- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:AEIS

Is Advanced Energy Industries Still a Good Pick After a 76% Price Surge in 2025?

Reviewed by Bailey Pemberton

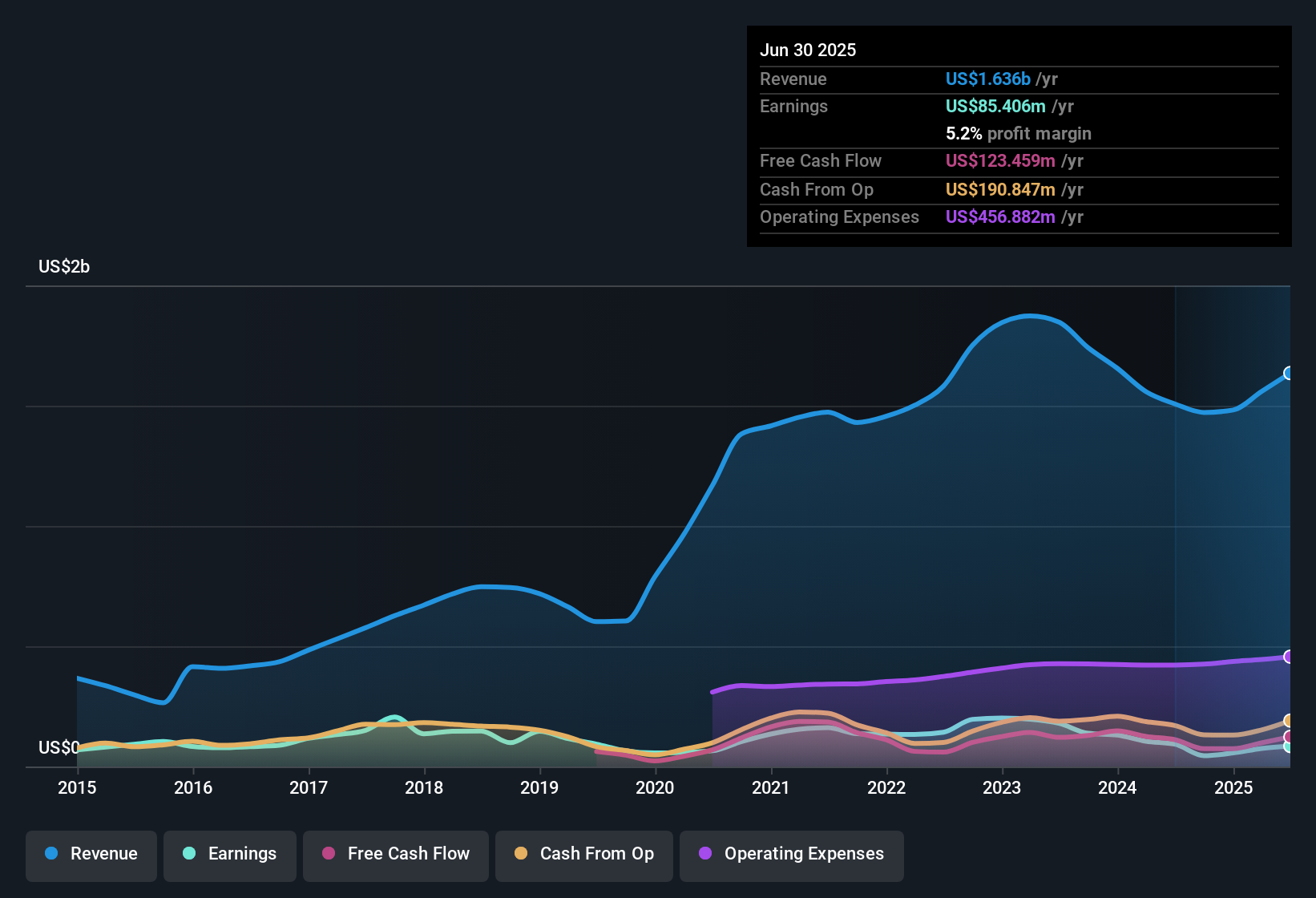

If you hold or are eyeing shares of Advanced Energy Industries, you are probably asking yourself, “Is now the time to buy, sell, or just wait?” The company’s stock has been on a remarkable run, closing at $202.61 most recently. Over just the past week, shares have climbed 5.5%, while the 30-day return stands at an impressive 18.6%. It is hard to ignore the numbers for the year so far, with the stock up 75.7%. Looking back even further, Advanced Energy Industries boasts a five-year performance of 206.0%. Clearly, something is driving this momentum.

Much of this energy has come from the growing demand for innovative power solutions across sectors like semiconductors, healthcare, and industrial manufacturing. Investors have also taken notice of the company's successful product launches and expansion into new, high-margin markets, which has given the stock extra lift. With headlines highlighting the company's newest partnerships and increased adoption of their technologies in the renewable energy space, traders are sensing both growth and shifting risk perceptions.

But here is where things get interesting. Despite all this price action, a closer look at valuation reveals something counterintuitive. Using a thorough analytic screen with six key checks for undervaluation, Advanced Energy Industries achieves a value score of 0. This means it does not appear undervalued on any front right now. So, what exactly are these valuation checks, and how should they shape your thinking on the stock’s next moves? Let us break them down and, after that, explore a perspective that might matter even more for long-term investors.

Advanced Energy Industries scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Advanced Energy Industries Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its expected future cash flows and discounting them back to today's value using an appropriate rate. For Advanced Energy Industries, this means mapping out how much cash the company is expected to generate over the coming years and then determining what that stream of cash is worth right now.

Currently, Advanced Energy Industries reports Free Cash Flow of $127.53 million. Analyst forecasts see Free Cash Flow rising to $188.4 million by 2026, and longer-term projections, partly driven by Simply Wall St modelling, suggest it could surpass $364 million in ten years. These healthy projections underscore strong anticipated growth in the business. It is important to note that only the next five years are guided by analyst estimates, with later years extrapolated from trends.

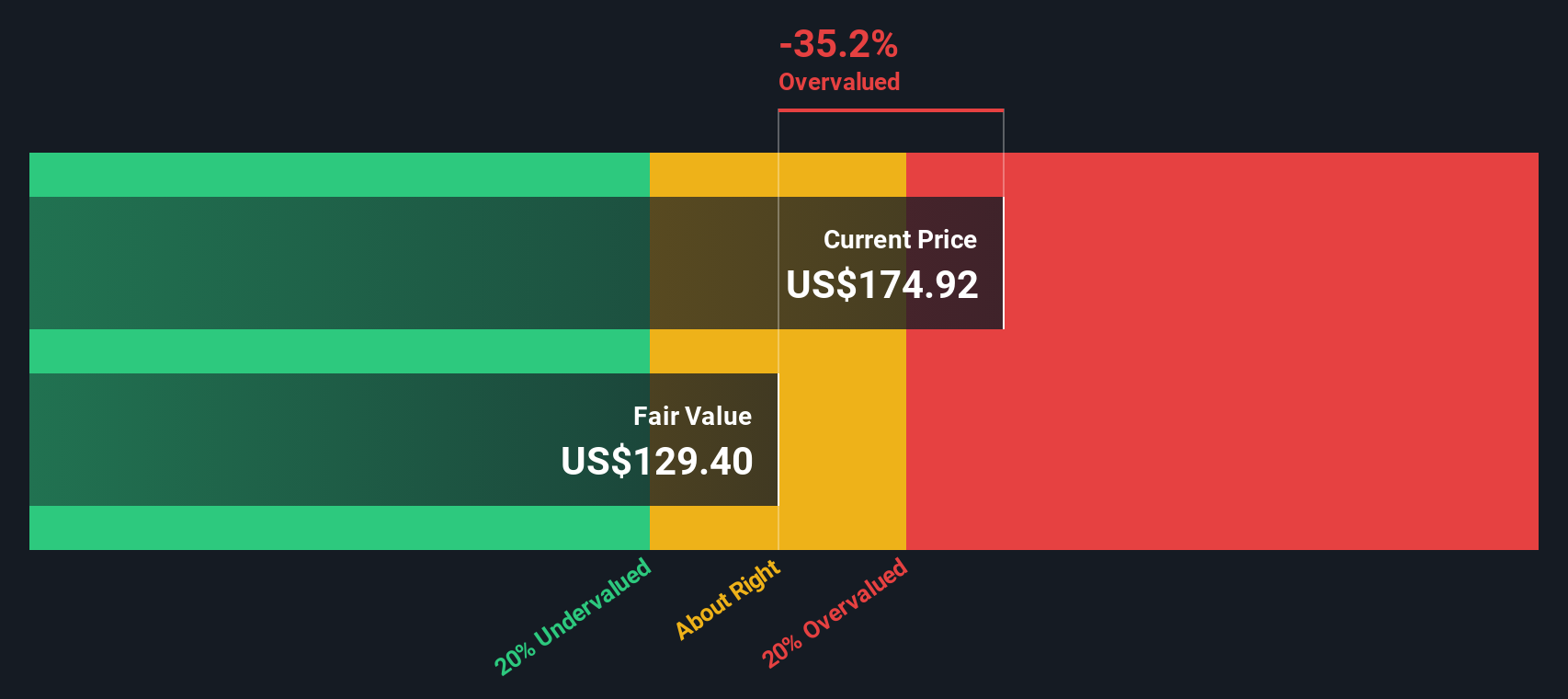

Despite this growth, the DCF model arrives at an estimated intrinsic value of $129.68 per share. With the current price at $202.61, the model implies the stock is trading at a 56.2% premium to its calculated fair value. This suggests that, based on projected cash flows, the shares are notably overvalued right now.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Advanced Energy Industries may be overvalued by 56.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Advanced Energy Industries Price vs Earnings

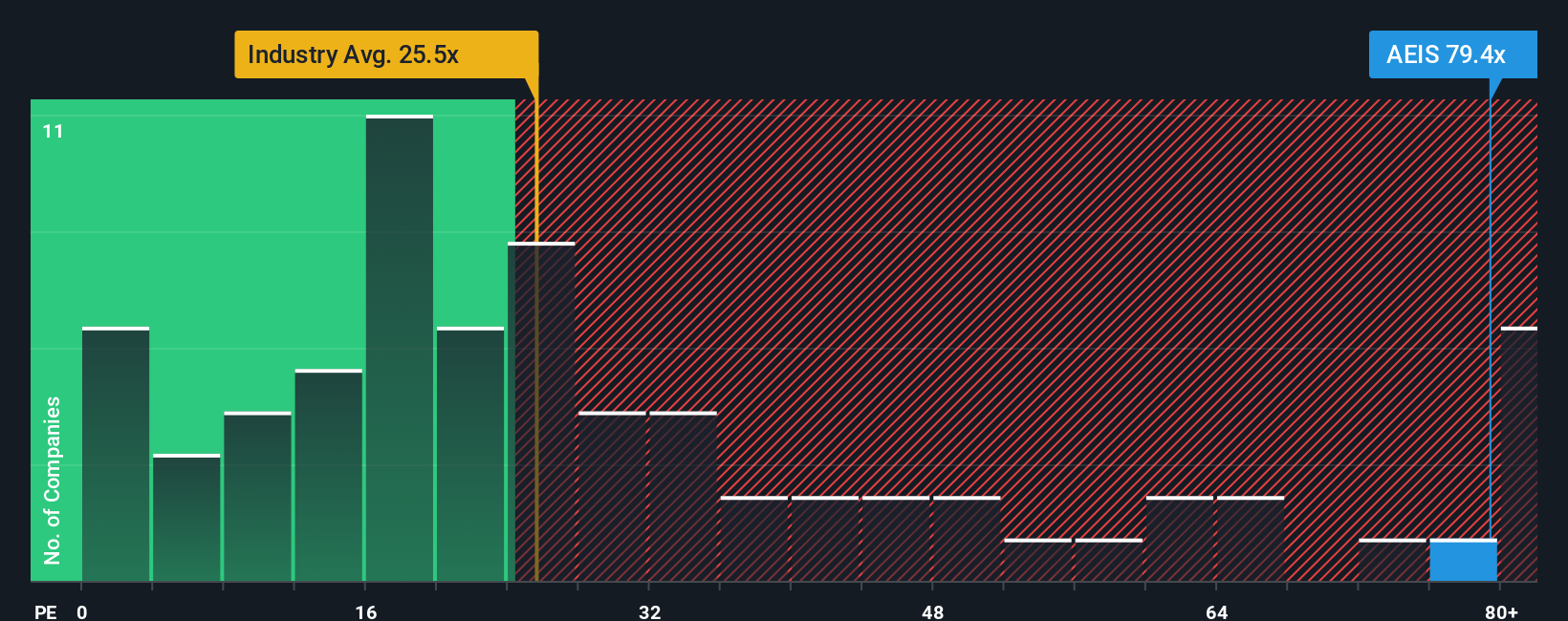

The Price-to-Earnings (PE) ratio is a favored valuation method for companies that are consistently profitable, like Advanced Energy Industries. It gives investors a snapshot of how much they are paying for each dollar of earnings, making it an especially useful tool when evaluating established businesses with steady income.

Expectations for future growth and the level of business risk tend to dictate what is considered a "normal" or "fair" PE ratio for a company. Faster-growing, more resilient companies often merit a higher PE, while riskier or slower-growing firms tend to see lower multiples. Comparing the current PE with industry standards and close peers can provide context, but it rarely tells the whole story.

Right now, Advanced Energy Industries trades at a lofty PE ratio of 89.3x, which towers above both the industry average of 25.9x and the peer group average of 30.7x. To provide a more tailored benchmark, Simply Wall St calculates a custom “Fair Ratio” for the stock, which sits at 53.9x. This proprietary metric factors in everything from earnings growth and profit margin to industry characteristics, company size, and risk profile. As a result, it is far more comprehensive than a simple peer or sector comparison.

With the actual PE ratio at 89.3x and the Fair Ratio at 53.9x, Advanced Energy Industries appears significantly overvalued using this approach. There is a sizable gap between how the market is pricing the stock and what the fundamentals suggest is reasonable.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Advanced Energy Industries Narrative

Earlier, we mentioned that there is an even better way to understand valuation; let us introduce you to Narratives. A Narrative is simply your story about a company, drawing together the facts and your perspective to create a coherent forecast. Your assumptions around future revenue, earnings, margins, and ultimately, fair value all come together in this process. Narratives link a company’s business story with financial projections, so you can see how your beliefs translate directly to a fair value estimate.

On Simply Wall St’s Community page, millions of investors craft and share their own Narratives, making it easy and accessible to plug in your outlook and instantly visualize how it measures up to the current share price. This process can help you decide if now looks like a buy or a sell. The best part is these Narratives update in real time as new news or earnings reports come out, so your research stays fresh and dynamic.

For Advanced Energy Industries, one investor might see huge potential in the AI and data center boom and use aggressive revenue projections, resulting in the highest fair value target of $180 per share. A more cautious investor, wary of industry headwinds and customer concentration, could set their Narrative at just $120 per share.

Do you think there's more to the story for Advanced Energy Industries? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEIS

Advanced Energy Industries

Provides precision power conversion, measurement, and control solutions in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)