- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:AVT

Sensirion Partnership Expands Avnet’s (AVT) Reach, But What Does It Mean for Long-Term Growth?

Reviewed by Sasha Jovanovic

- On October 2, 2025, Sensirion Holding AG announced it has added Avnet to its global distribution network, enhancing Sensirion’s market access and allowing customers to source its sensor technologies directly through Avnet’s supply chain and support channels.

- This collaboration leverages Avnet’s extensive distribution reach and engineering support to improve integration and accessibility of sensing solutions for a broad range of customer applications worldwide.

- We'll explore how Avnet's expanded product suite through the Sensirion partnership may influence its long-term growth narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Avnet Investment Narrative Recap

Shareholders in Avnet are betting on the company’s ability to expand its value-added distribution services, deepen customer relationships, and benefit from accelerating digitalization and IoT trends. The Sensirion partnership is well aligned with these themes, adding depth to Avnet’s capabilities and global portfolio, but in the short term, the biggest catalyst remains the anticipated recovery in industry demand, while the key risk continues to be further margin compression as regional mix and price competition shift. Among recent announcements, Avnet’s latest earnings report stands out. Despite expanded supplier partnerships and product offerings, the company’s recent period showed an 8.5% annual drop in sales, with net income and EPS falling sharply year on year. This context remains essential, as revenue pressure and margin volatility could weigh on Avnet’s ability to capitalize on new alliances or sector tailwinds. Yet, set against Avnet’s ongoing growth initiatives, investors should be aware that persistent margin compression from shifting regional sales could...

Read the full narrative on Avnet (it's free!)

Avnet's outlook anticipates $25.5 billion in revenue and $680.5 million in earnings by 2028. This requires 4.8% annual revenue growth and a $440.3 million increase in earnings from the current $240.2 million level.

Uncover how Avnet's forecasts yield a $52.75 fair value, in line with its current price.

Exploring Other Perspectives

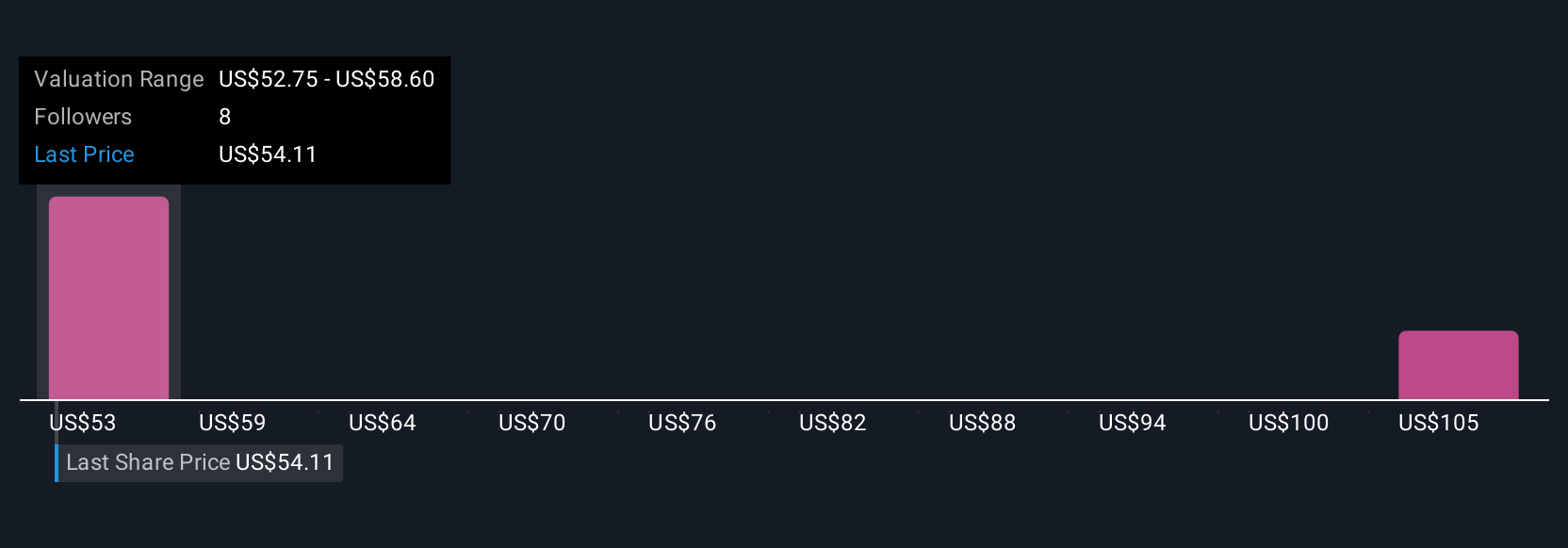

Four private investors in the Simply Wall St Community place Avnet’s fair value between US$52.75 and US$108.46 per share. With market opinions ranging widely and margins still under pressure, you can explore how these diverse perspectives reflect on Avnet’s longer-term performance outlook.

Explore 4 other fair value estimates on Avnet - why the stock might be worth just $52.75!

Build Your Own Avnet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avnet research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Avnet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avnet's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVT

Avnet

Distributes electronic component technology in the Americas, Europe, the Middle East, Africa, and Asia/Pacific.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives