- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:AEIS

Does Advanced Energy (AEIS) Leaning Into AI Power Modules Hint at a Shift in Its Growth Priorities?

Reviewed by Sasha Jovanovic

- In September 2025, Advanced Energy Industries announced an expansion of its ultra-efficient non-isolated bus converter family, introducing two new quarter brick modules for 48 V power conversion targeting advanced ICT equipment, AI servers, and industrial applications.

- This product launch highlights Advanced Energy Industries' commitment to developing high-efficiency, high-density power solutions tailored for fast-growing sectors like AI and next-generation industrial systems.

- We'll explore how Advanced Energy Industries' focus on AI-ready power modules influences its investment narrative and long-term growth outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Advanced Energy Industries Investment Narrative Recap

To be a shareholder in Advanced Energy Industries, you have to believe that AI-driven demand for high-efficiency power conversion and industrial diversification can offset customer concentration and cyclical risks in semiconductors. The recent launch of ultra-efficient bus converters is directionally positive but does not immediately address the concentration risk with hyperscale data center customers, which remains a primary short-term catalyst and the critical risk to monitor.

Of the recent company announcements, the September 2025 expansion of the non-isolated bus converter family is most relevant, as it deepens Advanced Energy’s presence in the AI and high-performance compute segment. This aligns with forward-looking catalysts around AI infrastructure growth but puts the spotlight back on how dependent these wins are on major hyperscaler clients.

However, investors should be aware that should even one large hyperscale customer cut spending, the revenue impact could be...

Read the full narrative on Advanced Energy Industries (it's free!)

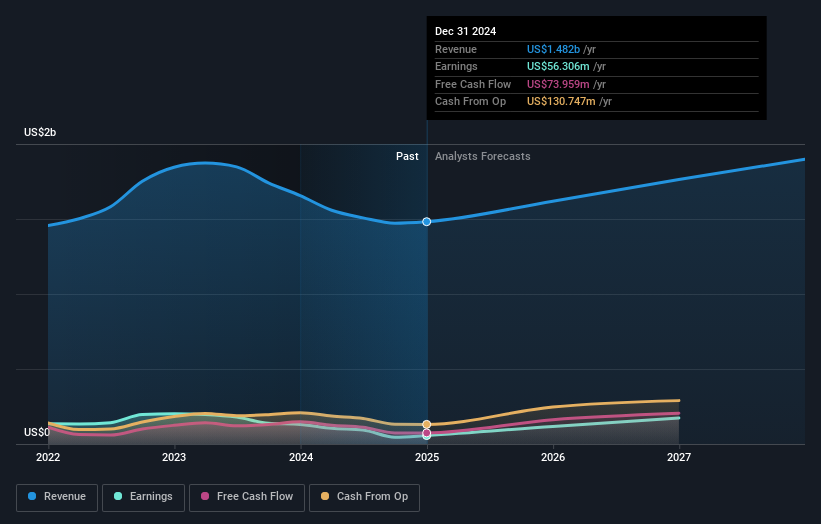

Advanced Energy Industries' narrative projects $2.1 billion revenue and $348.3 million earnings by 2028. This requires 8.5% yearly revenue growth and a $262.9 million earnings increase from $85.4 million today.

Uncover how Advanced Energy Industries' forecasts yield a $150.70 fair value, a 15% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community estimates for fair value range widely from US$129.50 to US$150.70, based on 2 independent forecasts. With hyperscale customer concentration still at the forefront, it pays to compare multiple viewpoints before forming your outlook on Advanced Energy’s future.

Explore 2 other fair value estimates on Advanced Energy Industries - why the stock might be worth as much as $150.70!

Build Your Own Advanced Energy Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Advanced Energy Industries research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Advanced Energy Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Advanced Energy Industries' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEIS

Advanced Energy Industries

Provides precision power conversion, measurement, and control solutions in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives