- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:EVLV

Evolv Technologies Holdings (EVLV): Assessing Valuation Gap and Growth Potential

Reviewed by Kshitija Bhandaru

Evolv Technologies Holdings (EVLV) has seen its stock price chart a bumpy path over the past month, despite recent annual growth in both revenue and net income. Investors may be looking beyond near-term volatility as they consider the company’s long-term potential.

See our latest analysis for Evolv Technologies Holdings.

Evolv Technologies Holdings’ share price has edged higher in 2024, and its one-year total shareholder return of nearly 1% tells a story of steady footing even as short-term share price momentum has cooled. Investors seem to be weighing recent business growth against evolving market sentiment, with attention shifting toward the company’s long-term trajectory and valuation context.

If you’re interested in spotting the next standout, now is a great time to expand your perspective and discover fast growing stocks with high insider ownership

With shares currently trading below analysts’ price targets and recent financial growth on display, the key question is whether this reflects an undervalued opportunity or if the market is already factoring in future gains.

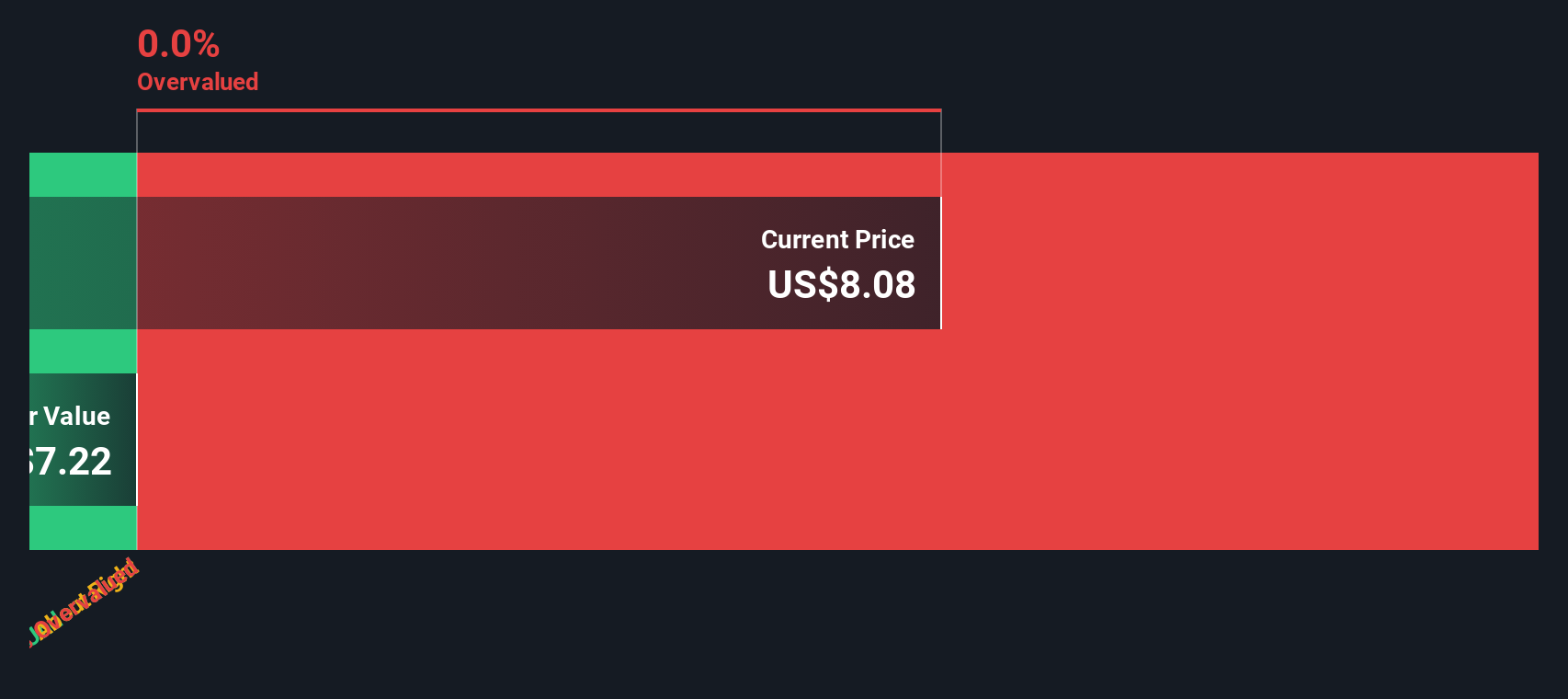

Most Popular Narrative: 20.9% Undervalued

Compared to its last close of $7.51, the most followed narrative sets Evolv Technologies Holdings’ fair value well above where the stock currently trades, pointing to a meaningful gap that has captured attention.

The increasing prevalence of large multi-year contracts with public school systems and hospitals, driven by heightened public safety concerns in high-density environments, is expanding Evolv's total addressable market and should support outsized revenue growth over the coming years. Growing customer adoption and frequent upgrades to newer platforms like Gen2 and eXpedite reflect a successful technology road map that is boosting customer retention rates and fostering longer-term subscription commitments. This is positively impacting both ARR and net margins.

What is behind these bold revenue assumptions? This narrative is fueled by dramatic contract wins and a willingness to apply aggressive future growth multiples rarely seen outside next-gen tech. Curious how these forecasts add up to the valuation target? The details are only revealed in the full narrative.

Result: Fair Value of $9.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operating losses or setbacks in customer expansion could quickly challenge optimism and prompt investors to reconsider Evolv Technologies Holdings' bullish valuation story.

Find out about the key risks to this Evolv Technologies Holdings narrative.

Another View: Caution from the SWS DCF Model

While analysts forecast strong growth and a fair value of $9.50, our DCF model tells a sharply different story. According to this cash flow-based approach, the stock is trading above its intrinsic value of $3.09. This suggests overvaluation from a fundamental perspective. Is the real upside smaller than it seems?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Evolv Technologies Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Evolv Technologies Holdings Narrative

If you want to dig into the numbers directly or reach your own conclusions, you can develop your own view in just a few minutes. Do it your way

A great starting point for your Evolv Technologies Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

The market is packed with opportunities that go beyond a single company. Act now and uncover stocks with strong potential, rapid growth, or an innovative edge using these powerful tools:

- Boost your portfolio with steady income by looking into these 19 dividend stocks with yields > 3% that consistently deliver attractive yields and reliable cash flow.

- Get ahead of tomorrow’s tech by checking out these 23 AI penny stocks and find companies transforming industries through advanced artificial intelligence solutions.

- Stay one step ahead by targeting value with these 914 undervalued stocks based on cash flows that the market may be overlooking, offering possible upside before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evolv Technologies Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EVLV

Evolv Technologies Holdings

Provides artificial intelligence (AI)-based weapons detection for security screening in the United States and internationally.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives