- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:AEIS

Has Advanced Energy Industries Risen Too Far After Strong 2024 Rally?

Reviewed by Bailey Pemberton

If you're eyeing Advanced Energy Industries right now, you're not alone. With the stock climbing a remarkable 44.3% so far this year and delivering an impressive 59.5% gain over the past twelve months, it's no wonder investors are debating whether there's still room to run. The journey hasn't been all smooth sailing, though. A slight dip of 4.5% in the past week stands out against a backdrop of robust longer-term gains, making it clear that the stock can be sensitive to broader market shifts and risk sentiment.

Looking further back, the story gets even more interesting. Over the last three years, Advanced Energy Industries has more than doubled, up 117.5%. Stretch that timeline to five years, and the return swells to a staggering 174.8%. These results certainly raise the question: does this pace still make sense based on how the company is valued right now, or are the recent highs raising the risk of a pullback?

Interestingly, when we put Advanced Energy through six standard valuation tests for signs of undervaluation, it doesn't score on any of them. The company's value score is 0 out of 6. That doesn't necessarily mean the stock is overvalued, but it does raise the stakes for anyone hoping to buy or hold at current levels.

In the sections ahead, we'll break down each valuation approach to see what the numbers really tell us. And if you're wondering whether these traditional frameworks are the best way to understand the opportunity here, stick around. There's an even better lens to use, and we'll get to that by the end.

Advanced Energy Industries scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Advanced Energy Industries Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating how much cash a company will generate in the future and then discounting those amounts back to today's dollars to determine what the business is intrinsically worth. This approach tries to answer the question: what would I pay now to own all the company's future cash flows?

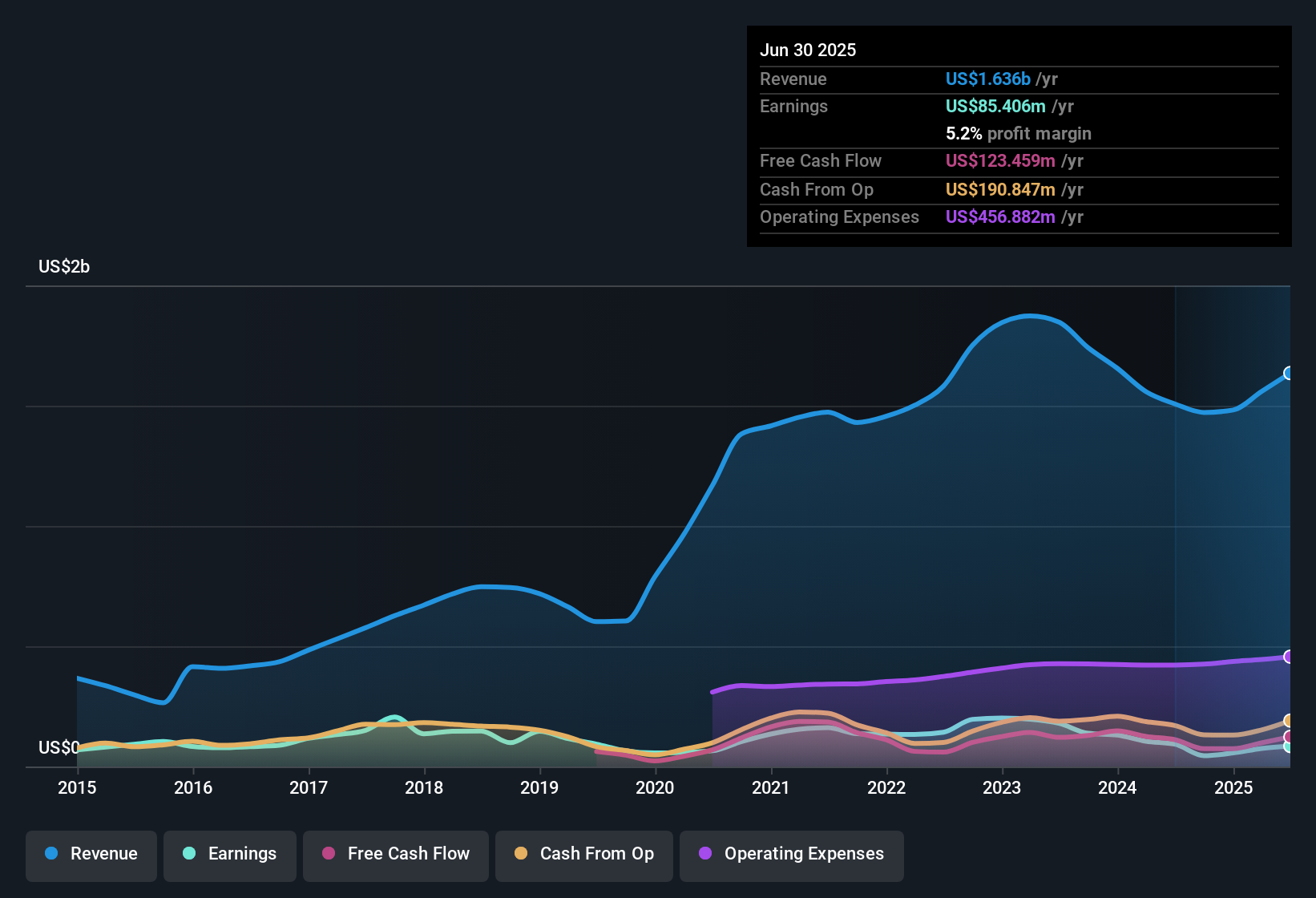

For Advanced Energy Industries, the latest reported Free Cash Flow stands at $127.5 million. Analysts estimate that annual Free Cash Flow could rise to $188.4 million by the end of 2026, with growth projections continuing over the next decade. Although analyst projections only extend up to five years, beyond that, cash flows are extrapolated based on historical patterns and industry expectations. According to these projections, the company's Free Cash Flow could reach approximately $364.4 million by 2035, more than doubling its current level.

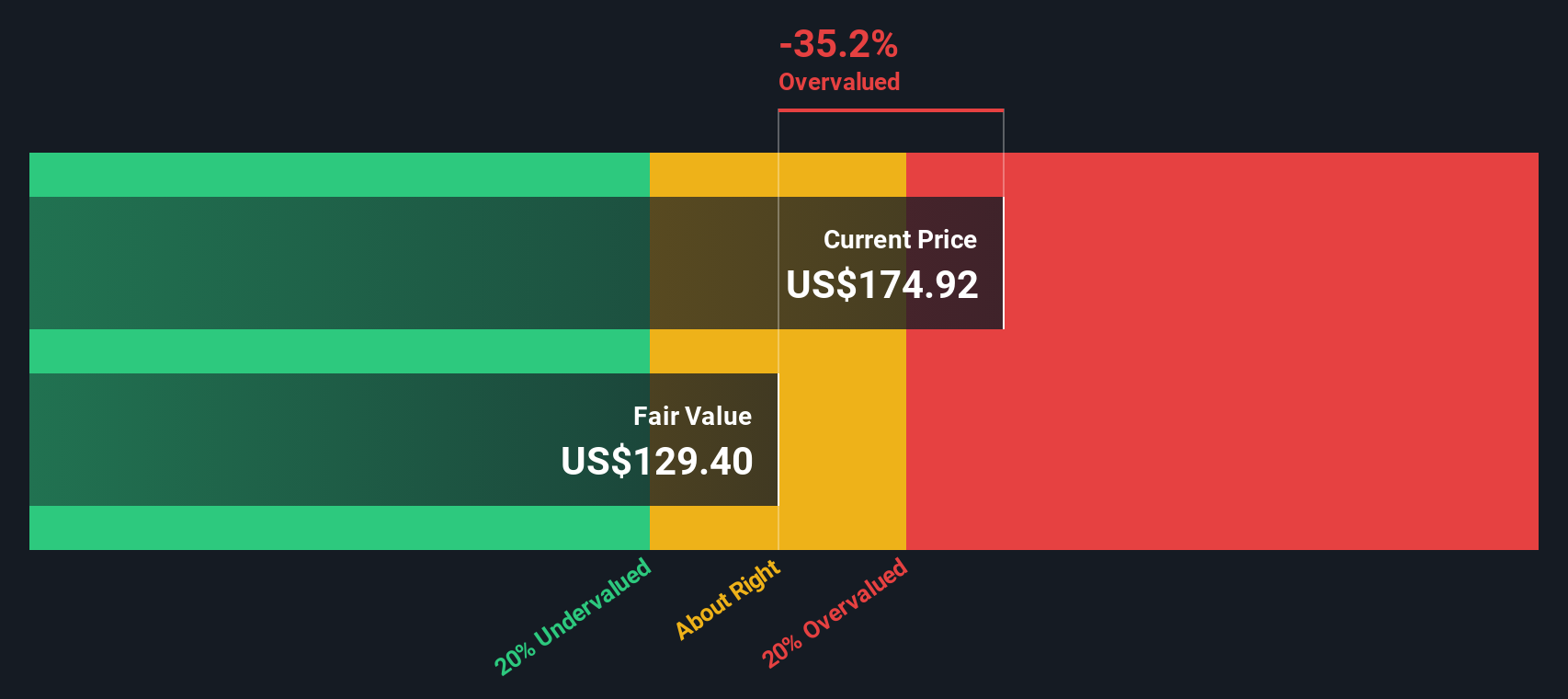

Bringing this information together, the DCF model calculates an estimated intrinsic value for Advanced Energy Industries of $130.83 per share. When compared with the actual share price, this implies the stock is about 27.2% overvalued at current levels.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Advanced Energy Industries.

Approach 2: Advanced Energy Industries Price vs Earnings

The price-to-earnings (PE) ratio is a common valuation multiple for profitable companies, as it provides a quick snapshot of how much investors are willing to pay for each dollar of current earnings. It is particularly relevant for companies like Advanced Energy Industries that have solid earnings, since it helps place current profitability into context against what the market and competitors are valuing similar businesses at.

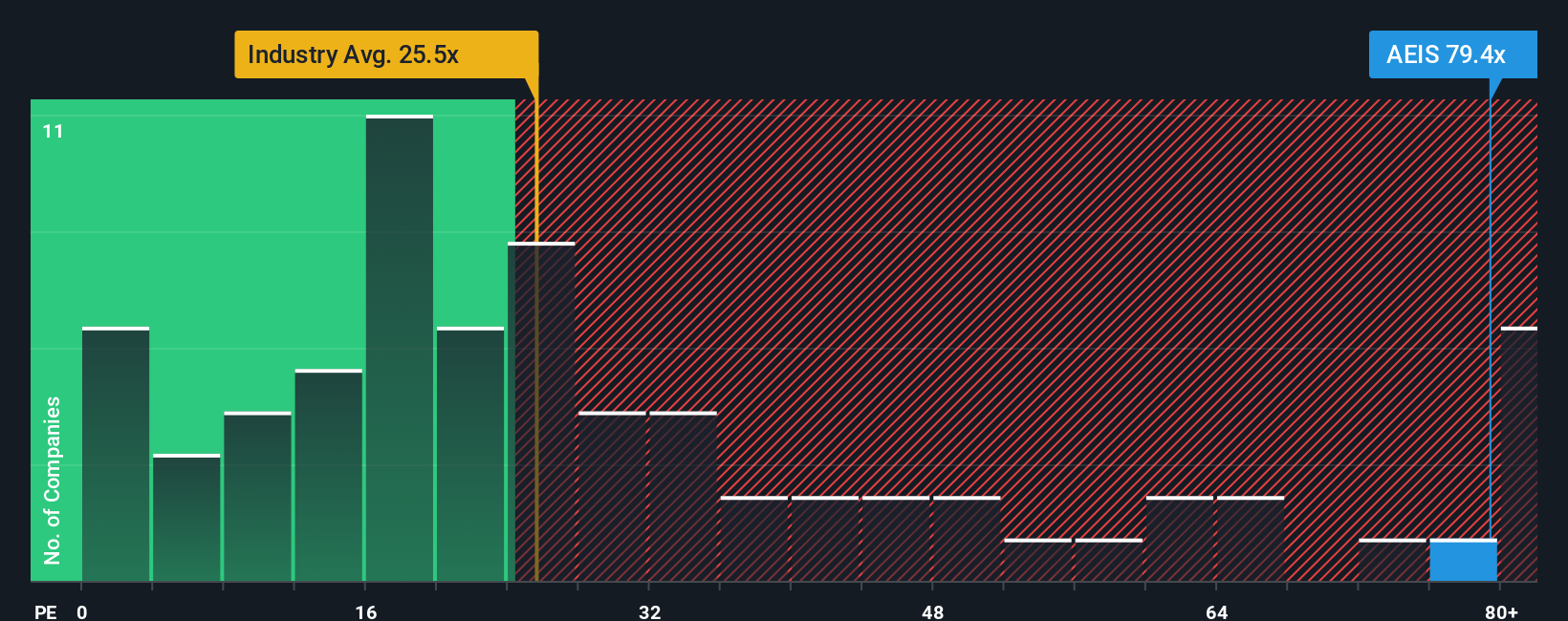

Growth prospects and the associated risks play a big role in determining what a "normal" or "fair" PE ratio should look like. A high-growth company may command a higher PE, while elevated risk or slowing growth typically brings it down. Currently, Advanced Energy Industries trades at a PE ratio of 73.4x, which is substantially higher than the Electronic industry average of 23.9x and the average of its peers at 29.2x. These comparisons suggest the market is pricing in robust expectations or perhaps some premium for its position in the market.

However, instead of simply comparing with industry or peer averages, a more nuanced approach is to look at Simply Wall St's proprietary "Fair Ratio." This metric takes into account the company’s specific earnings growth outlook, risk profile, profit margins, industry dynamics, and market capitalization, giving a much fuller perspective on what a justified PE should be. For Advanced Energy Industries, the Fair Ratio is calculated at 43.3x. Since the actual PE of 73.4x is meaningfully above this, it points to the stock being overvalued on this basis.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Advanced Energy Industries Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story behind the numbers, an opportunity to connect your perspective about Advanced Energy Industries’ future (such as its revenue growth and profit margins) with a clear, dynamic financial forecast and fair value estimate.

Narratives bridge the gap between the company’s business story and what the numbers mean for its valuation, making it simple for investors to see whether their outlook lines up with the market's current price. This powerful and easy-to-use tool is available, free, in Simply Wall St’s Community page and is already actively used by millions of investors around the world.

The real advantage is that Narratives update automatically as new news, earnings or forecasts are released, helping you keep your view current without extra legwork. By comparing your own Fair Value (based on your assumptions) to the latest share price, Narratives enable you to decide whether to buy or sell with greater conviction and personal clarity.

For example, some investors are highly optimistic about Advanced Energy Industries, expecting emerging data center and AI demand will drive revenue and margins to record highs, giving a fair value of $180 per share. Meanwhile, others remain cautious about customer concentration and semiconductor cycles, estimating fair value closer to $120. Narratives let you see, and act on, these diverse perspectives with real-time transparency.

Do you think there's more to the story for Advanced Energy Industries? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEIS

Advanced Energy Industries

Provides precision power conversion, measurement, and control solutions in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives