- United States

- /

- Communications

- /

- NasdaqGS:EXTR

Extreme Networks (EXTR): Valuation in Focus Following Major NFL Partnership Renewal and Next-Gen Stadium Wi-Fi Expansion

Reviewed by Simply Wall St

If you follow Extreme Networks (EXTR), this week’s announcement about the extension of its NFL partnership might have caught your attention. The company has inked a deal to remain the league’s official Wi-Fi Network Solutions Provider and Analytics Provider through 2028, a move that adds fresh deployments of 6 GHz Wi-Fi at major stadiums like MetLife and Pittsburgh’s venue. Not only does this keep Extreme’s logo front and center at some of the most watched events in the country, it also showcases the company’s ability to win and retain blue-chip customers eager for advanced connectivity solutions.

This news comes against a backdrop of strong price momentum for Extreme Networks. Shares are up 59% over the past year and have risen more than 28% just in the past three months, outperforming both the market and many tech peers. The NFL deal marks thirteen years of Extreme’s leadership in stadium connectivity, supported by recent high-profile deployments, which could signal growing confidence in its long-term upside and ability to capitalize on rising demand for high-capacity wired and wireless network solutions.

After such a run, is Extreme Networks still trading at an attractive valuation, or are investors already baking future growth into the price?

Most Popular Narrative: 9.1% Undervalued

According to the prevailing narrative, Extreme Networks is viewed as undervalued, with analysts pricing in upside potential based on future growth prospects and strategic wins across high-demand markets.

Recent large strategic wins, particularly in APAC and EMEA with government and Fortune 500 customers (such as the Japanese judiciary and John Deere), are establishing Extreme as a credible upmarket competitor. This is increasing cross-selling opportunities, expanding backlog, and strengthening the revenue and earnings outlook for FY26 and beyond.

Looking for the numbers fueling this bullish outlook? The core of this valuation lies in aggressive growth projections, climbing margins, and a premium future earnings multiple usually reserved for much larger tech names. Curious about the financial milestones analysts believe Extreme Networks will hit to warrant such optimism? The full narrative holds all the surprising details that back up the current fair value estimate.

Result: Fair Value of $23.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, significant reliance on large government contracts and fierce competition from bigger players could introduce volatility and challenge Extreme Networks’ growth assumptions.

Find out about the key risks to this Extreme Networks narrative.Another View: Rethinking the Valuation

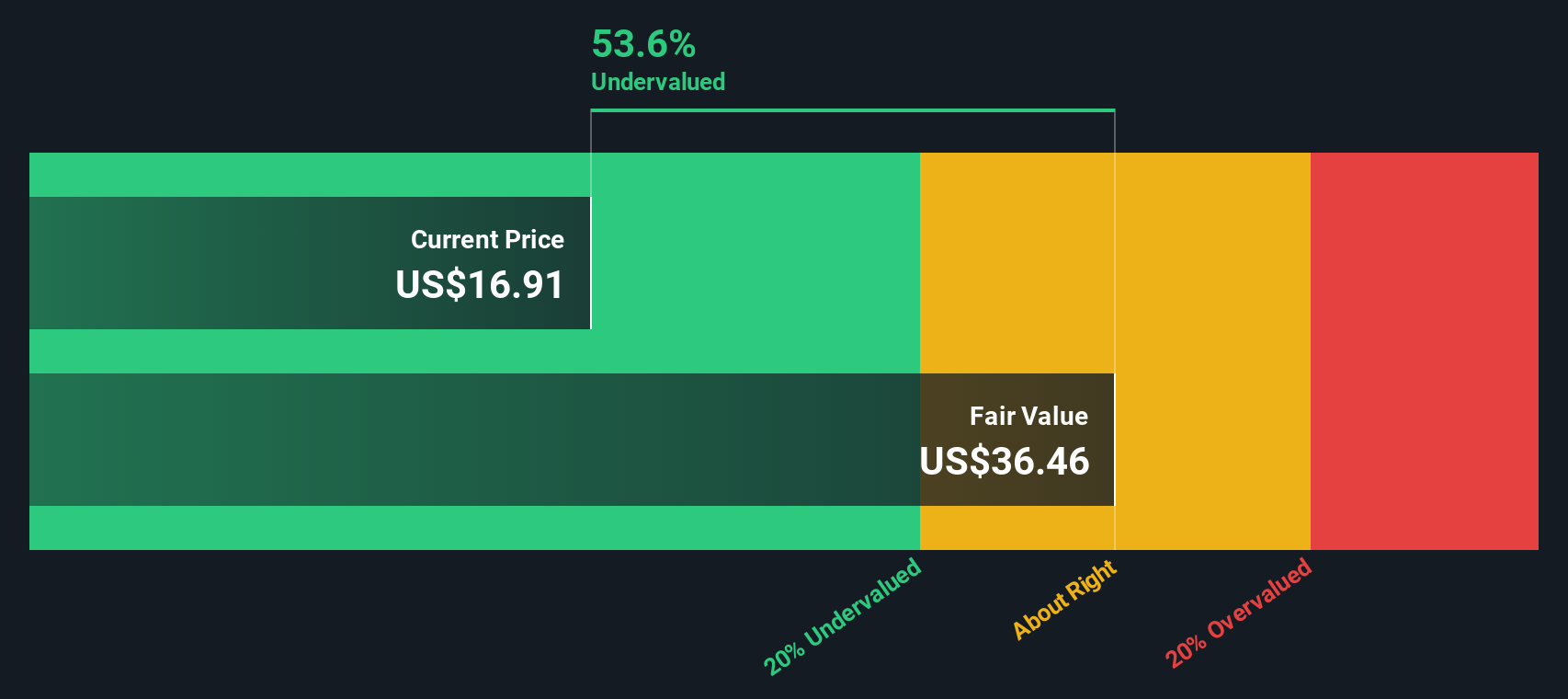

Looking from a different angle, our DCF model also points toward undervaluation and reinforces the first analysis. However, models can diverge when assumptions change. Does this agreement hint at real value, or are risks hiding in plain sight?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Extreme Networks to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Extreme Networks Narrative

If you want to see the numbers for yourself or dive deeper, it’s easy to craft your own perspective on Extreme Networks in just a few minutes. Do it your way

A great starting point for your Extreme Networks research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment opportunities?

Don’t let your next portfolio win slip by. Use Simply Wall Street’s screeners to spot fresh ideas that others might miss. There’s something for every strategy:

- Find tomorrow’s top performers by zeroing in on undervalued stocks based on cash flows that are flying under the radar but stacked with growth potential.

- Boost your income and stability with companies offering dividend stocks with yields > 3% to secure steady cash flows, even in volatile times.

- Stay a step ahead by tracking the pioneers leading breakthroughs in robotics and neural networks with our AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Extreme Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:EXTR

Extreme Networks

Develops, markets, and sells network infrastructure equipment and related software in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>