Key Takeaways

- Strong shift toward cloud-managed, subscription-based solutions and advanced technology is driving sustained revenue growth, higher margins, and improved customer retention.

- Operational efficiencies and competitiveness against larger rivals are fueling margin expansion, robust cash flow, and positioning for long-term industry tailwinds.

- Heavy reliance on third-party manufacturing and channel partners, smaller scale versus competitors, and slow SaaS transition all increase revenue volatility, margin risk, and innovation challenges.

Catalysts

About Extreme Networks- Provides software-driven networking solutions worldwide.

- Extreme Networks is seeing strong adoption of its cloud-managed networking and AI-driven automation (notably via Platform ONE), supported by increasing customer demand for scalable, flexible, and secure solutions as enterprises accelerate their digital transformations and shift toward cloud-first and hybrid work models. This is likely to drive sustained topline revenue growth and a higher proportion of high-margin recurring SaaS revenue.

- The proliferation of connected devices, the expansion of IoT, and greater network complexity are driving demand for Extreme's advanced fabric technology and unique microsegmentation and security capabilities; these differentiated features are winning share from major competitors and enabling larger deployments, leading to growing deal sizes, stronger customer retention, and increased net new bookings for future quarters.

- The company's ongoing transition to a subscription-based, recurring revenue model-highlighted by double-digit growth in SaaS annual recurring revenue and strong new subscription bookings-improves earnings stability, visibility, and gross margin expansion as the mix shifts away from legacy hardware and one-time sales.

- Recent improvements in operational efficiency, disciplined cost control, and supply chain management have resulted in record-low service costs, strong operating leverage, and significant improvements in both operating and free cash flow, setting the stage for continued margin expansion and more robust net income growth.

- Extreme's success in displacing larger incumbents (Cisco, HPE, Juniper) in the enterprise and public sector, along with the upcoming expansion of Wi-Fi 7 and next-gen wireless deployments, position the company to capitalize on the replacement and upgrade cycle industry-wide-an embedded long-term tailwind that supports both top-line growth and higher-margin business mix.

Extreme Networks Future Earnings and Revenue Growth

Assumptions

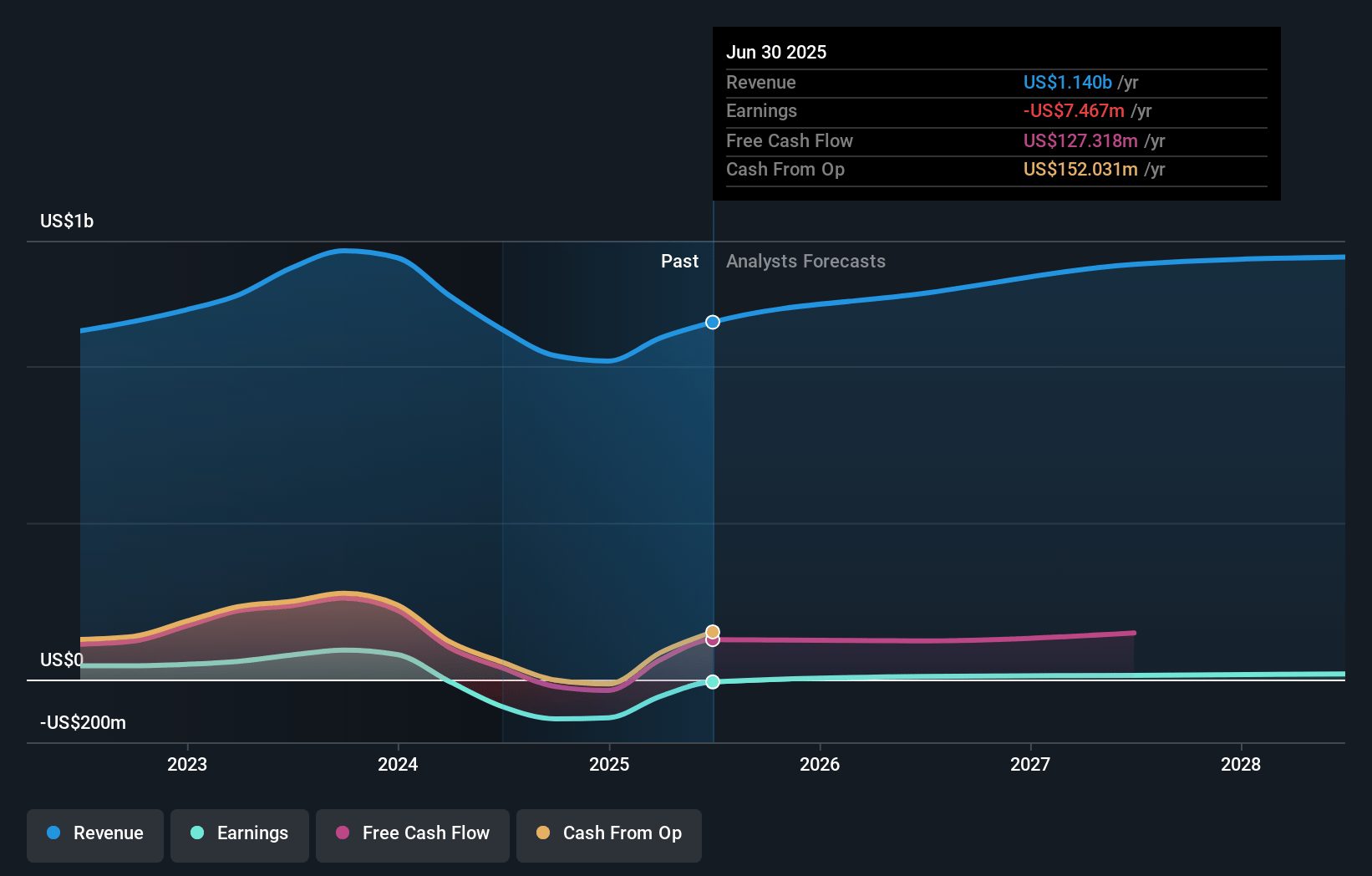

How have these above catalysts been quantified?- Analysts are assuming Extreme Networks's revenue will grow by 9.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -4.9% today to 2.7% in 3 years time.

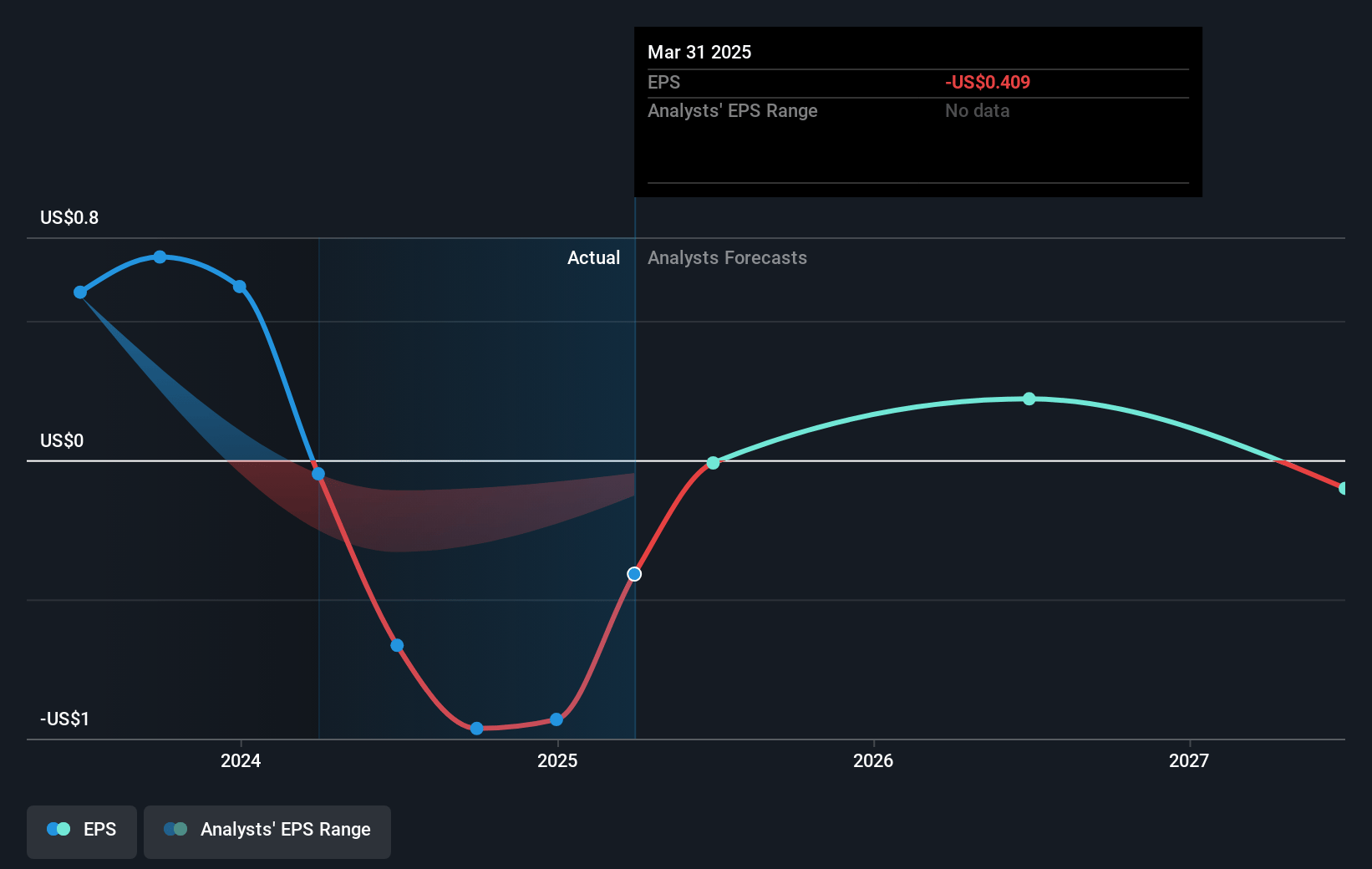

- Analysts expect earnings to reach $39.7 million (and earnings per share of $-0.03) by about July 2028, up from $-53.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 86.1x on those 2028 earnings, up from -43.8x today. This future PE is greater than the current PE for the US Communications industry at 28.4x.

- Analysts expect the number of shares outstanding to grow by 2.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.56%, as per the Simply Wall St company report.

Extreme Networks Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Extreme Networks relies heavily on third-party contract manufacturers in Asia (Taiwan, Vietnam, Philippines, Malaysia) and has no plans to establish U.S. manufacturing, making the company vulnerable to ongoing or future geopolitical tensions, trade negotiations, or escalation of tariffs-potentially pressuring gross margins and reducing profitability.

- The company's business model is highly dependent on channel partners for approximately 85% of sales, and changes or disruptions in partner programs-such as those at major competitors or channel inventory corrections-can lead to volatility in revenues and reduced pricing power, impacting revenue predictability and gross margins.

- Extreme operates at a much smaller scale compared to dominant industry players like Cisco, HPE, and Arista, which could hamper its ability to sustain long-term R&D spending and sales investments, ultimately slowing innovation and limiting future market share expansion, weighing on topline revenue growth and operating margins.

- While the transition towards SaaS and recurring revenue is underway, current recurring revenue was relatively flat as a percent of total revenue (due in part to surging product sales), which could mean future revenue streams become more volatile and less predictable if hardware sales decline or if Platform ONE/SaaS adoption fails to meet expectations, possibly impacting future earnings stability.

- The industry's accelerating shift toward automation, software-defined networking, and cloud-managed solutions increases the risk that Extreme (historically rooted in hardware and campus networking) could struggle to keep pace with rapidly evolving competitor offerings-especially if larger incumbents pivot or innovate faster-leading to longer-term erosion in gross margins and lost revenue opportunities.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $19.333 for Extreme Networks based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $22.5, and the most bearish reporting a price target of just $15.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $39.7 million, and it would be trading on a PE ratio of 86.1x, assuming you use a discount rate of 7.6%.

- Given the current share price of $17.73, the analyst price target of $19.33 is 8.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.