- United States

- /

- Tech Hardware

- /

- NasdaqGS:AAPL

Weekly Picks: 💸 AAPL's Valuation Risks, ASM's CashFlow Potential, and R3NK's 3 Big Tailwinds

Welcome to Weekly Picks, where each week our analysts hand pick their favourite Narratives from the community ( what is a Narrative? ).

This week’s picks cover:

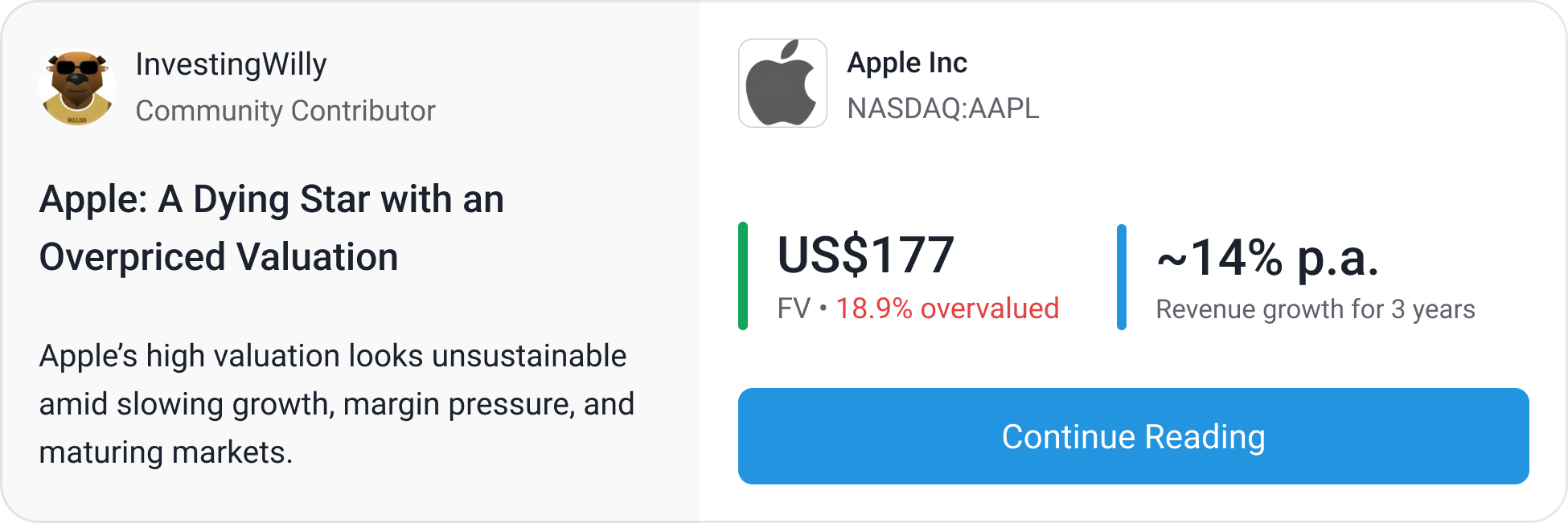

- 🍎 Why Apple’s current valuation seems unjustifiably high.

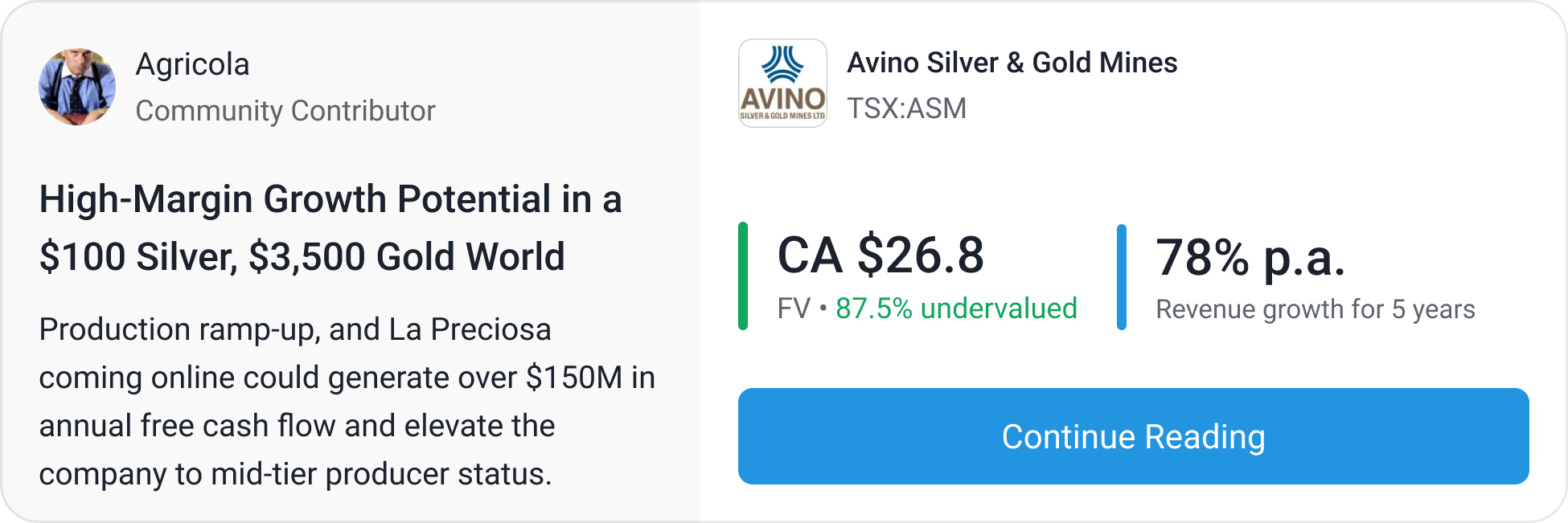

- 🪙 Why ASM free cash flow potential is grossly underappreciated.

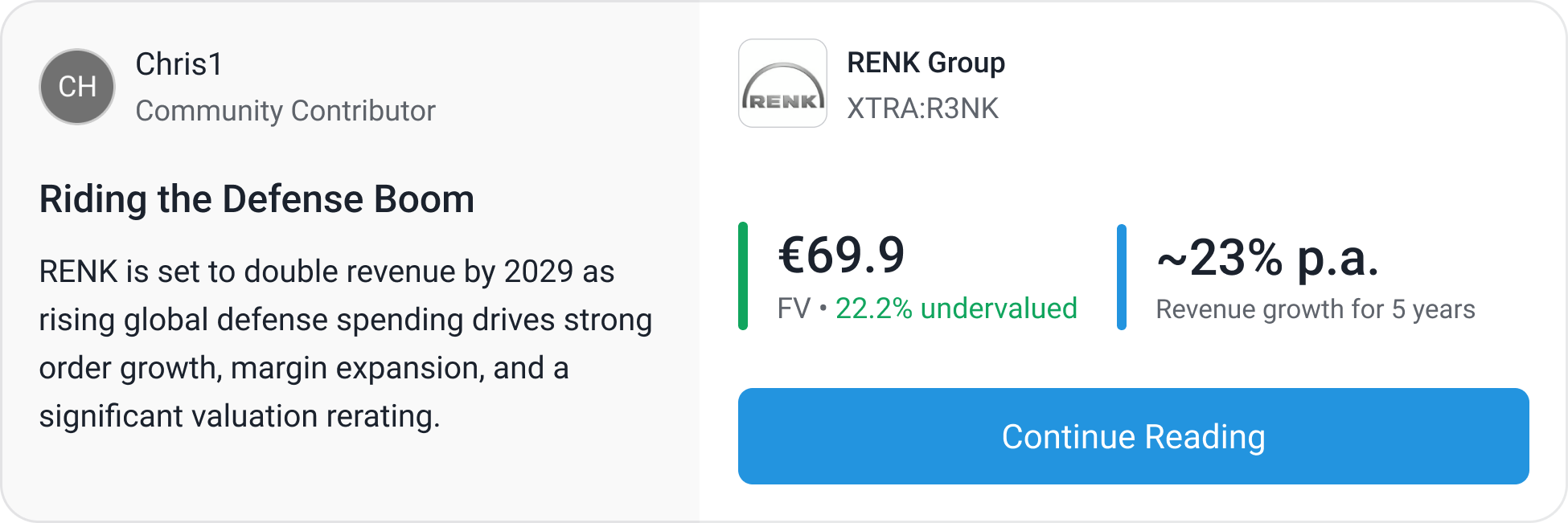

- 🇪🇺 Which 3 tailwinds could push R3NK’s revenue and earnings much higher

💡 Why we like it: It’s a gutsy contrarian take on a market darling, backed by clear-headed valuation logic. The author walks through slowing growth, margin pressure, and inflated expectations with conviction.

💡 Why we like it: This narrative is meticulous and grounded in serious calculations. The author lays out 2 scenarios with different prices for gold and silver, explaining why the latter means this stock is underappreciated.

💡 Why we like it: It ties global defense shifts to RENK’s contract wins and margin expansion. It’s concise, well-reasoned, and nails the upside-downside balance.

What's next?

-

🔔 Know when to act: Set the narrative valuations as your own fair value to know when to buy, hold or sell the stock.

-

🤔 Get answers: Ask the author any questions in the comments section. Feel free to like as well to support their work.

-

✨ Discover more Narratives: There are hundreds of other insightful stock narratives on our Community page .

-

✍️ Build an audience: Have your narrative seen by millions of investors, simply meet our Featuring criteria to go into the running!

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Michael Paige and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.

About NasdaqGS:AAPL

Apple

Designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Quanta Services (PWR): Strengthening the Backbone of the AI Power Grid.

KLA Corporation (KLAC): Engineering Yield in the Age of Chiplets and Sub-2nm Nodes.

Monolithic Power Systems (MPWR): The AI "Power Play" Facing a Transition from Scarcity to Scale.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026