- United States

- /

- Medical Equipment

- /

- NasdaqGM:STAA

3 Stocks Estimated To Be Undervalued By 37.6% To 45.7%

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq Composite recently retreated from record highs, investors are closely watching how strong corporate earnings and economic data balance ongoing concerns about tariffs. In this fluctuating environment, identifying undervalued stocks can be a strategic approach for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Robert Half (RHI) | $41.80 | $82.59 | 49.4% |

| Repligen (RGEN) | $114.80 | $224.90 | 49% |

| Hesai Group (HSAI) | $20.86 | $41.09 | 49.2% |

| Freshpet (FRPT) | $68.12 | $133.26 | 48.9% |

| Definitive Healthcare (DH) | $3.99 | $7.80 | 48.8% |

| Carter Bankshares (CARE) | $18.10 | $35.50 | 49% |

| Camden National (CAC) | $42.29 | $83.80 | 49.5% |

| Atlantic Union Bankshares (AUB) | $32.98 | $65.45 | 49.6% |

| ACNB (ACNB) | $43.36 | $85.03 | 49% |

| Acadia Realty Trust (AKR) | $18.61 | $36.69 | 49.3% |

We're going to check out a few of the best picks from our screener tool.

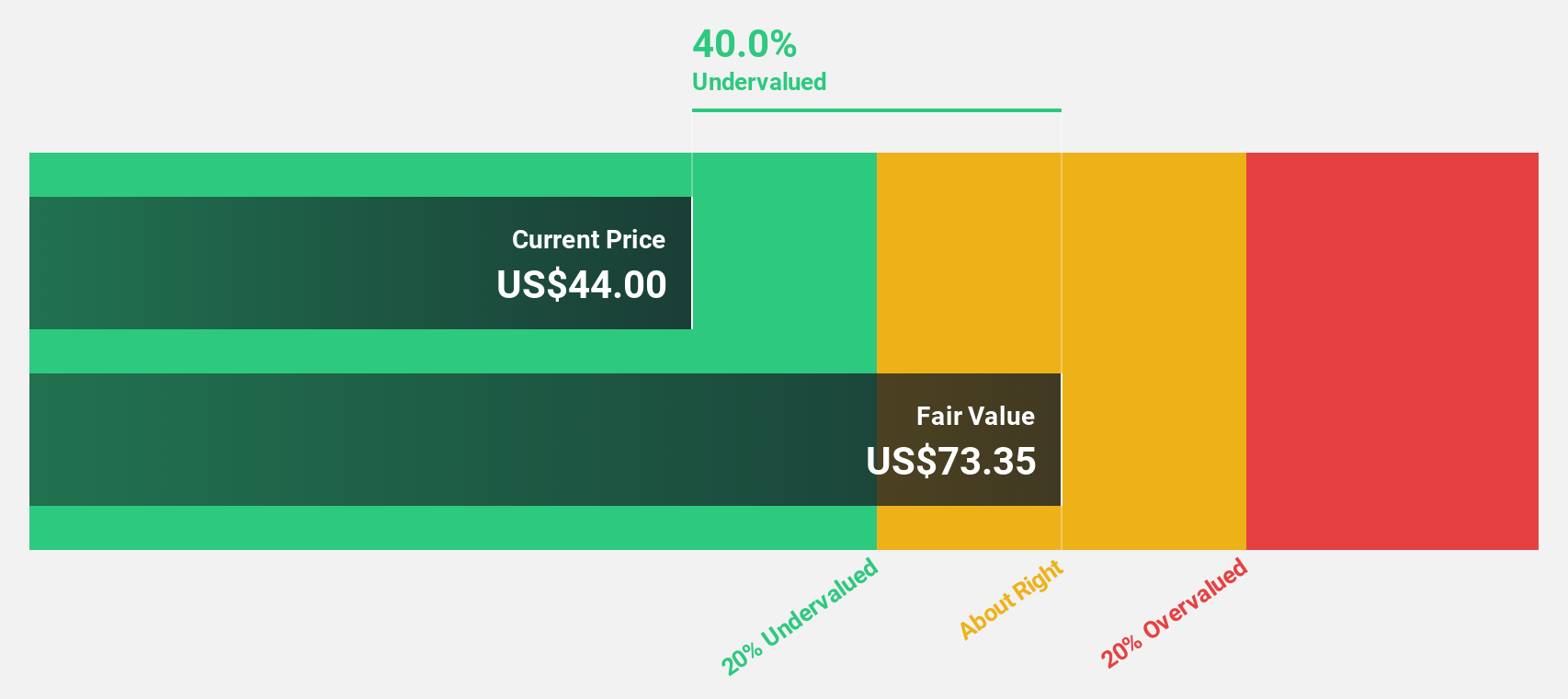

Clearfield (CLFD)

Overview: Clearfield, Inc. manufactures and sells fiber connectivity products both in the United States and internationally, with a market cap of $595.28 million.

Operations: The company generates revenue primarily from its Clearfield segment, which accounts for $140.25 million, and Nestor Cables, contributing $40.16 million.

Estimated Discount To Fair Value: 41.3%

Clearfield, Inc. is trading significantly below its estimated fair value of US$73.27, with a current price around US$43, suggesting it could be undervalued based on cash flows. Recent earnings show a turnaround from a net loss to a net income of US$1.33 million in Q2 2025, highlighting improving financial health. The company’s addition to multiple Russell Growth Indexes underscores market recognition and potential growth prospects despite slower revenue growth forecasts compared to industry benchmarks.

- Our growth report here indicates Clearfield may be poised for an improving outlook.

- Navigate through the intricacies of Clearfield with our comprehensive financial health report here.

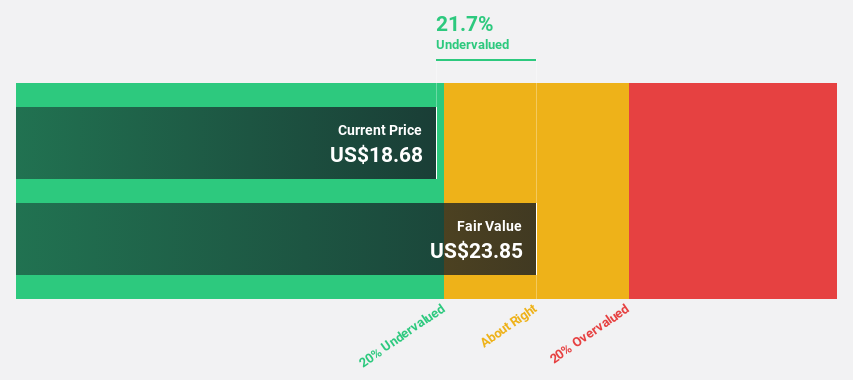

STAAR Surgical (STAA)

Overview: STAAR Surgical Company designs, develops, manufactures, and sells implantable lenses and delivery systems for the eye, with a market cap of approximately $859.50 million.

Operations: The company generates revenue primarily from its ophthalmic surgical products, amounting to $279.13 million.

Estimated Discount To Fair Value: 37.6%

STAAR Surgical is trading at US$17.76, well below its estimated fair value of US$28.46, highlighting potential undervaluation based on cash flows. The company anticipates becoming profitable within three years, with revenue growth expected to outpace the broader U.S. market slightly. Despite a recent net loss and low future return on equity forecasts, STAAR's inclusion in several Russell Value Indexes reflects market confidence amid strategic shifts like a new CFO appointment and capital stewardship initiatives.

- Our comprehensive growth report raises the possibility that STAAR Surgical is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of STAAR Surgical stock in this financial health report.

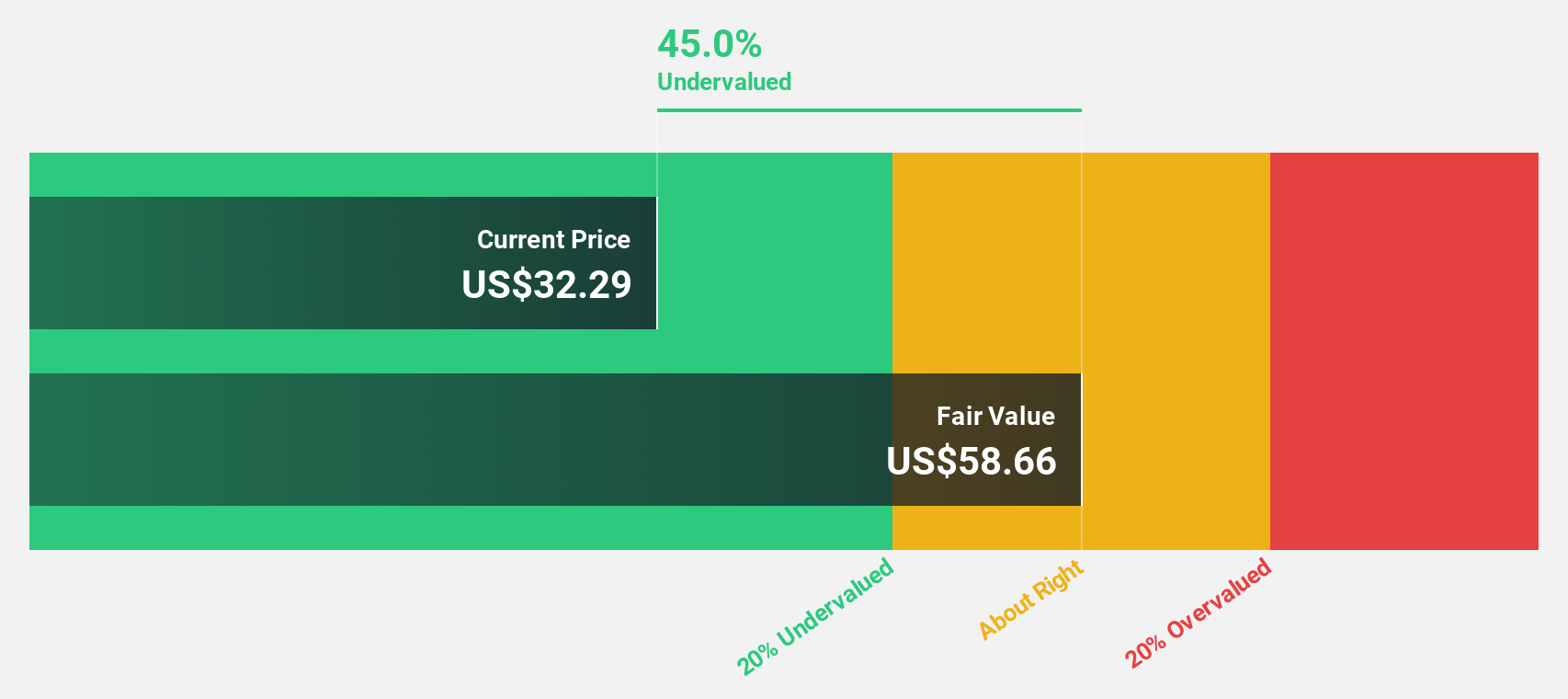

Tenable Holdings (TENB)

Overview: Tenable Holdings, Inc. offers cyber exposure management solutions across various global regions and has a market cap of approximately $4.04 billion.

Operations: The company's revenue is primarily derived from its Security Software & Services segment, totaling $923.20 million.

Estimated Discount To Fair Value: 45.7%

Tenable Holdings is trading at US$33.29, significantly below its estimated fair value of US$61.26, suggesting undervaluation based on cash flows. The company is expected to achieve profitability within three years with above-average market profit growth forecasts. Despite a recent net loss and slower revenue growth compared to the U.S. market, Tenable's strategic leadership changes and share buyback initiatives underscore its commitment to enhancing shareholder value amidst expanding cybersecurity solutions.

- In light of our recent growth report, it seems possible that Tenable Holdings' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Tenable Holdings' balance sheet health report.

Where To Now?

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 172 more companies for you to explore.Click here to unveil our expertly curated list of 175 Undervalued US Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:STAA

STAAR Surgical

Designs, develops, manufactures, and sells implantable lenses for the eye and accessory delivery systems to deliver the lenses into the eye.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives