- United States

- /

- Communications

- /

- NasdaqGS:CSCO

Cisco Systems (NASDAQ:CSCO) has Stabilized their Balance Sheet and can Focus on the Future

The Balance Sheet is a crucial point of review for investors, because it gives insight for the flexibility and structural integrity of an organization. That is why we are going to assess Cisco Systems, Inc. (NASDAQ:CSCO) financial health, and see if they are running effective operations.

Check out our latest analysis for Cisco Systems

What Is Cisco Systems's Debt?

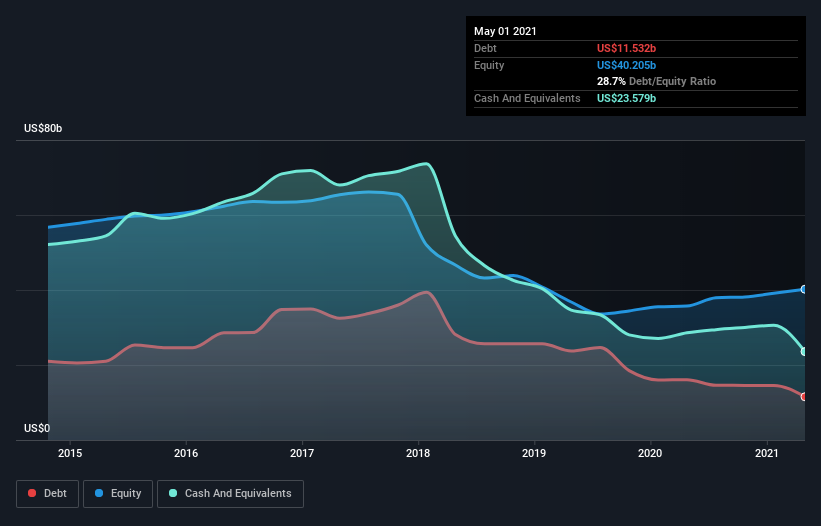

As you can see below, Cisco Systems had US$11.5b of debt at May 2021, down from US$16.1b a year prior. But it also has US$23.6b in cash to offset that, meaning it has US$12.0b net cash.

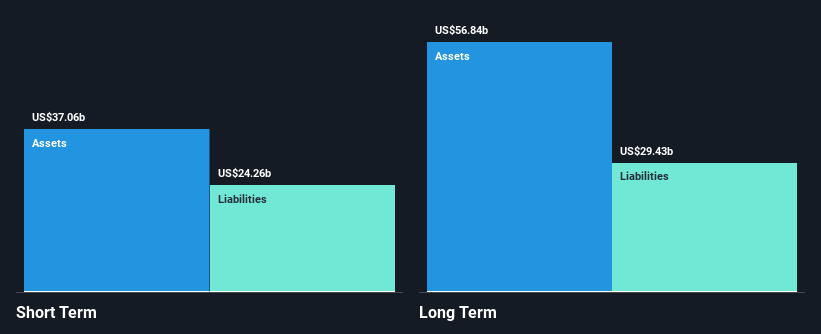

A Look At Cisco Systems' Liabilities

Zooming in on the latest balance sheet data, we can see that Cisco Systems had liabilities of US$24.3b due within 12 months and liabilities of US$29.4b due beyond that. On the other hand, it had cash of US$23.6b and US$9.34b worth of receivables due within a year. So, its liabilities total US$20.8b more than the combination of its cash and short-term receivables. Offsetting this are Cisco's long term assets, amounting to US$56.8b.

A complete picture can be seen in the chart below:

Of course, Cisco Systems has a large market capitalization of US$234.4b, so these liabilities are probably manageable.

Despite its noteworthy liabilities, Cisco Systems boasts net cash, so it's fair to say it does not have a heavy debt load!

But the other side of the story is that Cisco Systems saw its EBIT decline by 6.3% over the last year. That sort of decline, if sustained, will obviously make debt harder to handle.

The balance sheet is clearly the area to focus on when you are analyzing debt. But ultimately, the future profitability of the business will decide if Cisco Systems can strengthen its balance sheet over time.

So if you're focused on the future, you can check out this free report showing analyst profit forecasts.

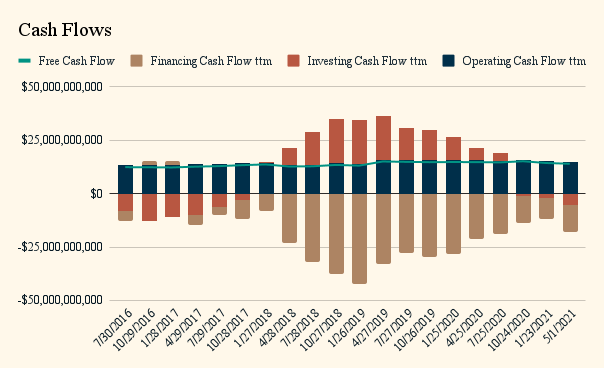

Finally, a business needs free cash flow to pay off debt. The difference between profits and free cash flow is that the first is in the books, and the second is in the bank. Investors should mostly be concerned with cash, because accountants have a lot of freedom to dance around profits.

Over the last three years, Cisco Systems actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces. Now, let's see how Cisco is handling its cash flows:

It seems that in the previous period, the largest cash outflows were, from financing - which mostly consist of debt repayments. That is why, at the beginning of our analysis, we say the debt balance slowly go down for Cisco. Cash from operating activities is quite constant, which indicates that the business has not improved both with regard to growth or efficiency of operations. The business is also returning cash to shareholders via their dividend, which currently has a 2.66% yield.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Cisco Systems has US$12.0b in net cash.

It impressed us with free cash flow of US$14b, being 105% of its EBIT.

The company is stabilizing its debt balance and has become more secure and stable. They can look towards the future and work on providing growth or maximizing value for shareholders. Overall, it looks like they have a healthy balance sheet.

So is Cisco Systems's debt a risk? It doesn't seem so to us. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Cisco Systems insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:CSCO

Cisco Systems

Designs, develops, and sells technologies that help to power, secure, and draw insights from the internet in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Beyond 2026, Beyond a Double

A case for TSXV:AUMB to reach USD$2.69 (CAD$3.70) by 2030 (15X).

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

Figma is still deeply embedded as the default design system in big companies, and the ecosystem (Buzz, Slides, Sites, Make) is clearly the strategic play rather than a one‑off product bet. None of those qualitative assumptions have really broken yet, the bigger change has been sentiment toward growth/AI software in general, not Figma’s product reality. Assuming ~30% annual growth, margins stepping up to 25%, and a 40x PE in 2030 with an 8.4% discount rate is too optimistic now considering how the broader market is now pricing similar SaaS names, which means you can believe in the long term thesis and still accept that the stock might chop sideways or even drift lower while expectations and multiples reset. I will be sharing an update soon.