- United States

- /

- Communications

- /

- NasdaqGS:DGII

How Digi International’s (DGII) 25 Million XBee Module Milestone Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Digi International recently announced it has surpassed shipments of 25 million Digi XBee wireless modules, a milestone underscoring widespread use of its IoT solutions across sectors like smart cities, agriculture, and robotics.

- This achievement highlights Digi's broad protocol support and ongoing expansion with new offerings such as Digi XBee Hive gateways that address evolving connectivity needs in mission-critical environments.

- We'll explore how Digi's major milestone in XBee module shipments could influence the company’s investment outlook and IoT positioning.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Digi International Investment Narrative Recap

For shareholders in Digi International, the overarching thesis centers on the growth of IoT connectivity, particularly Digi's push toward high-margin recurring revenue from subscription and device management solutions. The company's recent milestone of 25 million Digi XBee wireless module shipments affirms its industry relevance yet does not appear to materially shift near-term catalysts, with flat overall revenue guidance and pressure on recurring revenue growth remaining the most important short-term focus and risk.

Among several updates, the launch of the Digi XBee for Wi-SUN solution stands out for its direct connection to the XBee milestone, reinforcing Digi's goal to address evolving connectivity needs in sectors like smart cities and utilities. This new product highlights the company's commitment to staying at the forefront of protocol innovation, but recurring revenue remains central to driving future profit expansion.

However, against this positive momentum, investors should be mindful of the persistent risks from APAC demand softness and the possibility that recurring growth could decelerate if...

Read the full narrative on Digi International (it's free!)

Digi International is forecast to reach $497.0 million in revenue and $72.6 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 5.7% and a $29.9 million increase in earnings from the current $42.7 million.

Uncover how Digi International's forecasts yield a $40.50 fair value, a 15% upside to its current price.

Exploring Other Perspectives

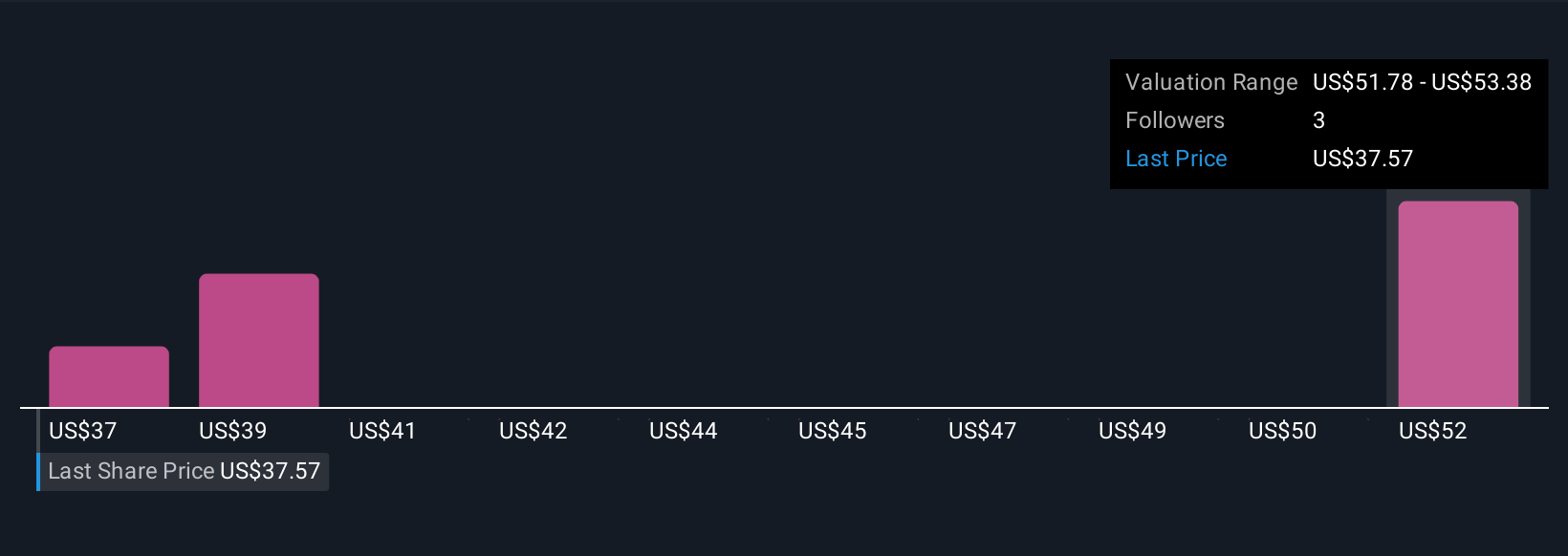

Simply Wall St Community members offer 3 distinct fair value estimates for Digi International, ranging from US$37.38 to US$53.67. While optimism about recurring revenue growth is widespread, the outlook could quickly shift if the pace of ARR adoption slows, so review other perspectives before deciding.

Explore 3 other fair value estimates on Digi International - why the stock might be worth just $37.38!

Build Your Own Digi International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Digi International research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Digi International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Digi International's overall financial health at a glance.

No Opportunity In Digi International?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DGII

Digi International

Provides business and mission-critical Internet of Things (IoT) connectivity products, services, and solutions in the United States, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives