- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:CODA

Can You Imagine How Elated Coda Octopus Group's (NASDAQ:CODA) Shareholders Feel About Its 352% Share Price Gain?

Buying shares in the best businesses can build meaningful wealth for you and your family. And we've seen some truly amazing gains over the years. Just think about the savvy investors who held Coda Octopus Group, Inc. (NASDAQ:CODA) shares for the last five years, while they gained 352%. If that doesn't get you thinking about long term investing, we don't know what will. Unfortunately, though, the stock has dropped 5.7% over a week.

View our latest analysis for Coda Octopus Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Coda Octopus Group actually saw its EPS drop 4.7% per year.

By glancing at these numbers, we'd posit that the decline in earnings per share is not representative of how the business has changed over the years. Therefore, it's worth taking a look at other metrics to try to understand the share price movements.

In contrast revenue growth of 3.8% per year is probably viewed as evidence that Coda Octopus Group is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

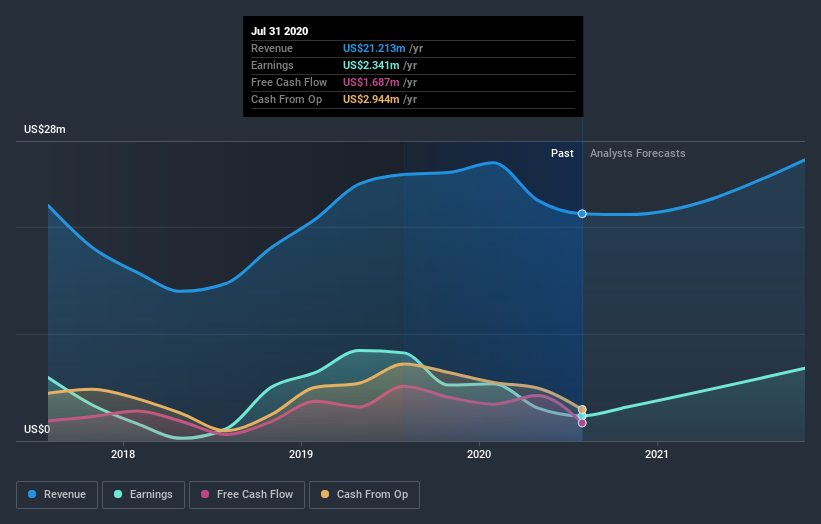

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Coda Octopus Group in this interactive graph of future profit estimates.

A Different Perspective

While the broader market gained around 25% in the last year, Coda Octopus Group shareholders lost 28%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 35%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Coda Octopus Group has 3 warning signs we think you should be aware of.

We will like Coda Octopus Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Coda Octopus Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:CODA

Coda Octopus Group

Sells and rentals underwater technologies and equipment for real time 3D imaging, mapping, defense, and survey applications in the United States, Europe, Australia, Asia, the Middle East, and Africa.

Flawless balance sheet with proven track record.