- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:FEIM

Our Take On Frequency Electronics' (NASDAQ:FEIM) CEO Salary

Stan Sloane became the CEO of Frequency Electronics, Inc. (NASDAQ:FEIM) in 2018, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Frequency Electronics.

View our latest analysis for Frequency Electronics

How Does Total Compensation For Stan Sloane Compare With Other Companies In The Industry?

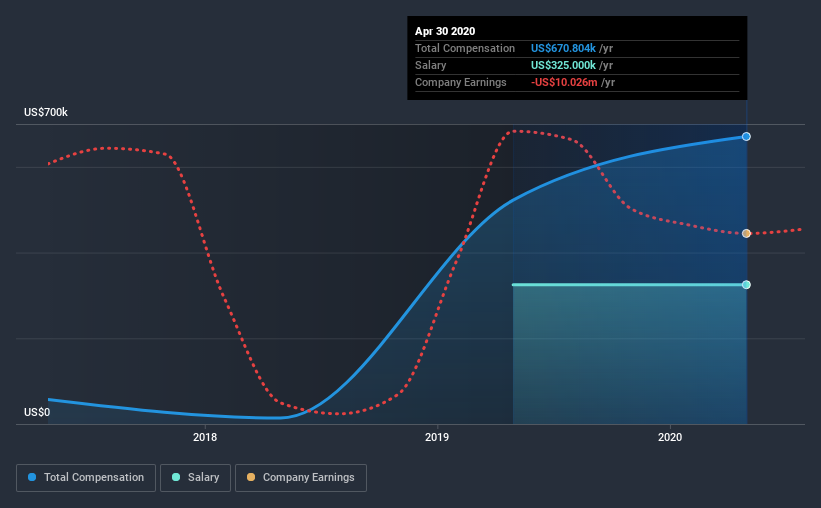

At the time of writing, our data shows that Frequency Electronics, Inc. has a market capitalization of US$92m, and reported total annual CEO compensation of US$671k for the year to April 2020. We note that's an increase of 28% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$325k.

In comparison with other companies in the industry with market capitalizations under US$200m, the reported median total CEO compensation was US$375k. Accordingly, our analysis reveals that Frequency Electronics, Inc. pays Stan Sloane north of the industry median. What's more, Stan Sloane holds US$308k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$325k | US$325k | 48% |

| Other | US$346k | US$197k | 52% |

| Total Compensation | US$671k | US$522k | 100% |

On an industry level, around 33% of total compensation represents salary and 67% is other remuneration. Frequency Electronics pays out 48% of remuneration in the form of a salary, significantly higher than the industry average. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Frequency Electronics, Inc.'s Growth Numbers

Frequency Electronics, Inc.'s earnings per share (EPS) grew 13% per year over the last three years. Its revenue is down 18% over the previous year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Frequency Electronics, Inc. Been A Good Investment?

With a total shareholder return of 12% over three years, Frequency Electronics, Inc. shareholders would, in general, be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

As we touched on above, Frequency Electronics, Inc. is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. However, we must not forget that the EPS growth has been very strong over three years. We also note that, over the same time frame, shareholder returns haven't been bad. While it may be worth researching further, we don't see a problem with the high CEO pay, given the good EPS growth.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 2 warning signs (and 1 which shouldn't be ignored) in Frequency Electronics we think you should know about.

Important note: Frequency Electronics is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Frequency Electronics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGM:FEIM

Frequency Electronics

Engages in the design, development, manufacture, marketing, and sale of precision time and frequency control products and components for microwave integrated circuit applications.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Ferrari's Intrinsic and Historical Valuation

Recently Updated Narratives

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

Looking to be second time lucky with a game-changing new product

Adobe - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).