- United States

- /

- Entertainment

- /

- NYSE:EB

3 US Penny Stocks With Market Caps Under $400M

Reviewed by Simply Wall St

As the U.S. stock market navigates fluctuations due to recent jobs reports and consumer sentiment, investors continue to explore diverse opportunities across various sectors. Among these are penny stocks, a term that might seem outdated but remains relevant for those seeking potential growth at lower price points. Typically associated with smaller or newer companies, penny stocks can offer intriguing prospects when they boast strong financials and a clear path for growth. In this article, we will explore three such U.S.-based penny stocks that stand out for their financial resilience and potential upside in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.88 | $6.38M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $120.63M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2798 | $10.12M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.99 | $90.69M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.95 | $53.09M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.82 | $45.59M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.415 | $46.86M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.52 | $26.96M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.882 | $81.84M | ★★★★★☆ |

Click here to see the full list of 706 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Cambium Networks (NasdaqGM:CMBM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cambium Networks Corporation, along with its subsidiaries, designs, develops, and manufactures wireless broadband and Wi-Fi networking infrastructure solutions with a market cap of $36.72 million.

Operations: Cambium Networks generates revenue from its Computer Networks segment, totaling $172.22 million.

Market Cap: $36.72M

Cambium Networks, with a market cap of US$36.72 million, is navigating challenges typical of penny stocks. Despite being unprofitable, its short-term assets exceed both long-term and short-term liabilities, indicating some financial stability. The company's revenue for the third quarter was US$43.73 million, showing slight growth from the previous year while narrowing its net loss to US$9.68 million from US$26.2 million a year ago. Cambium's management team is experienced and has seen recent changes with Melissa Cada-Bartoli stepping in as Global Controller and Chief Accounting Officer, potentially influencing future strategic directions.

- Unlock comprehensive insights into our analysis of Cambium Networks stock in this financial health report.

- Learn about Cambium Networks' future growth trajectory here.

Solitario Resources (NYSEAM:XPL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Solitario Resources Corp. is an exploration stage company focused on acquiring and exploring precious metal, zinc, and other base metal properties in North and South America, with a market cap of $54.35 million.

Operations: Solitario Resources Corp. does not report any revenue segments as it is an exploration stage company focused on acquiring and exploring metal properties.

Market Cap: $54.35M

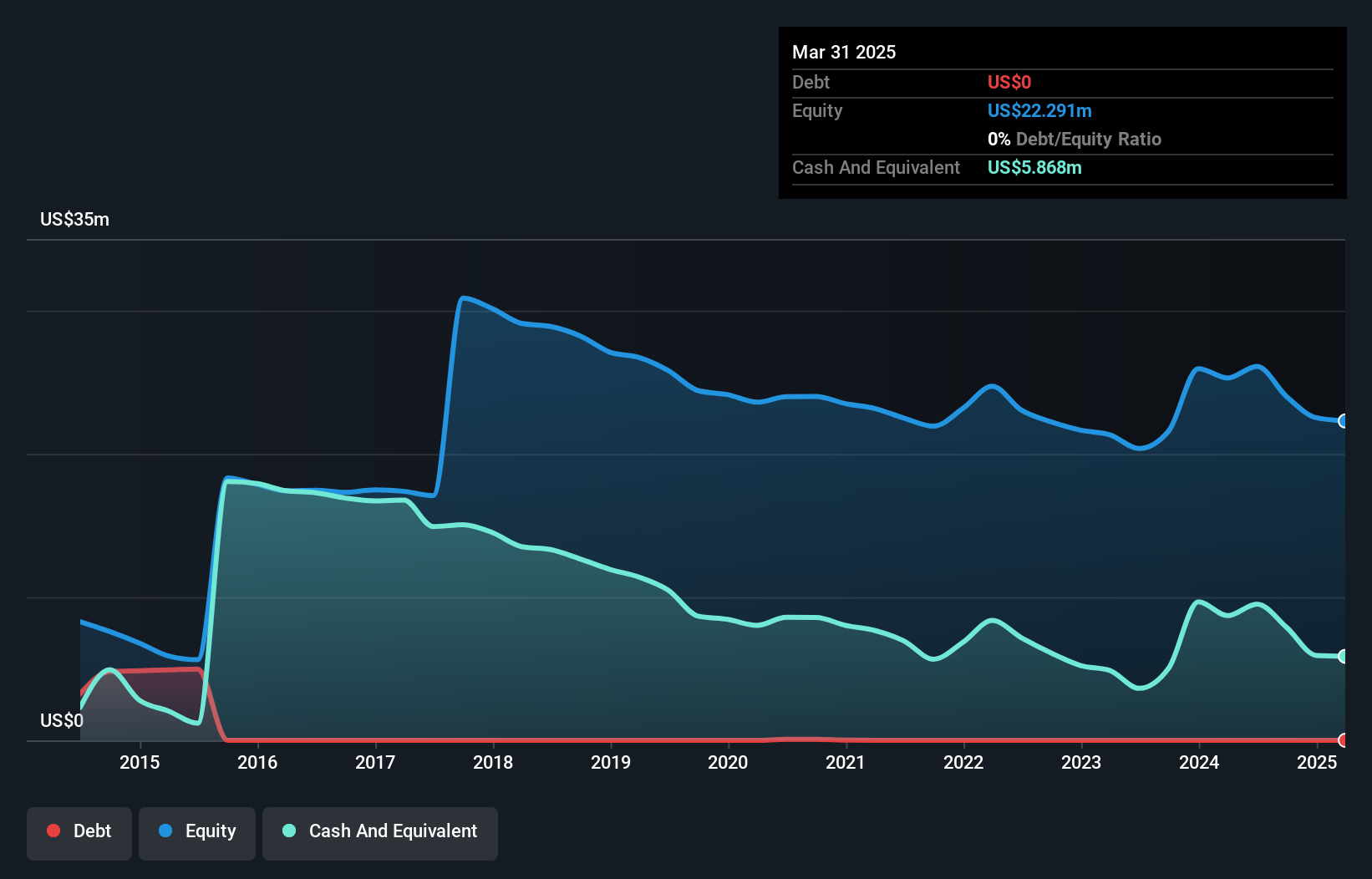

Solitario Resources, with a market cap of US$54.35 million, is pre-revenue and focuses on exploration-stage mining projects. The company is debt-free and has sufficient cash runway for over a year based on current free cash flow trends. Its recent drilling at the Golden Crest Project in South Dakota revealed significant gold mineralization, including promising grades increasing with depth in the lower Deadwood formation. This discovery marks the first outside the historic Homestake-Wharf district, highlighting potential future exploration upside. Solitario's short-term assets comfortably cover both its short-term and long-term liabilities, indicating financial resilience amidst its exploratory focus.

- Click to explore a detailed breakdown of our findings in Solitario Resources' financial health report.

- Examine Solitario Resources' past performance report to understand how it has performed in prior years.

Eventbrite (NYSE:EB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Eventbrite, Inc. operates a two-sided marketplace offering self-service ticketing and marketing tools for event creators both in the United States and internationally, with a market cap of approximately $319.71 million.

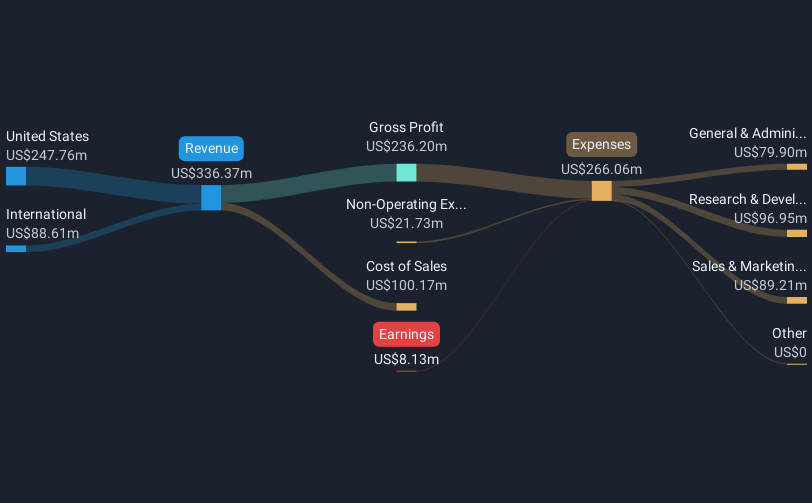

Operations: The company's revenue primarily stems from its Internet Software & Services segment, generating $336.37 million.

Market Cap: $319.71M

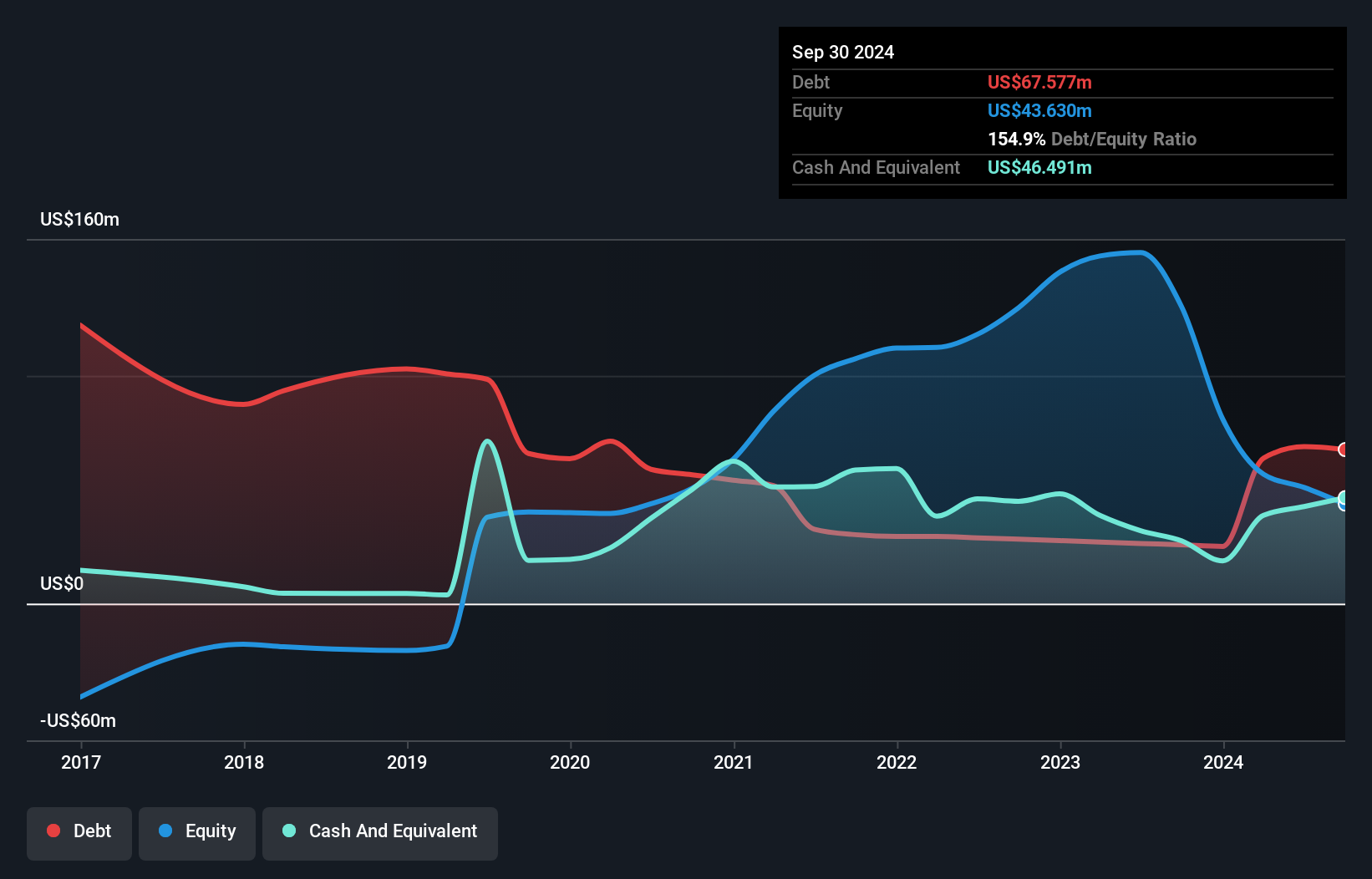

Eventbrite, with a market cap of US$319.71 million, operates in the Internet Software & Services sector and has shown resilience despite recent challenges. Its revenue for 2024 is projected between US$322 million and US$326 million, reflecting modest growth from previous years. Although currently unprofitable with a negative return on equity of -4.52%, it has reduced its net losses significantly over the past five years by 37.6% annually. The company maintains a strong financial position with short-term assets exceeding both short-term and long-term liabilities, supported by sufficient cash reserves to sustain operations for over three years without additional funding needs.

- Jump into the full analysis health report here for a deeper understanding of Eventbrite.

- Gain insights into Eventbrite's outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Embark on your investment journey to our 706 US Penny Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Eventbrite, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eventbrite might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EB

Eventbrite

Operates a two-sided marketplace that provides self-service ticketing and marketing tools for event creators in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives