- United States

- /

- Tech Hardware

- /

- NYSE:GPGI

A Look at CompoSecure's (CMPO) Valuation Following Its Move to the NYSE

Most Popular Narrative: Fairly Valued

The most widely followed narrative currently values CompoSecure as fairly valued, with the latest analysis indicating the price target is closely aligned to the current market price. The valuation is based on consensus forecasts about the company’s future growth and profitability, using a discount rate of 8.15%.

“Expanding premium card and digital security offerings, along with major partnerships, is broadening the customer base and establishing recurring, stable revenue streams. Operational efficiency initiatives are boosting profitability and sustaining margin growth. This is positioning the company for incremental gains across traditional and digital segments.”

Think CompoSecure’s valuation is just another routine Wall Street call? The secret sauce behind this price target includes bold growth bets and headline-making profitability projections. Curious about which aggressive financial assumptions turn today’s stock price into a fair value verdict? The full narrative uncovers the forecasted numbers, management moves, and partnerships that analysts believe could define CompoSecure’s next chapter.

Result: Fair Value of $19.00 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensified adoption of digital payments and growing sustainability concerns could threaten CompoSecure’s ability to maintain its strong growth trajectory.

Find out about the key risks to this CompoSecure narrative.Another View: What Does the SWS DCF Model Reveal?

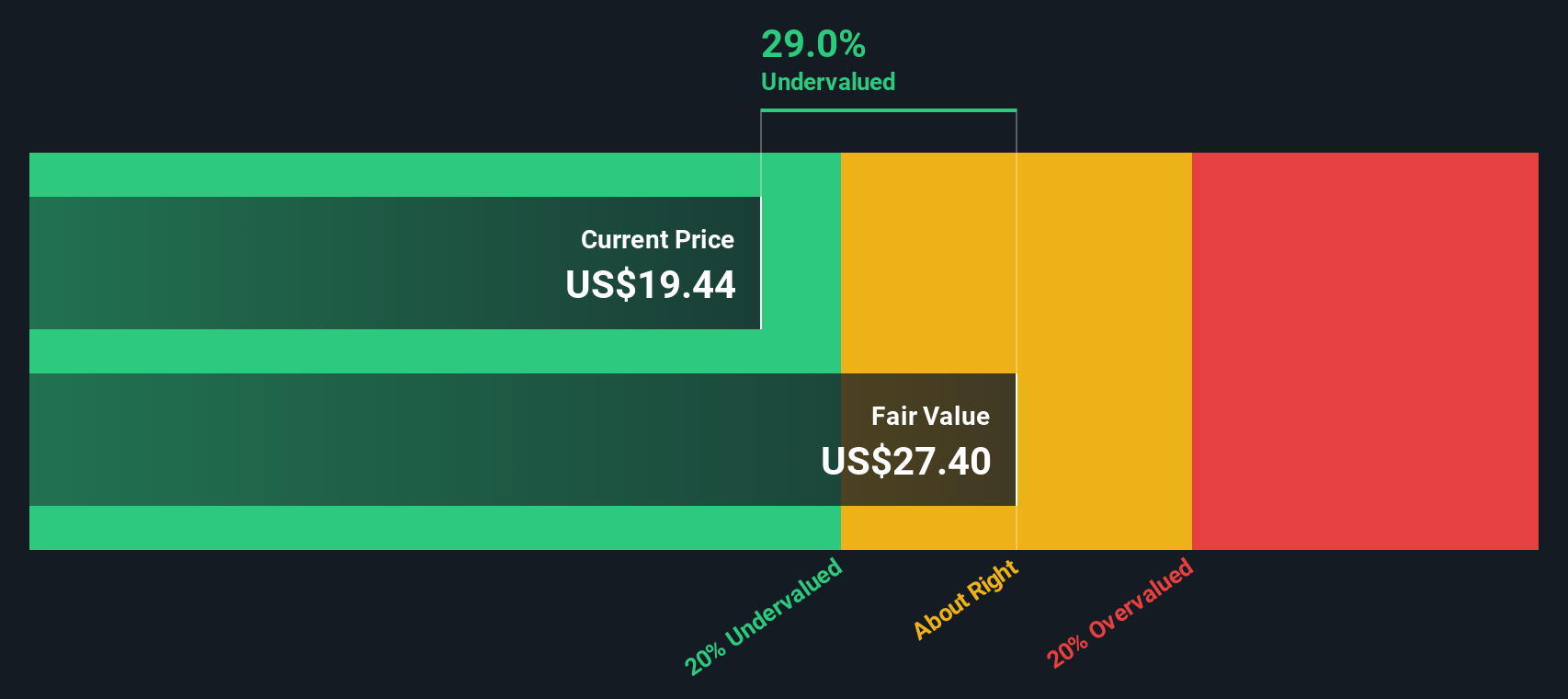

While the consensus sees CompoSecure as fairly valued based on analyst growth assumptions, our DCF model points to a different story. This suggests the shares may actually be undervalued. Could this unlock hidden opportunity, or are both sides missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CompoSecure Narrative

If you think there’s more to CompoSecure’s story or want to dig into the details your own way, you can build a personalized outlook in just minutes with Do it your way.

A great starting point for your CompoSecure research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for Your Next Smart Investment?

Finding compelling opportunities doesn’t end with CompoSecure. Take charge of your financial future by searching for stocks that could offer growth, stability, or innovation you might be missing out on.

- Spot high-potential small caps with strong financials by using penny stocks with strong financials. Uncover emerging companies that could become tomorrow’s leaders.

- Tap into the booming healthcare revolution and identify promising disruptors shaping medicine’s future with healthcare AI stocks.

- Secure steady income streams for your portfolio by browsing dividend stocks with yields > 3% to find stocks with attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPGI

GPGI

Operates as a diversified, multi-industry compounder comprised of companies in various industries.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Alphabet - A Fundamental and Historical Valuation

The Compound Effect: From Acquisition to Integration

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion