- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:EVLV

The Price Is Right For Evolv Technologies Holdings, Inc. (NASDAQ:EVLV) Even After Diving 28%

Unfortunately for some shareholders, the Evolv Technologies Holdings, Inc. (NASDAQ:EVLV) share price has dived 28% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 54% loss during that time.

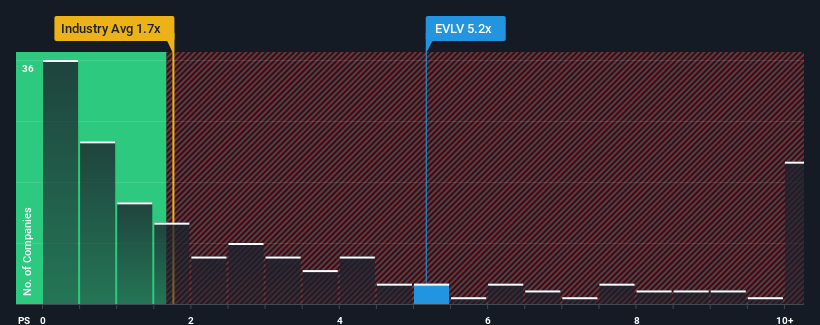

In spite of the heavy fall in price, given around half the companies in the United States' Electronic industry have price-to-sales ratios (or "P/S") below 1.7x, you may still consider Evolv Technologies Holdings as a stock to avoid entirely with its 5.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Evolv Technologies Holdings

What Does Evolv Technologies Holdings' Recent Performance Look Like?

Recent times have been pleasing for Evolv Technologies Holdings as its revenue has risen in spite of the industry's average revenue going into reverse. It seems that many are expecting the company to continue defying the broader industry adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Evolv Technologies Holdings will help you uncover what's on the horizon.How Is Evolv Technologies Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Evolv Technologies Holdings' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 30% each year as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 10% each year, which is noticeably less attractive.

In light of this, it's understandable that Evolv Technologies Holdings' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Evolv Technologies Holdings' P/S?

Even after such a strong price drop, Evolv Technologies Holdings' P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Evolv Technologies Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electronic industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Evolv Technologies Holdings (of which 1 doesn't sit too well with us!) you should know about.

If you're unsure about the strength of Evolv Technologies Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Evolv Technologies Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EVLV

Evolv Technologies Holdings

Provides artificial intelligence (AI)-based weapons detection for security screening in the United States and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026