- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:FORD

Forward Industries (FORD): Exploring the Valuation Behind Its Recent Quiet Share Momentum

Reviewed by Simply Wall St

What’s Behind Forward Industries' (FORD) Recent Moves?

Forward Industries (FORD) has recently landed on investors’ radars, although there’s no major news event driving the shift. Sometimes, when a stock starts moving without a clear headline, it is often a sign that the market is beginning to rethink its valuation or that insiders may know something the rest of us do not. For long-term shareholders and new investors alike, this kind of unprompted action can be just as intriguing as a blockbuster earnings announcement.

Looking over the past year, Forward Industries’ shares have crept up close to 9%, with most of those gains coming in the last few months. The stock has advanced more than 6% year to date and has seen roughly 5% upside during the last three months. While the company hasn’t posted headline-making revenue or income growth, forward momentum may be catching some investors off guard, especially given that results have remained in the red.

With the stock quietly gathering pace, the big question is whether this under-the-radar move sets up a potential bargain or if the market already sees the company’s future growth and has priced it in accordingly.

Price-to-Book of -1926.4x: Is it justified?

By traditional metrics, Forward Industries appears highly overvalued on a price-to-book basis when compared to its industry peers. The company’s price-to-book ratio sits at a striking -1926.4x, whereas the US Electronic industry averages around 2.5x. Negative equity values distort the figure, but the extreme difference signals an unusual valuation dynamic.

The price-to-book ratio measures a company's market value relative to its book value. This metric is especially significant for hardware and electronics companies where tangible asset values matter. In cases of negative equity, as with Forward Industries, the ratio can indicate concerns about the company’s underlying financial condition or recent losses.

This valuation gap suggests that the market might be pricing in future growth or a turnaround that is not reflected in present fundamentals. Alternatively, investors may be speculating beyond the company's current assets. As a result, cautious interpretation is warranted when using this multiple to judge Forward Industries' worth.

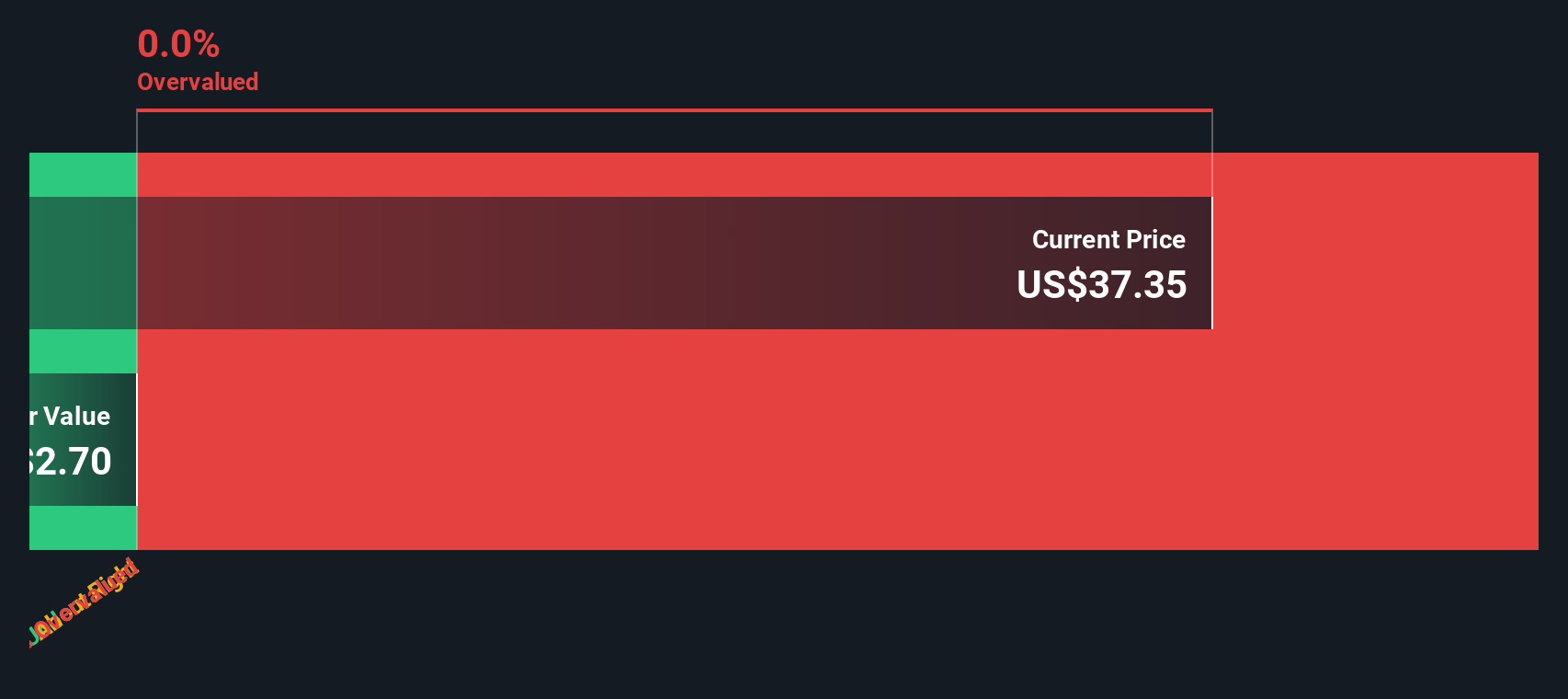

Result: Fair Value of $36.10 (OVERVALUED)

See our latest analysis for Forward Industries.However, ongoing negative net income and a lack of clear revenue growth could undermine optimism if these trends persist in upcoming quarters.

Find out about the key risks to this Forward Industries narrative.Another View: Do Other Valuation Methods Agree?

Taking a step back, our DCF model does not provide a fair value estimate for Forward Industries due to insufficient data. This leaves us questioning whether the market and traditional multiples might be telling different stories. What could we be missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Forward Industries Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can quickly build your own perspective on Forward Industries. Do it your way

A great starting point for your Forward Industries research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Ready to take control of your financial future? Don’t let today’s opportunity pass you by when you can tap into even more unique stock ideas right now.

- Target higher yields and steady income streams by checking out our list of dividend stocks with yields > 3%, which consistently reward shareholders.

- Find tomorrow’s market leaders on the frontier of artificial intelligence by scoping out our handpicked selection of AI penny stocks.

- Zero in on opportunities that may be flying under the radar by searching for undervalued stocks based on cash flows trading at compelling prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FORD

Forward Industries

Designs, manufactures, sources, markets, and distributes carry and protective solutions.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives