- United States

- /

- Communications

- /

- OTCPK:CASS.Q

Health Check: How Prudently Does Casa Systems (NASDAQ:CASA) Use Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Casa Systems, Inc. (NASDAQ:CASA) makes use of debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Casa Systems

What Is Casa Systems's Debt?

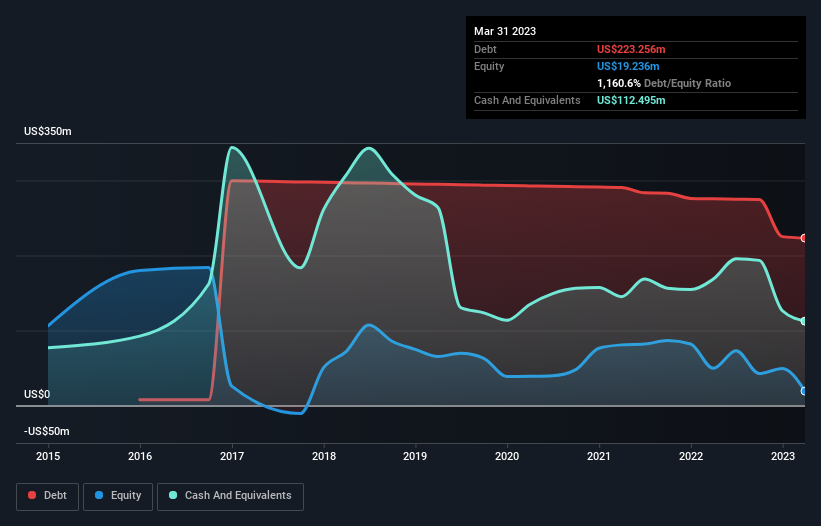

As you can see below, Casa Systems had US$223.3m of debt at March 2023, down from US$275.6m a year prior. However, because it has a cash reserve of US$112.5m, its net debt is less, at about US$110.8m.

How Strong Is Casa Systems' Balance Sheet?

According to the last reported balance sheet, Casa Systems had liabilities of US$312.1m due within 12 months, and liabilities of US$24.8m due beyond 12 months. On the other hand, it had cash of US$112.5m and US$47.5m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$176.9m.

The deficiency here weighs heavily on the US$102.8m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Casa Systems would probably need a major re-capitalization if its creditors were to demand repayment. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Casa Systems can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Casa Systems had a loss before interest and tax, and actually shrunk its revenue by 26%, to US$267m. To be frank that doesn't bode well.

Caveat Emptor

Not only did Casa Systems's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost a very considerable US$64m at the EBIT level. When we look at that alongside the significant liabilities, we're not particularly confident about the company. It would need to improve its operations quickly for us to be interested in it. Not least because it had negative free cash flow of US$39m over the last twelve months. So suffice it to say we consider the stock to be risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Casa Systems (1 is potentially serious) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:CASS.Q

Casa Systems

A communications technology company, provides solutions for next-generation physical, virtualized, and cloud native architectures for cable broadband, fixed-line broadband, and wireless networks in North America, Latin America, the Asia-Pacific, Europe, the Middle East, and Africa.

Slightly overvalued with worrying balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026