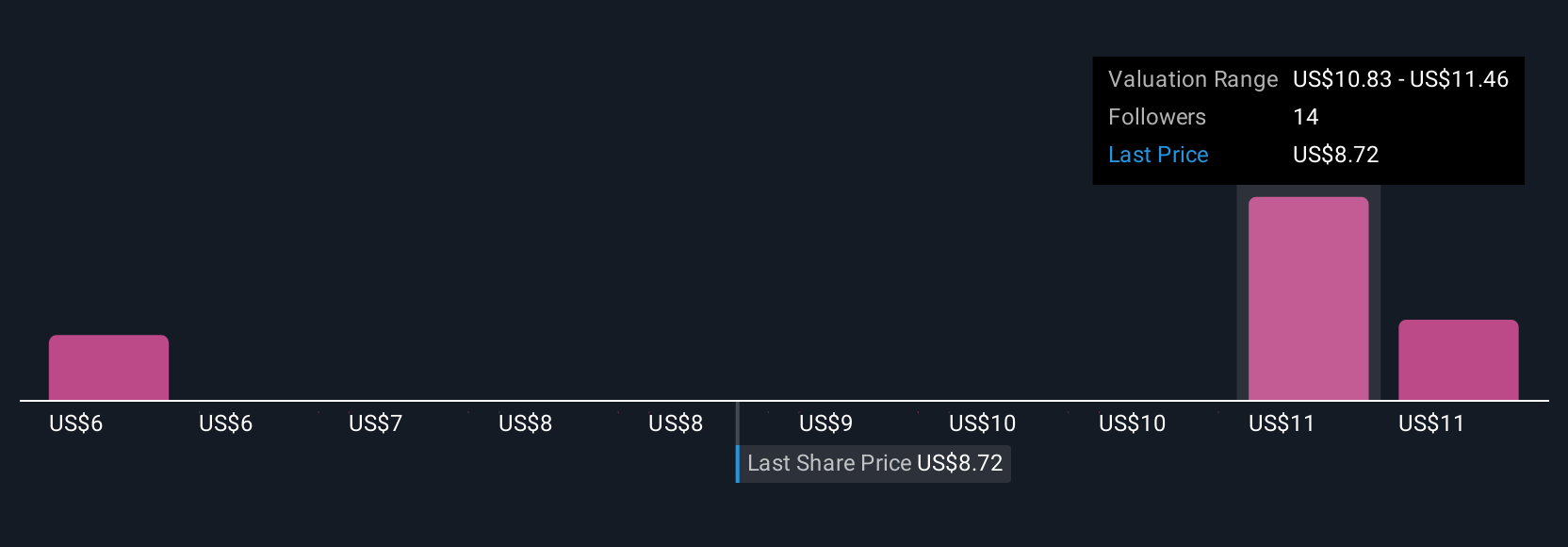

Simply Wall St Community members provided three fair value estimates for Harmonic, ranging from US$5.36 to US$12.10 per share. As you compare these diverse valuations, remember that heavy customer concentration can influence both short-term results and long-term confidence in the stock’s performance outlook.

Explore 3 other fair value estimates on Harmonic - why the stock might be worth as much as 26% more than the current price!

Build Your Own Harmonic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harmonic research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Harmonic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harmonic's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harmonic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HLIT

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives