- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:EVLV

Why Evolv’s (EVLV) Unified Threat Management Update Puts Its Competitive Strategy in the Spotlight

Reviewed by Sasha Jovanovic

- Evolv Technologies Holdings recently rolled out major software updates across its security screening and analytics platforms, introducing new features to bolster user efficiency and threat detection capabilities for its global customer base.

- A key highlight of this release is the ability to manage alerts from multiple security systems on a single device, reflecting Evolv’s ongoing focus on streamlining security operations for venue operators and security professionals.

- We’ll look at how these software enhancements for unified threat management could influence Evolv’s investment case and future growth prospects.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Evolv Technologies Holdings Investment Narrative Recap

To be a shareholder in Evolv Technologies Holdings is to believe in the growing demand for advanced, AI-driven physical security solutions and the company’s potential to expand its footprint across key verticals. While the recent launch of unified software updates enhances Evolv’s product value and may support customer retention, the most immediate catalyst remains the pace of multi-year contract wins and deployments. The largest risk continues to be the company’s path to scale, as persistent net losses and increasing costs could pressure margins and delay profitability. Given the modest near-term impact of these updates on revenue or cost structure, their significance is more incremental than transformative.

Among Evolv’s recent announcements, the agreement with the Buffalo Sabres stands out for its relevance, as it highlights tangible adoption of the upgraded Evolv Express system in high-profile venues. This reflects how customer wins may act as the primary lever for near-term revenue growth, even as ongoing investments in software propel incremental improvements in the user experience.

But while new contracts and software upgrades offer upside, investors should also be mindful that looming legal and compliance challenges could still unsettle sentiment...

Read the full narrative on Evolv Technologies Holdings (it's free!)

Evolv Technologies Holdings is projected to reach $208.0 million in revenue and $18.8 million in earnings by 2028. This outlook requires annual revenue growth of 19.8% and an $107.2 million increase in earnings from the current earnings of -$88.4 million.

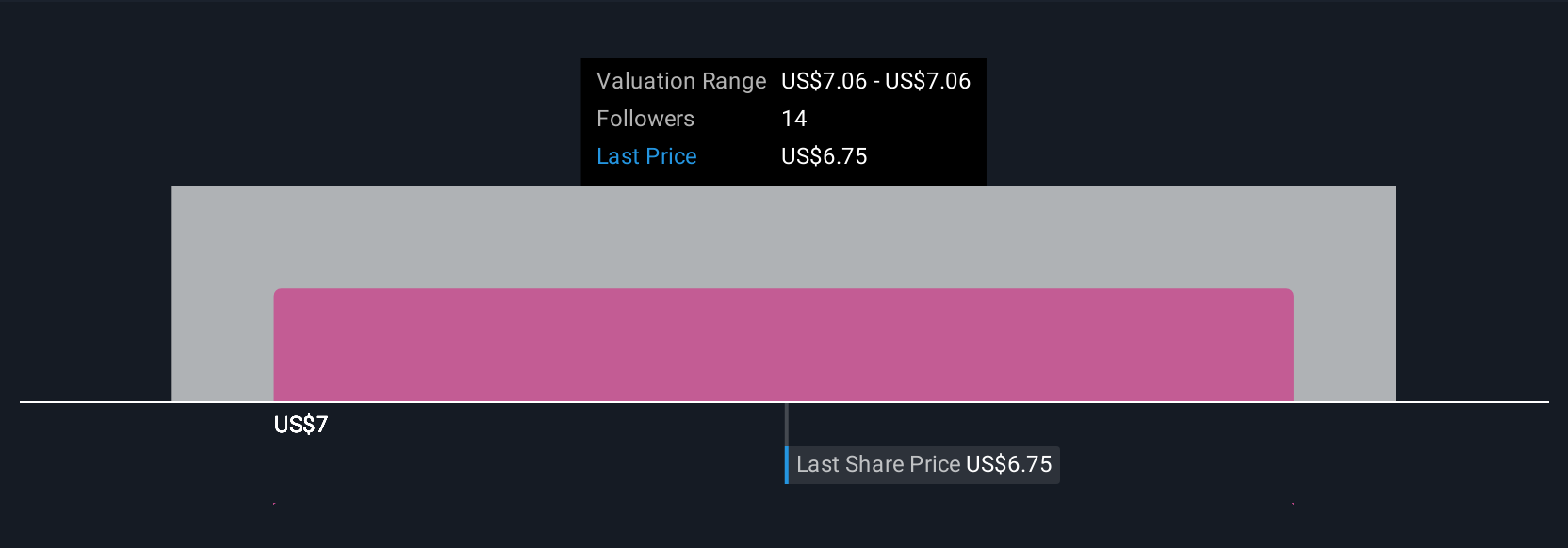

Uncover how Evolv Technologies Holdings' forecasts yield a $9.50 fair value, a 17% upside to its current price.

Exploring Other Perspectives

All 10 Simply Wall St Community fair value estimates for Evolv are tightly grouped at US$9.50. While these investors share a single outlook, ongoing legal and compliance risks could prompt differing views on future performance.

Explore another fair value estimate on Evolv Technologies Holdings - why the stock might be worth as much as 17% more than the current price!

Build Your Own Evolv Technologies Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evolv Technologies Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Evolv Technologies Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evolv Technologies Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evolv Technologies Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EVLV

Evolv Technologies Holdings

Provides artificial intelligence (AI)-based weapons detection for security screening in the United States and internationally.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives