- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:FEIM

Here's Why We Think Frequency Electronics (NASDAQ:FEIM) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Frequency Electronics (NASDAQ:FEIM). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Frequency Electronics' Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. It is awe-striking that Frequency Electronics' EPS went from US$0.59 to US$2.43 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. Could this be a sign that the business has reached an inflection point?

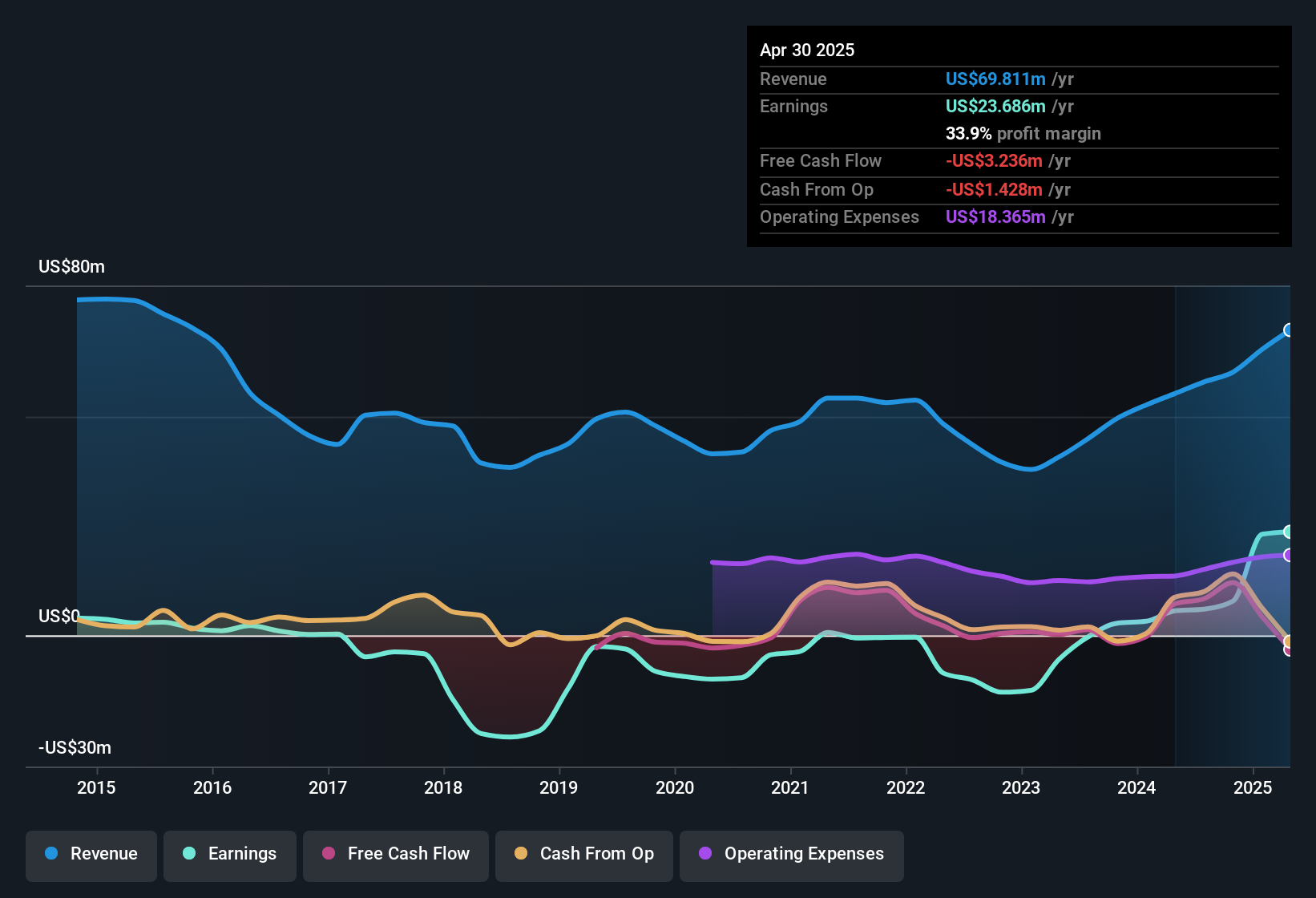

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Frequency Electronics shareholders is that EBIT margins have grown from 9.1% to 17% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

View our latest analysis for Frequency Electronics

Frequency Electronics isn't a huge company, given its market capitalisation of US$276m. That makes it extra important to check on its balance sheet strength.

Are Frequency Electronics Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the bigger deal is that the Independent Director, Russell Sarachek, paid US$59k to buy shares at an average price of US$15.71. Strong buying like that could be a sign of opportunity.

On top of the insider buying, it's good to see that Frequency Electronics insiders have a valuable investment in the business. To be specific, they have US$16m worth of shares. That's a lot of money, and no small incentive to work hard. Those holdings account for over 5.8% of the company; visible skin in the game.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Tom McClelland is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Frequency Electronics with market caps between US$100m and US$400m is about US$1.6m.

The Frequency Electronics CEO received US$821k in compensation for the year ending April 2024. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Frequency Electronics Worth Keeping An Eye On?

Frequency Electronics' earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Frequency Electronics deserves timely attention. Before you take the next step you should know about the 2 warning signs for Frequency Electronics (1 is a bit concerning!) that we have uncovered.

The good news is that Frequency Electronics is not the only stock with insider buying. Here's a list of small cap, undervalued companies in the US with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FEIM

Frequency Electronics

Engages in the design, development, manufacture, marketing, and sale of precision time and frequency control products and components for microwave integrated circuit applications.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Asset-Light but Valuation-Heavy: A Fundamental Breakdown of Marriott ($MAR)

Why did Novo Nordisk flop?

Xero: Growth Was Priced In — Execution Is Not

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks