- United States

- /

- Communications

- /

- NasdaqGS:COMM

Is CommScope Still Worth a Look After Its Impressive 195% Rally in 2024?

Reviewed by Bailey Pemberton

If you are scratching your head over what to do with CommScope Holding Company’s stock right now, you are definitely not alone. This is one of those names that has surprised even seasoned investors, thanks to its dramatic run in 2024. While the stock has softened just a bit lately, with a 0.9% dip over the past week and a 4.7% slide in the last month, the bigger picture has been nothing short of impressive. Year to date, CommScope is up an incredible 195.7%, and over the past year, it’s handed backers a 154.3% gain. Looking back even further, those who have held for the wild ride since 2019 have seen gains of 65.3%.

Such striking price movements tend to get investors asking whether the market is finally reassessing the risks facing the company or if there are real, structural stories behind this renewed optimism. Market sentiment can be fickle and external developments can amplify moves, but the scale of CommScope’s run suggests an underlying shift that deserves a closer look.

When it comes to value, the numbers tell an interesting story. The latest valuation “score” for CommScope stands at 4 out of 6, signaling that it is considered undervalued in four major assessments. Whether that is enough to tip the scales in your portfolio depends on how you weigh different approaches to valuation, which is a topic we will explore in detail. If you are hoping for an even sharper lens on what CommScope is really worth, stay tuned, because there is a smarter way to interpret these numbers that comes at the end.

Approach 1: CommScope Holding Company Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model determines what a company is worth by estimating its future free cash flows and then discounting those amounts back to today’s value. This method captures both near-term analyst forecasts and longer-term growth potential, making it a favorite for assessing a business’s fundamental value.

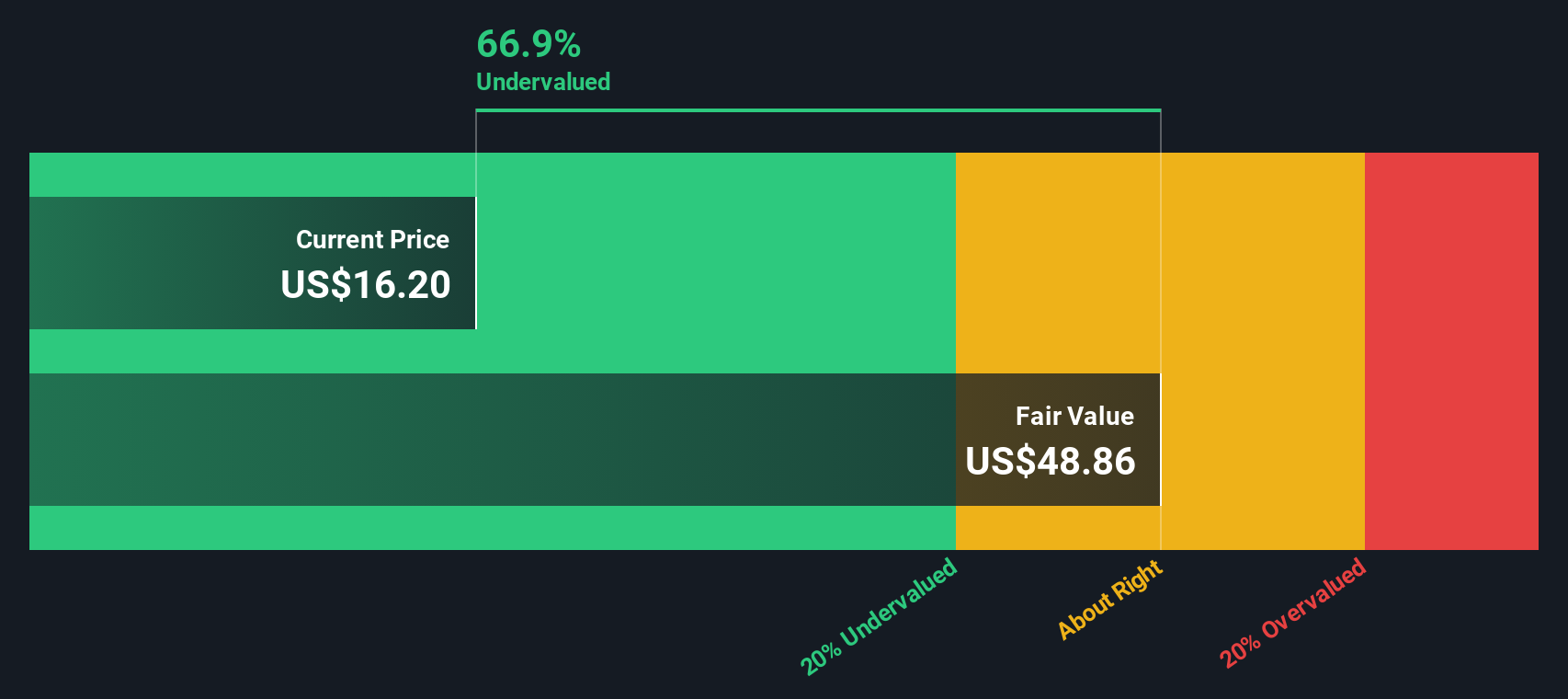

For CommScope Holding Company, the latest reported Free Cash Flow (FCF) stands at $236.8 Million. Analysts provide detailed projections for the next few years. Beyond 2027, forecasts are extended based on reasonable growth assumptions. According to these projections, CommScope’s FCF could reach approximately $1.51 Billion by 2035, all measured in US dollars. The result is an estimated intrinsic value per share of $48.86 using the two-stage Free Cash Flow to Equity model.

Currently, the DCF analysis suggests CommScope’s stock is trading at a steep 68.8% discount to its calculated fair value. This means the shares appear significantly undervalued on a cash flow basis and could have notable upside potential if the assumptions hold.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CommScope Holding Company is undervalued by 68.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: CommScope Holding Company Price vs Earnings

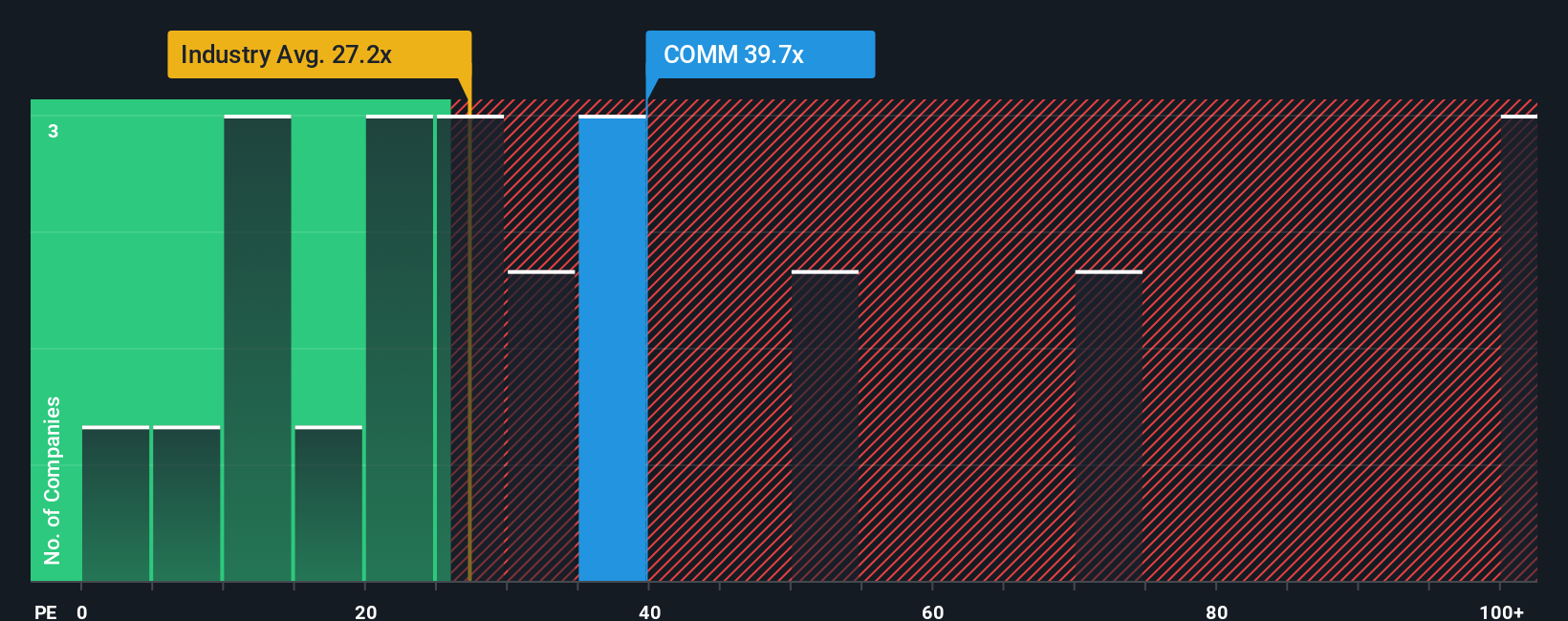

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics for companies that are profitable, like CommScope Holding Company. It gives investors a clear, apples-to-apples way to understand how much they are paying for each dollar of company earnings, making it easier to judge whether a stock represents good value for its level of profitability.

It is important to note that what counts as a "fair" or "normal" PE ratio depends a lot on the company’s growth outlook and risk profile. Companies with strong, consistent earnings growth and less risk are generally awarded higher PE ratios, while riskier or slower-growing firms usually trade at lower multiples.

Currently, CommScope Holding Company trades at a PE ratio of 37.4x. For context, this is just below its peer average of 38.8x, but well above the communications industry average of 30.1x. To provide a more tailored perspective, Simply Wall St has developed the "Fair Ratio," which for CommScope is 24.5x.

The Fair Ratio digs deeper than a simple industry or peer comparison by factoring in the company’s specific earnings growth prospects, profit margins, risk level, industry standing, and overall market capitalization. This makes it a much more meaningful barometer of where the stock should logically trade, especially for investors wanting a valuation that accounts for the actual company behind the ticker symbol.

Comparing CommScope’s current PE ratio of 37.4x to its Fair Ratio of 24.5x suggests that the stock is trading above what would be considered fair for its characteristics, signaling potential overvaluation right now.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

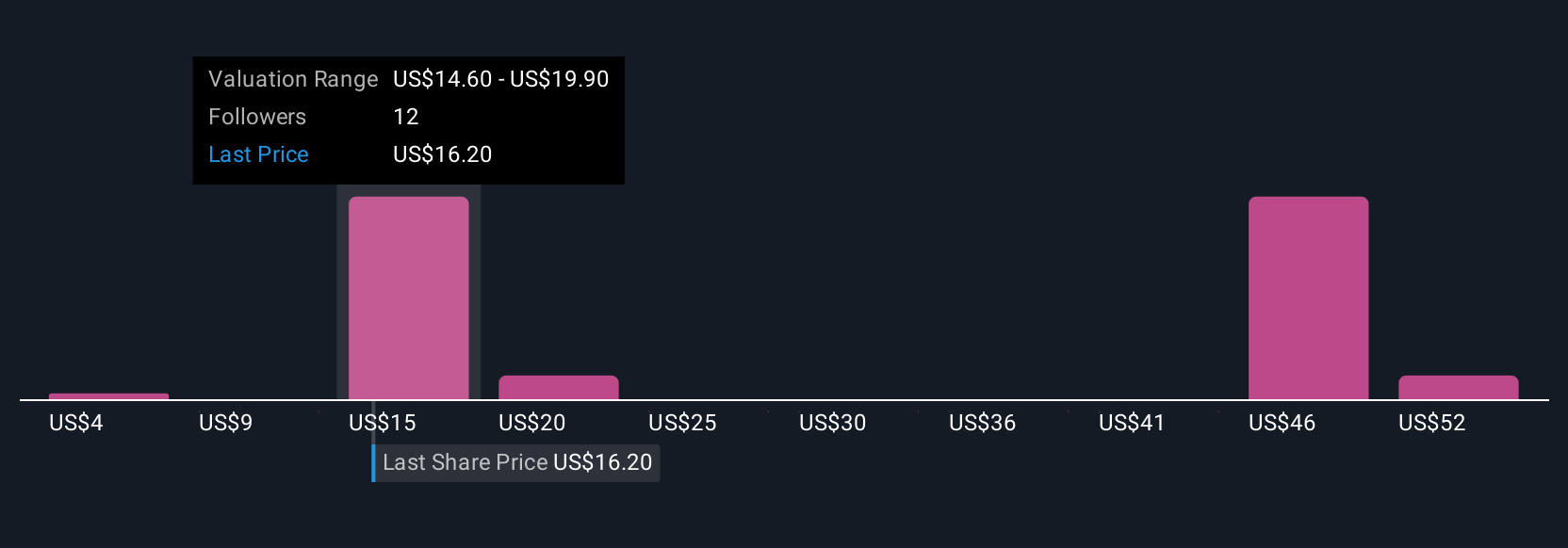

Upgrade Your Decision Making: Choose your CommScope Holding Company Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple yet powerful way to view a company, such as CommScope Holding Company, not just through numbers, but as a story that connects your perspective on its business potential to specific financial forecasts and a calculated fair value. Narratives let you create, adapt, and discuss your own outlook for revenues, earnings, and margins, making your investment decision more meaningful than any single metric. This approach is easily accessible via the Community page on Simply Wall St and is already used by millions of investors. Narratives help you decide whether to buy, hold, or sell by directly comparing your own or the community’s Fair Value estimates to the current Price of the stock. They update dynamically as news or earnings reports come in, ensuring your view stays relevant. For example, one investor’s optimistic Narrative for CommScope might highlight innovation-driven growth and assign a high fair value, while another may focus on business risks and set a much lower one. This way, you can always compare a range of perspectives and make a decision that fits your view.

Do you think there's more to the story for CommScope Holding Company? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COMM

CommScope Holding Company

Provides infrastructure solutions for communications, data center, and entertainment networks.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives