- United States

- /

- Communications

- /

- NasdaqGS:EXTR

Should Extreme Networks’ (EXTR) Launch of AI-Driven Platform ONE Prompt Investor Action?

Reviewed by Simply Wall St

- Earlier this month, Extreme Networks released general availability of Extreme Platform ONE™, marking the industry’s first networking solution with fully integrated conversational, multimodal, and agentic AI to enhance enterprise network management and automation.

- An impressive 265 early adopter customers have already implemented the new platform, reflecting strong initial demand for advanced AI-driven network solutions.

- We’ll now explore how the integration of AI-powered automation in Extreme Platform ONE may reshape the company’s broader investment narrative.

Extreme Networks Investment Narrative Recap

For shareholders, the core belief driving Extreme Networks’ investment case is that rising demand for AI-powered network automation and cloud-managed solutions will support a gradual transition to higher-margin recurring revenue. The recent general availability of Extreme Platform ONE signals further progress on this front, as strong early adoption could reinforce momentum behind the company’s SaaS growth narrative in the short term. However, the most prominent risk remains the company’s dependence on third-party manufacturing in Asia, leaving gross margins exposed to shifting geopolitical or trade conditions; this news event does not materially reduce that risk.

The June 2025 collaboration with Intel aimed at enhancing AI in network management stands out as highly relevant, further underpinning the push toward differentiated AI-driven automation. Should integration of these combined capabilities accelerate real-world adoption of Platform ONE, it could address key catalysts around recurring revenue growth and customer retention, both closely watched by the market as topline drivers.

By contrast, investors should not underestimate the significance of continued reliance on manufacturing partners across Asia, especially if...

Read the full narrative on Extreme Networks (it's free!)

Extreme Networks' projections indicate $1.4 billion in revenue and $39.7 million in earnings by 2028. This scenario assumes a 9.8% annual revenue growth rate and a $93.6 million increase in earnings from the current $-53.9 million.

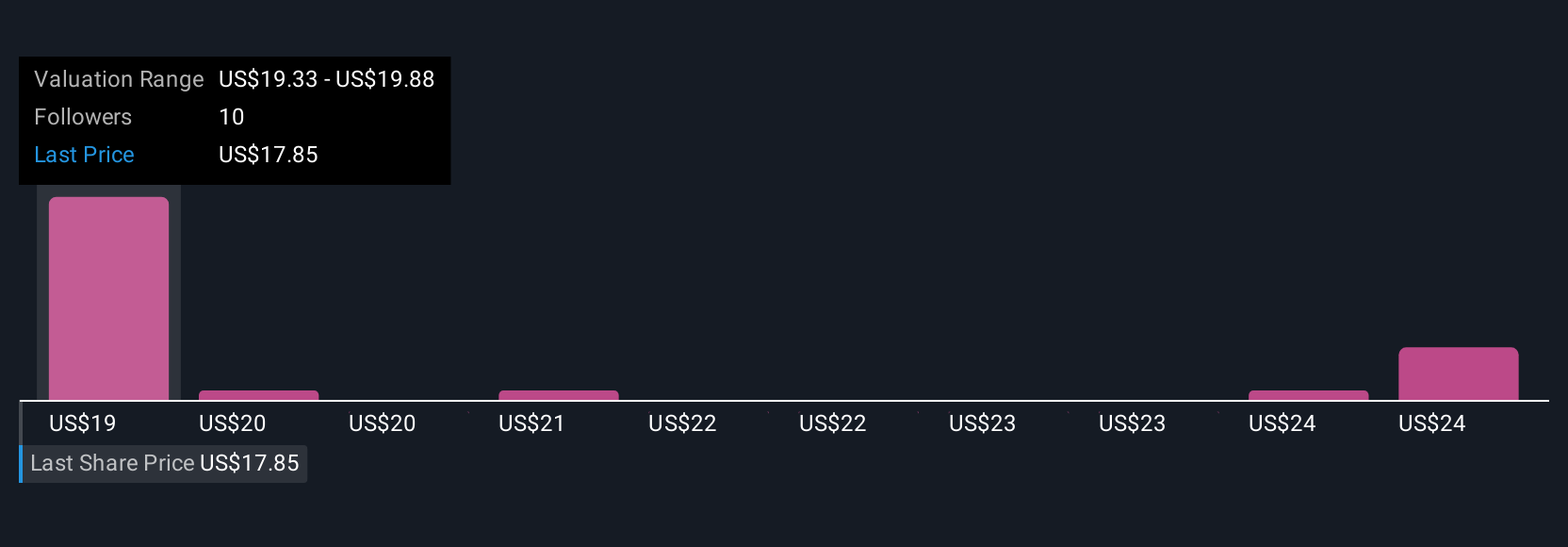

Uncover how Extreme Networks' forecasts yield a $19.33 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Extreme’s fair value between US$19.33 and US$24.79, reflecting a spread of five unique viewpoints. As accelerating customer demand for Extreme Platform ONE drives growth in SaaS revenues, you can discover more perspectives shaping the stock’s outlook here.

Build Your Own Extreme Networks Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Extreme Networks research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Extreme Networks research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Extreme Networks' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Extreme Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXTR

Extreme Networks

Provides software-driven networking solutions worldwide.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives