- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:ARBE

Can Arbe Robotics' (ARBE) Award-Winning Radar Reinforce Its Leadership in Autonomous Vehicle Safety?

Reviewed by Sasha Jovanovic

- Arbe Robotics Ltd.'s perception radar technology was recently named "Sensor Technology Solution of the Year" at the 2025 AutoTech Breakthrough Awards, recognizing its role in ultra-high-resolution automotive sensing for autonomous driving.

- This award highlights the company's innovation in transforming radar into a critical safety component for autonomous vehicles, emphasizing enhanced reliability and night-time pedestrian detection capabilities.

- We'll explore how this industry recognition for Arbe Robotics' perception radar could shape the company's investment narrative around autonomous vehicle technology leadership.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Arbe Robotics' Investment Narrative?

For anyone considering Arbe Robotics, the big picture hinges on whether their radar technology can become a foundational piece of future autonomous vehicle systems. The recent "Sensor Technology Solution of the Year" award by AutoTech Breakthrough brings validation and fresh visibility, but the immediate impact on short-term business catalysts remains modest. Despite the high praise, the company still faces pressing challenges: quarterly sales remain low, it is unprofitable, cash reserves offer less than a year's runway, and there’s persistent dilution from recent share issuances. While the accolade adds credibility and may improve negotiations with OEMs and partners, the key catalyst will remain clear evidence of commercial wins or revenue traction in automotive or defense projects. Right now, the central risk is that industry recognition doesn’t guarantee near-term sales or financial stability.

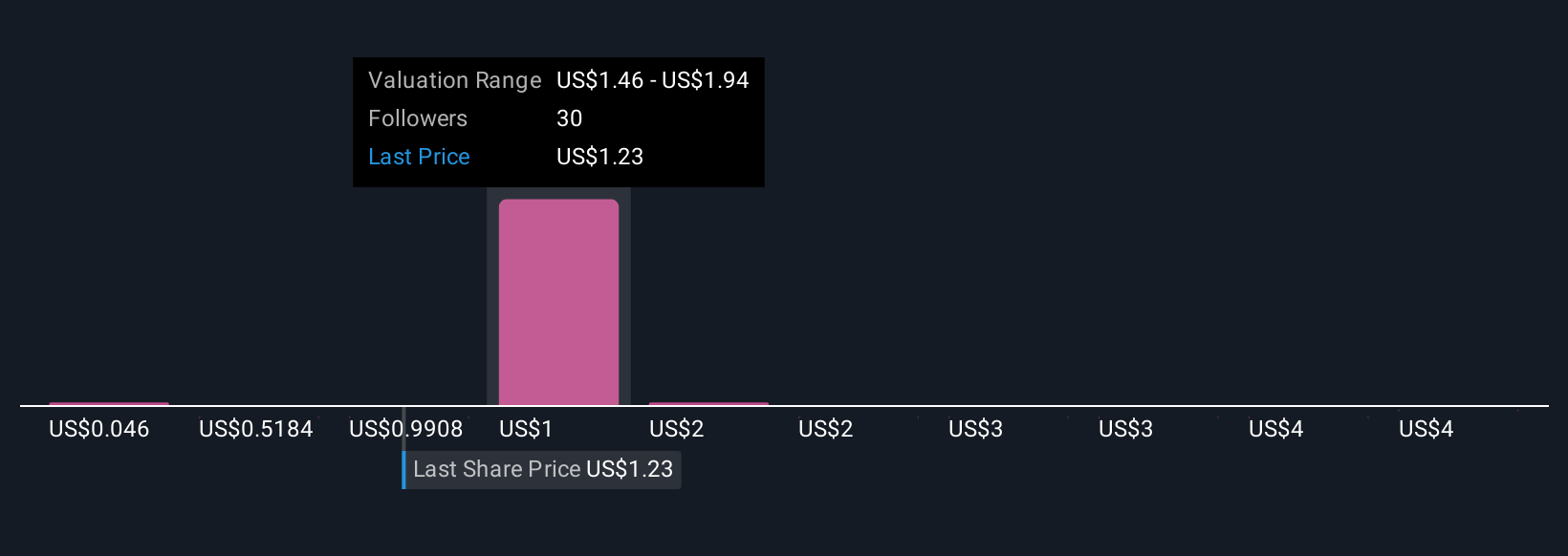

But, despite rising recognition, the path to substantial revenues remains a question for now. Our valuation report unveils the possibility Arbe Robotics' shares may be trading at a premium.Exploring Other Perspectives

Explore 6 other fair value estimates on Arbe Robotics - why the stock might be worth less than half the current price!

Build Your Own Arbe Robotics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arbe Robotics research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Arbe Robotics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arbe Robotics' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ARBE

Arbe Robotics

A semiconductor company, provides 4D imaging radar solutions to suppliers of parts or systems, autonomous ground vehicles, and commercial and industrial vehicles in China, Sweden, Germany, the United States, Israel, and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion